Outlook of the Indian Steel Industry

India is one of the few bright spots for the world’s steel industry in what is predicted to be a lower growth era. India has become the second-largest steel producer in the world, overtaking Japan, with a growth rate of 4.9%. According to the short-term projections given by Worldsteel, India is also expected to become the world number two in steel consumption by end of 2019.

What is driving the steel demand in India?

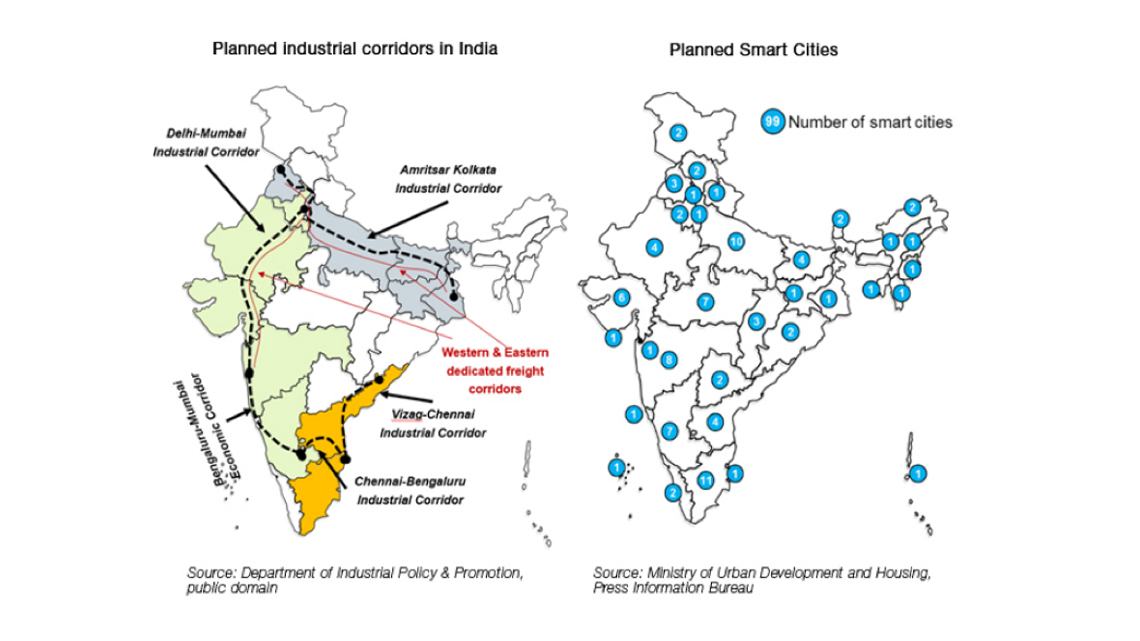

A study conducted by Worldsteel in collaboration with the Indian Steel Association notes that the construction sector is going to be a pan-India driver of steel demand in the country. This would be driven by strong government thrust for infrastructure development and housing for all. Government initiatives such as ‘Smart Cities’ and ‘Affordable Housing’ as well as building of industrial corridors will boost India’s steel demand definitively. For the country, it means enhanced connectivity, reduced logistical costs and well-distributed development spanning all Indian states.

Further support to development of the steel industry is expected to come through the ‘Make in India’ initiative, which aims to transform India into a global design and manufacturing hub, with sectors along the industrial and freight corridors. To that end, a number of Indian states are expected to set up automotive and ancillary industries to become global hubs for manufacturing export-oriented small cars.

All these factors, along with favourable demographics, point to a high scope for improved macroeconomic fundamentals and sustained growth in steel demand in the near future. In fact, steel demand is expected to grow by 7.3% in India. Even so, in 2017, the apparent per capita steel consumption in India for finished steel was much below the world average of 212.3 kg. This suggests that the steel demand in India remains largely untapped as of now.

What are the challenges ahead?

In order to unleash the demand-led growth of steel industry in India, the government is pushing through extensive reforms to strengthen infrastructure to enhance productivity. It would be intriguing to see how effectively India implements its reform agenda and infrastructure plans to pave the way for optimal growth and expansion of the steel industry.

In parallel with this, there are certain international trends such as the looming trade wars and economic slowdown which are going to test the mettle of Indian steel industry. Amidst this backdrop, there have been some concerns as the government is inching closer to signing the Regional Comprehensive Economic Partnership (RCEP) deal which would clear the way for duty-free steel imports.

It is worth noting here that the cost of steel production in India is higher compared to other countries by about US$40 a tonne because of creaking infrastructure, high taxes and expensive cost of capital. In consideration of this, the Indian steel industry has urged its government to provide an export incentive of equal value to put both the domestic and global companies on an equal footing before opening up the steel markets for global competitors.