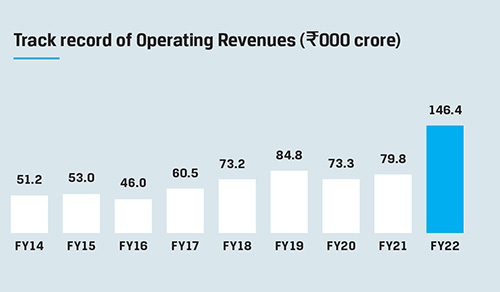

Over the years, JSW Steel has not only challenged the status quo to deliver superior results and accelerated growth, but also built a responsible business that creates sustainable value. Growing to become India’s largest steelmaker, we are enabled by technology-driven efficiency, a value-added product profile, robust financial fundamentals, unremitting support from our employees and communities, and a central focus on progressing on our sustainability parameters.

The annual demand for finished steel in India is expected to touch 240 MnT by FY 2030-31, more than doubling from the current levels. This will be enabled by the government’s thrust on infrastructure and housing development, increasing share of manufacturing in India’s GDP through initiatives such as Production-Linked Incentive (PLI) Scheme and National Infrastructure Pipeline (NIP). Moreover, following the disruptions induced by COVID-19 and the geo-political realignments post the Russia-Ukraine situation, many economies have been shifting their supply chains towards developing Asian countries, which acts as a global trade opportunity for India.

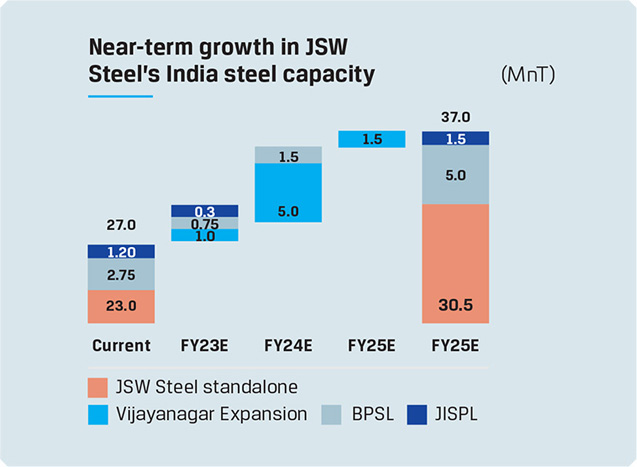

At JSW Steel, we are well placed to leverage this opportunity, and are prudently expanding our capacities across upstream and downstream facilities. In the past five years, we have grown our domestic capacities from 18 MTPA to touch 27 MTPA through organic and inorganic opportunities and have become the most geographically diversified steel producer in India, with a presence in Western, Southern and Eastern India.

In the near-term, we expect to take this to 37 MTPA through brownfield projects, with capex well below global benchmarks of replacement cost of c.$1,000/tonne for BF-based capacity.

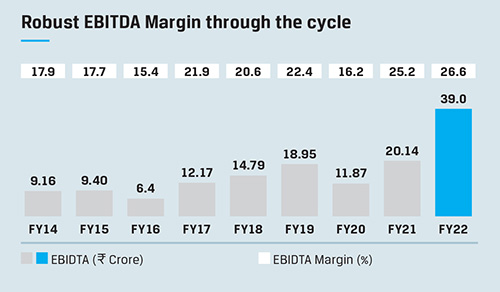

We have a resilient business model with a focus on cost leadership globally through efficient operations. Over the years, JSW Steel has built efficiencies that have helped improve our overall profitability and insulate against downside risks on price and cost movements in the market. We are continuously utilising technology, analytics and innovation to further optimise our cost and operational efficiencies.

Our mining rights in nine captive iron ore mines in Karnataka and four in Odisha significantly add to our business competency. This access to captive raw material helps us mitigate risks on the raw material availability and quality fronts. The mines are well-positioned to cater to the needs of our integrated steel plants, and we have integrated efficient logistics to reduce overheads. We have been implementing digitalisation at our Odisha mines, to further enhance our efficiencies.

Conversion cost in FY 2021-22

On the basis of the weighted average score out of 10, across 23 different parameters from World Steel Dynamics’ World-Class Steelmaker rankings as of November 2021, we have been ranked 5th in Asia and 12th in the world.

Resource optimisation and digitalisation

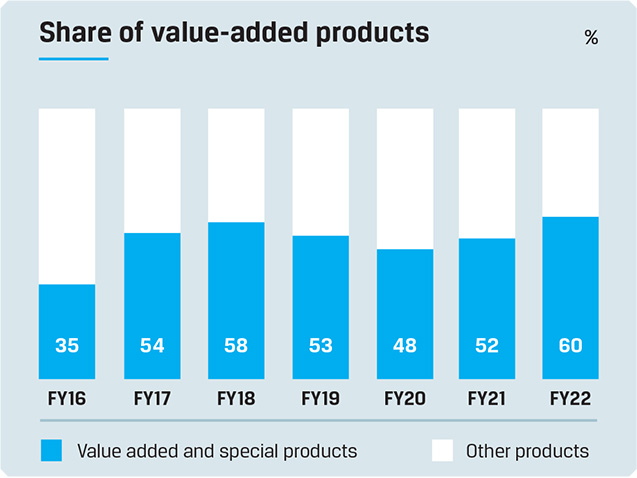

In line with the evolving needs of our customers, we have continuously innovated and introduced new products in the market, and progressively increased our share of Value-Added and Special Products (VASP) in our portfolio. Our products across categories such as hot rolled, cold rolled, colour coated, electrical steel, alloy steel and tinplate find varying applications across industries. Our brands enjoy continued goodwill in the market given the assured quality and advanced applicability. We have also been able to understand the pulse of the market and develop first-to-market product solutions in domestic market.

Our operations remain committed to achieving the sustainability targets. In FY 2021-22, we achieved environment product declaration (EPD) for all our finished steel products.

Our Platina brand (tinplate products) meets the surging demand of food packaging industry along with enabling import and plastic substitution. JSW Steel is also a leading producer of automotive steel with capability to produce AHSS to a tensile strength of 1,180 Mpa. This helps meet requirements of light-weighting and safety for the auto industry. JSW Steel also produces electrical steel products which enhances energy efficiency and reduces carbon emissions. Similarly, our Galvos brand plays a key role in solar structure installations for the renewable energy industry. All of these value-added products help us reduce our overall carbon emissions, contributing to our vision of decarbonisation.

Diversification of product profile and customer baseAt JSW Steel, sustainability translates into everything we do. We have identified 17 priority areas across Environmental, Social and Governance (ESG) parameters and are working tirelessly to achieve specific aims.

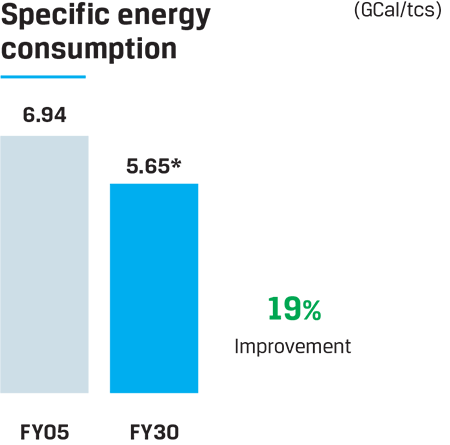

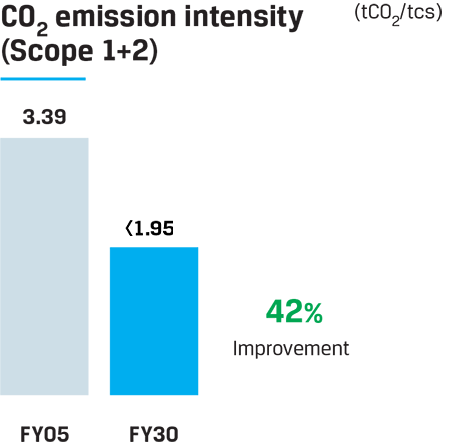

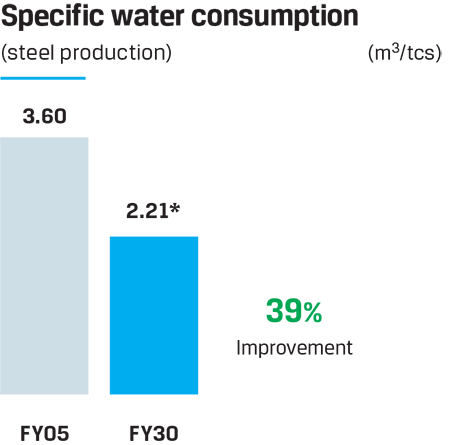

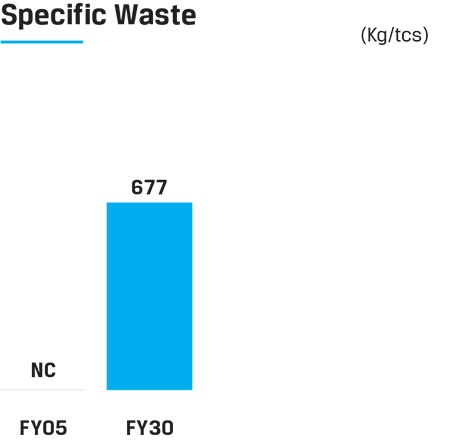

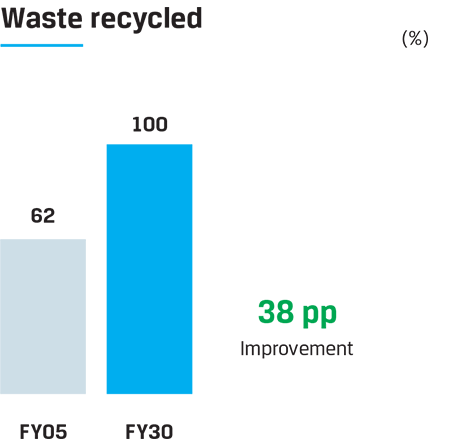

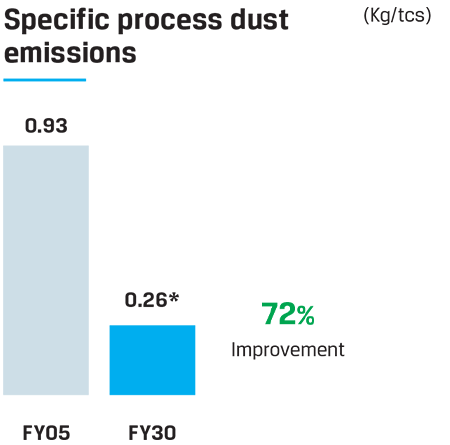

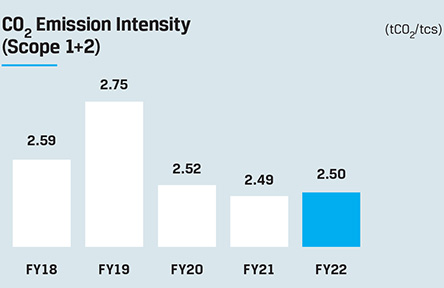

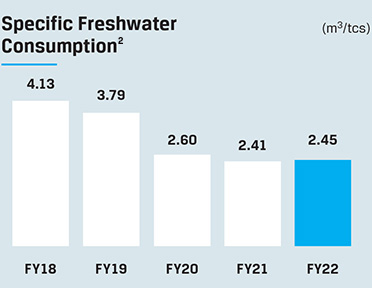

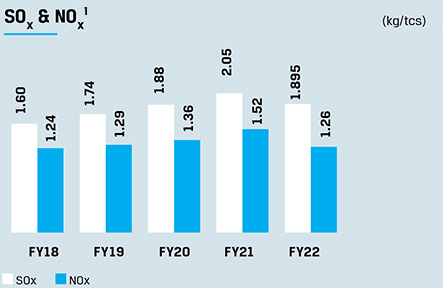

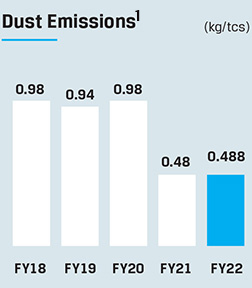

We have set specific targets for the most material sustainability parameters and are actively progressing on all key performance indicators. A brief snapshot of our sustainability performance and 2030 targets is provided.

Environment

Climate Change

Water Resources

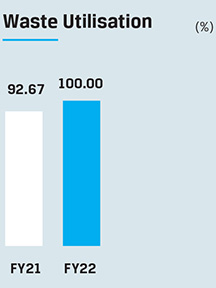

Waste

NC - Not comparable

Air emissions

Biodiversity

Strive to achieve

no net loss of biodiversity

at our operating sites

Target reduction in specific CO2

emissions by 2030 vs baseline year of

2005

* The above reflects revised and more stringent targets. | The targets for 2030 are based on baseline figures of 2005.

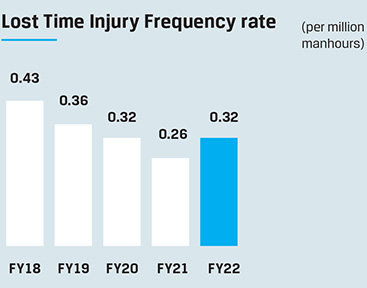

Social

We are also progressively improving our safety performance through the deployment of specific health and safety initiatives and competency development, to nurture safety culture across the organisation. On the social front, JSW Foundation is positively touching the lives of more than a million people in India. In FY 2021-22, JSW Foundation becomes the first CSR Foundation in India to be compliant with ISO 26000:2010 framework for contributing to sustainable development and it also became a member of the United Nations Global Compact (UNGC).

Governance

Our illustrious Board sets our overall strategic direction, and their collective skills and competencies contribute to our responsible growth story. We have a diverse Board in terms of gender, with three women members; and in terms of skill sets and areas of expertise.

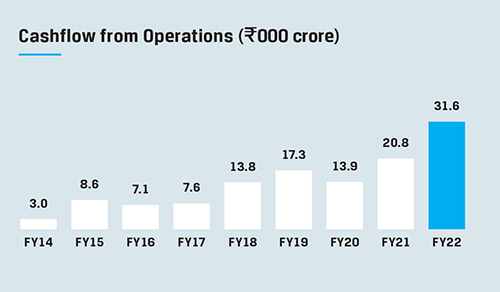

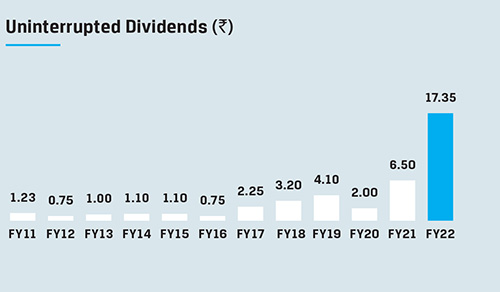

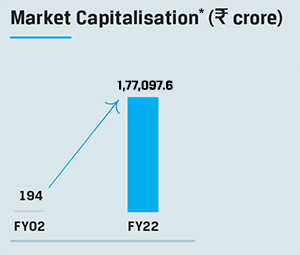

Mainstreaming sustainability in business imperativesOur capital allocation strategy is built to capture value-accretive opportunities, while maintaining our leverage well under stated levels. Through our efforts, we have been able to deliver superior returns for shareholders through dividends and share price appreciation.

Resource efficiency initiatives

Restatement of information

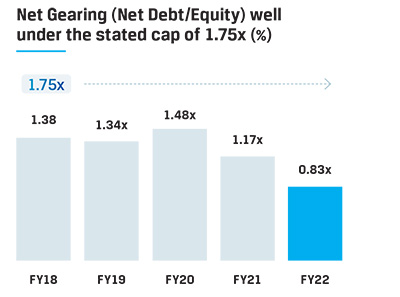

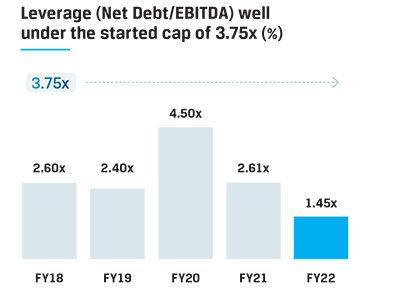

We continue to maintain a healthy balance sheet despite charting out large investments to expand our capacity. On the back of healthy profitability in FY 2021-22, both our Net Debt to Equity and Net Debt to EBITDA ratios have declined and are comfortably placed at 0.83x and 1.45x, respectively. With new capacities coming on stream driving volume growth, we are well placed to maintain our Net Debt to EBITDA ratio well below 3.75x.

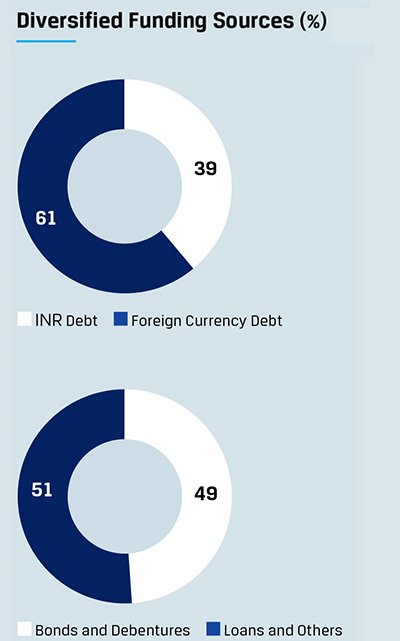

We are consistently reducing our cost of capital with access to diverse pools of liquidity and strong relationships with institutions across the world. We successfully raised the global steel industry’s first USD sustainability-linked bond worth $500m in September 2021. Our credit ratings from both domestic and international agencies remain strong.

Prudent financial management

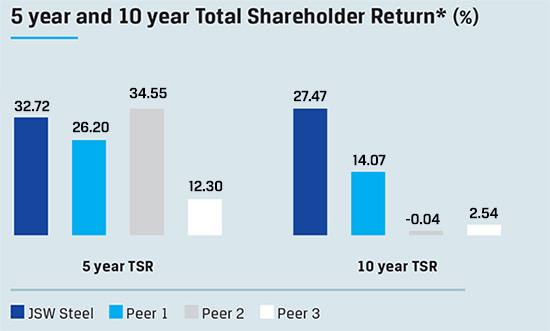

Peer 1, Peer 2 and Peer 3 represent Tata Steel, JSPL and SAIL respectively

* TSR data is as of March 31, 2022

* Market capitalisation data is as of March 31, 2022