Our prudent financial and treasury management, optimal capital allocation, and access to global sources of funding have consistently strengthened our balance sheet. Thus, we have been able to pursue our strategies of capacity expansion and acquisition with highly competitive cost of capital. A strong financial profile, with comfortably serviceable debt levels, improved credit ratings and a robust liquidity position set us up well for an accelerated growth path.

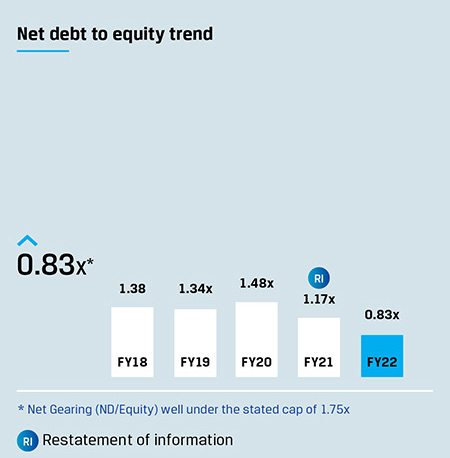

Net debt to equity

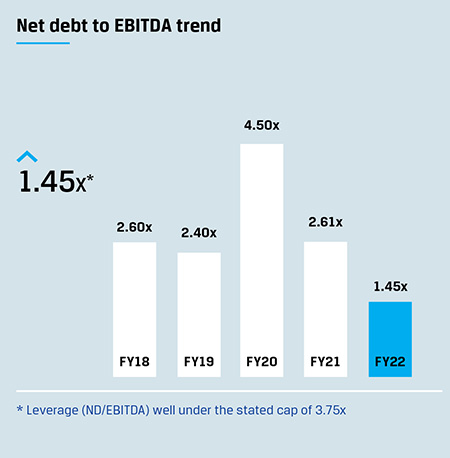

Net debt to EBITDA

Cash and cash equivalents

At JSW Steel, we maintain high levels of engagement with domestic and international banks and financial institutions, which vest their capital with us. We consider it our fiduciary responsibility to ensure consistent financial returns and deliver value to retain their confidence in us.

Capital successfully raised

through international markets

since 2014

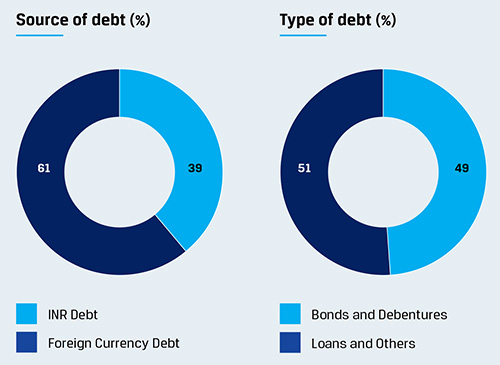

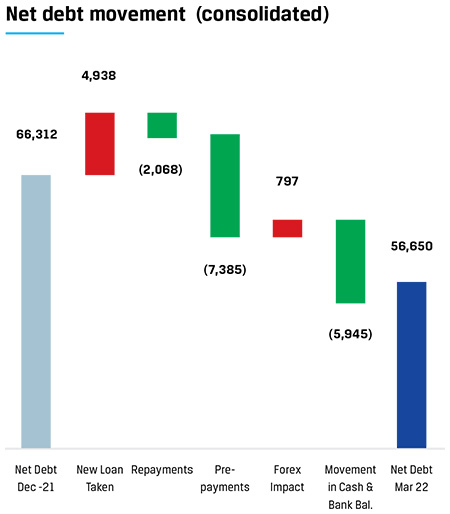

At the end of FY 2021-22, our total debt stood at `56,650 crore, with our net gearing (ND/Equity) well under the stated cap of 1.75x and leverage (ND/EBITDA) under the stated cap of 3.75x.

During the year, we have spent `14,198 crore on capex projects, aligning to our capacity expansion strategy. Further, the year also witnessed the completion of the BPSL acquisition. Considering these two significant outlays, our debt has only increased by `4,035 crore during the year.

JSW Steel Q4 FY 2022 Results Presentation

Note: Net Debt excludes Acceptances

Net Debt/EBITDA on LTM basis

In September 2021, we became the first steel company globally to raise Sustainability Linked Bonds. We have raised $1 billion via bonds issuance in the overseas market through a Reg S/144A issuance. We raised two tranches of bonds with a tenure of 5.5 and 10.5 years respectively. The proceeds of the issue will be used to fund capex plans as well as to refinance debt. The 10.5-year tranche was issued as a Sustainability Linked Bond (SLB) where the company has committed to a target of achieving ≤1.95 tonnes of CO2 per tonne of crude steel produced, by March 2030.

We have chosen to measure our performance against the Sustainability Performance Target (SPT) through CO2 emissions intensity as our KPI, calculated as tonnes CO2 per tonne of crude steel produced (tCO2/tcs). This will cover our

Scope 1 and Scope 2 emissions from the three integrated steel plants in India. We will assess our sustainability performance against SPT for the period 2020 to 2030, providing a target towards reducing the CO2 emission intensity from our three integrated steel plants in India. We aim to reduce our emissions by ~23% by 2030 to a level ≤1.95 tCO2/tcs.

We follow a strategic hedging policy for forex, interest rates and commodities, so that we mitigate any risk to our financial or operational profile. For international trade, we planned exports as per business plan and hedge actual imports using forwards and options. For long-term debt and capital account cash flow, hedging is undertaken for up to 12 months’ rolling repayments either through forwards or options. Further, depending on market conditions, longer tenor hedges may also be undertaken from time to time. From an interest rate risk standpoint, we maintain a desired fixed and floating rate liability ratio by hedging through interest rate swaps, as needed.

On the commodities front, we endeavour to hedge all input commodities (where risk mitigation avenues exist) linked to physical supplies up to 25% of total consumption based on certain price ranges that are acceptable. However, depending on the market supply conditions, we may choose to hedge the entire exposure in a particular commodity.