The government’s infrastructure push and an opportunity to leverage the gap created in the international market by recent geopolitical events have created an unprecedented momentum for the Indian steel industry. At JSW Steel, we are well-aligned with these developments and the larger India growth story with its increasing demand for steel in various sectors. Towards this end, we continue to actively invest in greenfield and brownfield projects and pursue select inorganic opportunities to augment our capacities.

Total domestic installed capacity

(including BPSL and JISPL)

Total downstream capacity

At JSW Steel, we are well-placed to address the strong demand growth enabled by the government’s thrust on infrastructure, housing and the increasing share of manufacturing in GDP. Significant opportunities arise from projects under the $1.4 trillion National Infrastructure Pipeline (NIP), the realignment of global supply chains and China+1 sourcing approach of MNCs. The Production-Linked Incentive (PLI) scheme, launched by the government to promote manufacturing in select sectors, will also act as a boost to the steel industry.

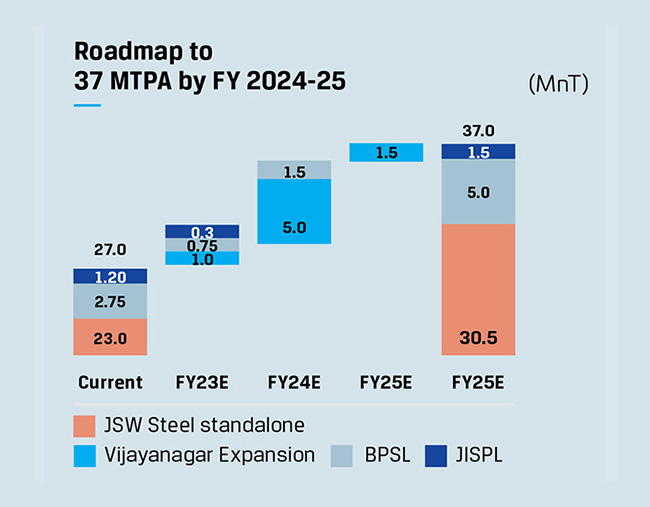

Aligned to these prospects, we have a near-term target of taking our domestic installed capacities to 37 MTPA by FY 2024-25. The expansion projects at Vijayanagar and Bhushan Power and Steel Limited (BPSL) will be key to executing this plan.

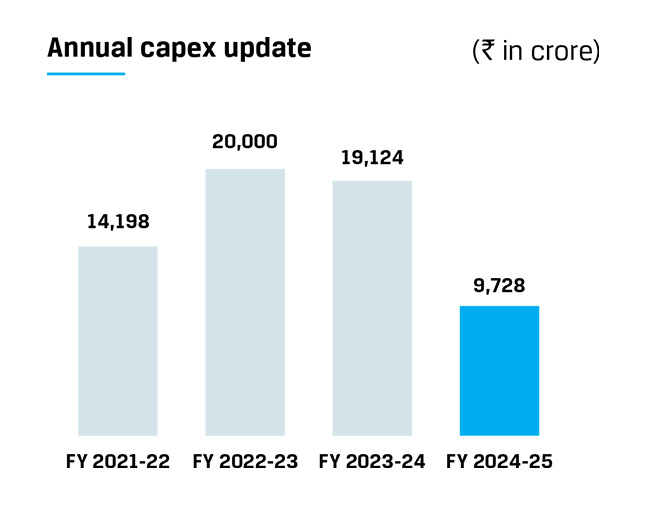

Ongoing capex programme

Unspent capex including creditors & acceptance

Sinter plant and other facilities to support 5 MTPA expansion at Vijayanagar1

LRPC2 and other projects

Sustenance capex

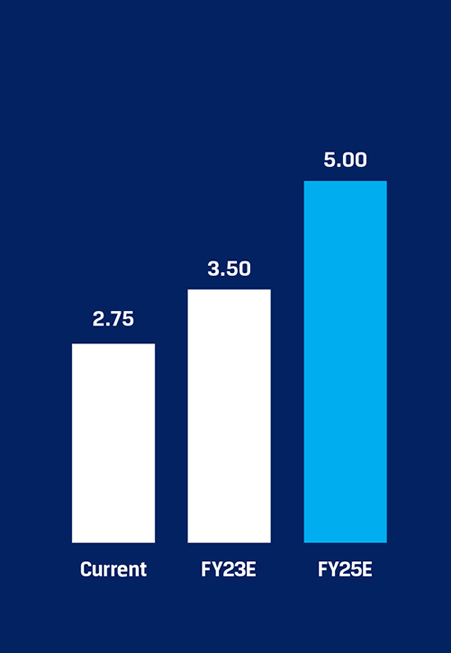

BPSL: Expansion from 2.75 MTPA to 5 MTPA in

2 phases and sustenance capex

The biggest growth achievement of FY 2021-22 is the commissioning of the additional 5 MTPA capacities at our Dolvi facility, essentially doubling its installed capacity.

The expansion comprises one of India’s largest blast furnaces and steel melt shops (SMS), with two converters, 350 tonnes each. The new SMS is equipped with state-of-the-art energy recovery systems to reduce carbon emission intensity. The key components of the expansion include:

Pellet plant of 8 MTPA

Two phases of coke oven battery totalling 3 MTPA capacity

4.5 MTPA blast furnace

5 MTPA steel melt shop

5 MTPA hot strip mill

JSW Steel Vijayanagar Works, our flagship facility, is also India’s largest single-location steel plant and the world’s sixth largest steel plant

With a value-accretive, `20,000 crore investment, the 12 MTPA plant is set to increase its installed capacity by 5 MTPA by FY 2023-24, along with additional capacity augmentation of 1 MTPA and a coke oven of 1.5 MTPA. We expect to leverage the existing facilities at Vijayanagar to support the project and utilise surplus pellets, sinter, coke-making facilities at existing operations to meet the key raw material requirements of the project.

The civil works of the brownfield project has commenced and long lead items have been ordered and letters of credit established.

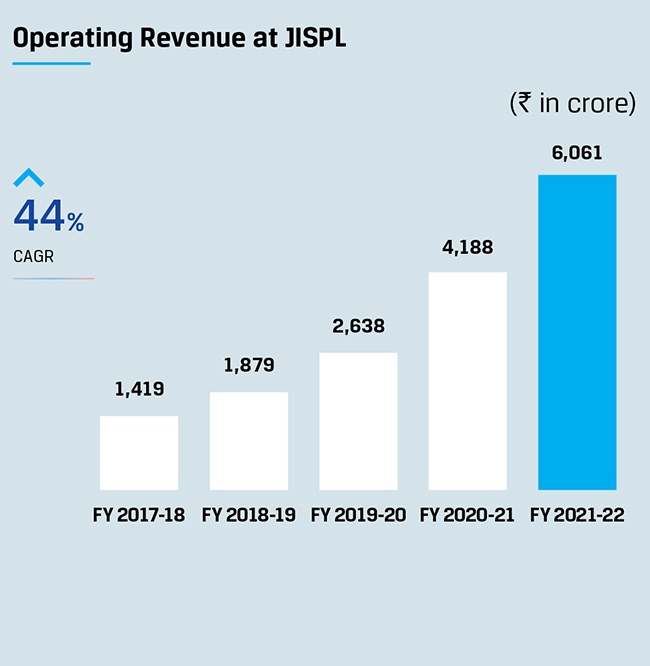

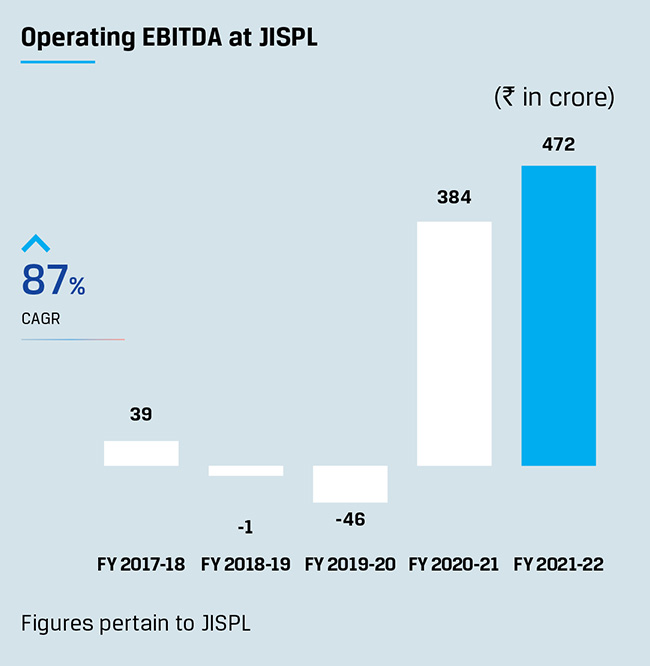

We pursue selective acquisitions that are value-accretive and/or strategically positioned to provide us a competitive edge through capacities, market access or value-addition competencies. During FY 2021-22, we were able to turnaround and improve the profitability of all our acquisitions, across ACCIL, VTPL, VIL and BPSL. JSW Ispat Special Steel Ltd. or JISPL (previously Monnet Ispat & Energy Limited) has also reported a net profit for FY 2021-22. We are increasingly looking at merging some of our businesses to simplify our governance structure.

A consortium of JSW Steel and AION completed the acquisition of the Monnet Ispat & Energy Ltd. (now JISPL). Restarted pellet plant in November 2018.

Restarted Blast Furnace and steel melt shop operations in February 2019. Implemented pellet plant expansion to 2.2 MTPA. Increased DRI production by using own pellets and process improvements. Restarted TMT operations. Introduced JSW Neosteelbrand under licensing arrangement.

Refurbished blast furnace, SMS and oxygen plant to bolster operations. Converted to Special Steel by modification of Caster, commissioning of one additional Vacuum De-gasifier. Introduced Round Cast in Billet/Bloom Caster.

Successfully navigated through the COVID-19 crisis. Achieved highest quarterly EBITDA in Q4 FY 2021 post takeover by the consortium through operational excellence; commenced operations at the slab caster.

Achieved profitability on an annual basis for the first time since acquisition.

We increased our stake in BPSL to 83.3% in FY 2021-22, compared to 49% in FY 2020-21.

The acquisition further diversifies JSW Steel Group’s presence and provides a strategic access to the fast-emerging market in eastern India. In the near term, we expect to nearly double the capacity at BPSL to augment our overall portfolio.

BPSL installed

capacity roadmap

(Tinplate capacity)

Downstream capacity

Crude steel capacity

finishing capacity

integrated steel plant with a finishing capacity of 3 MNTPA*

*million net tonnes per annum