Organisational overview

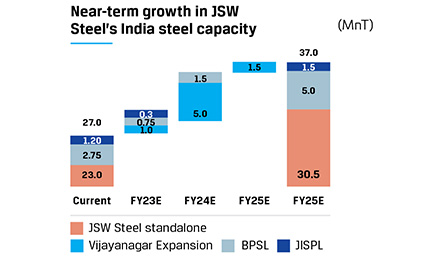

JSW Steel, the flagship business of the diversified conglomerate JSW Group, is a leading integrated steel manufacturer in India with a proven track record of operational excellence, cost efficiency, sustainable practices and high-quality steelmaking. The Company has grown from a single manufacturing unit to 14 manufacturing units in India, with a current domestic crude steel capacity of 27 million tonnes per annum (MTPA).

Domestic installed capacity

(including BPSL and JISPL)

JSW Steel’s integrated operations span mining, raw material processing units such as beneficiation plants, pelletisation and sinter plants, steel manufacturing facilities to downstream value addition capabilities such as production of cold rolled, galvanised and galvalume, colour-coated, electrical and tin plate products. With a total domestic downstream capacity of ~12.6 MTPA, the Company is progressively adding competitive edge to its market presence.

Domestic downstream capacity

*Includes JSW Coated Products Ltd., ACCIL, JSWVTPL, VIL and BPSL

The Company manufactures and offers an extensive portfolio of flat and long products, comprising hot rolled coils, sheets and plates, cold rolled coils and sheets, galvanised and galvalume products, tinplate, non-grain oriented electrical steel, pre-painted galvanised and galvalume products, thermo-mechanically treated (TMT) bars, wire rods, rails, grinding balls and special steel bars. JSW Steel is one of the leading producers and exporters of coated flat steel products in India. The Company has been steadily increasing its share of exports of valueadded products.

In November 2021, JSW Steel was ranked 12th among the top 34 world-class steelmakers, according to the ‘WorldClass Steelmaker Rankings’ by World Steel Dynamics (WSD), based on a variety of factors. In particular, JSW Steel achieved the highest rating (10 out of 10) on the following criteria: expanding capacity, location in highgrowth markets and labour costs. On cost cutting efforts, the Company achieved 8 out of 10, putting JSW Steel ahead of all other steelmakers based in India and resulted in a ranking of fifth among Asian steelmakers.

JSW Steel’s overseas manufacturing facilities comprise a plate and pipe mill in Baytown, Texas, U.S., a steel making facility at Ohio, U.S., and a long product mill in Italy. The Baytown facility has a 1.2 million net tonnes per annum (MNTPA) plate mill and a 0.55 MNTPA pipe mill. The Ohio facility is a hot rolling mill with a 3 MNTPA capacity. It is partially backward integrated with a 1.5 MNTPA Electric Arc Furnace (EAF). The facility in Italy produces long products — railway lines, bars, wire rods and grinding balls — with an aggregate capacity of 1.3 MTPA.

As outlined in the National Steel Policy 2017, India has set an ambitious target of achieving 300 MTPA of steel production capacity by 2030. The Government of India’s mega infrastructure push to support economic growth and thrust on affordable housing bode well for domestic steel demand. Further, per capita steel consumption in India remains well below the global average. JSW Steel is expanding its manufacturing capacity, in line with the nation’s aspirations, and setting up world-class steelmaking processes that are environment-friendly as well. The Company targets to increase its domestic steel capacity to 37 MTPA by FY 2024-25 from 27 MTPA at present.

Note: JSW Steel’s ownership in JSW Ispat Special Products Ltd. (JISPL) is 23.1%; announced merger with JISPL in May 2022

In FY 2021-22, JSW Steel began integrated operations at its 5 MTPA capacity expansion at Dolvi. Raw material processing capacity was also ramped up to support higher production.

In Vijayanagar, debottlenecking initiatives are underway to increase the capacity by 1 MTPA. Further, the Company has made good progress with its brownfield expansion of 5 MTPA, for an estimated capex of ₹20,000 crore. And another 1.5 MTPA will be added after completing the ongoing modification and expansion of the blast furnace. The completion of these expansion plans will take Vijayanagar’s installed capacity to 19.5 MTPA by FY 2024-25 from 12 MTPA currently

The expansion at BPSL to 3.5 MTPA is progressing well and is expected to be completed by Q2 FY 2022-23 and the Phase-II expansion from 3.5 MTPA to 5 MTPA is expected to be completed by FY 2023-24.

Diversification of product portfolio

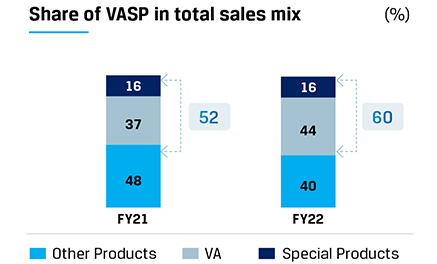

Rising consumer aspirations and the inevitable growth in infrastructure spending are significant macro trends in India. JSW Steel believes that these trends will lead to an increase in demand for steel. The Company has moved quickly to create a portfolio of relevant value-added product capacities in anticipation of this change. JSW Steel further intends to increase the proportion of high margin value-added products in the product mix so as to improve resilience to withstand steel price volatility, and offer a broad-based suite of products to meet the growing requirements of customers and facilitate import substitution. The share of valueadded and special product (VASP) sale was 60% of consolidated sales volume as on March 31, 2022, which contributed to the increase in margins.

Several downstream capacity expansion projects are also underway, which will bolster the Company’s value-added portfolio by adding to its colour coating and tin-plate capacities significantly. Of these, the modernisation and capacity enhancement projects at Vasind and Tarapur have been commissioned.

Backward integration leads to lower cost of conversion

Over the years, JSW Steel has reduced its dependence on iron ore procurement by acquiring mines in Karnataka and Odisha, to insulate its operations from the consistent availability of raw material. Currently, JSW Steel owns 13 iron ore mines (nine in Karnataka and four in Odisha), with aggregate reserves of 1.35 billion tonnes. In FY 2021-22, the Company met 43% of its total iron ore requirements from captive mines.

Share of captive iron ore in total requirement

Further, most of JSW Steel’s power requirements in domestic production are met through captive plants. Of the 1,029 MW, aggregate captive power capacity, Vijayanagar Works has an installed captive generation capacity of 865 MW, Dolvi Works has 67 MW as well as long-term power purchase arrangements with JSW Energy; and Salem Works has 97 MW. The Company also has tie-ups for utilities and industrial gases partially with its wholly owned subsidiary JSW Industrial Gases Private Limited, as well as strategic partnership for coil coatings with JSW Paints Limited.

Additionally the Company’s manufacturing plants are strategically located in areas that are well-connected by rail, road and port networks, which makes it easy and cost-effective to move materials. These factors, along with operational excellence, high people productivity and state-of-the-art manufacturing facilities, enable JSW Steel to record one of the lowest conversion costs among Indian steelmakers.

Moving up the steel value chain

Over the last few years, there has been an increasing demand for specialty steel across user industries like renewable power, automobile and capital goods industries, among others. India has largely relied on imports to meet domestic demand. To drive import substitution and achieve self-reliance, the Government of India has announced the Production Linked Incentive (PLI) scheme for manufacturing specialty steel. However, specialty steelmaking requires enhanced level of precision and capabilities.

JSW Steel is building stronger competencies in its Cold Rolled (CR) products. Vijayanagar Works’ CRM-2 is the only mill in India with the capability to produce some of the Advanced High Strength Automotive Steel (AHSS) grades for use in automobile. JSW Steel has also launched a first-of-its kind Automotive Steel R&D lab at Vijayanagar to develop next-generation AHSS. The Company received approvals for 25 different grades of AHSS from auto OEMs in FY 2021-22, including high-strength structural steel for passenger and commercial vehicle applications and special alloy steel grade with better specific steel purity qualities.

Setting benchmarks in sustainability

JSW Steel integrates broader national and global sustainable development goals into its business strategy. In line with India’s Nationally Determined Contributions (NDCs) to address climate change, The Company targets to bring down GHG emissions by 42% (from the base year 2005 levels) to <1.95 tonnes of CO2 per tonne of crude steel (tcs) by 2030. To achieve the target, the Company will focus on replacing thermal power with renewable power, higher usage of steel scrap in its operations and increase beneficiation of low and medium grade iron ore. JSW Steel has entered into a solar and wind power purchase agreement through SPVs set up by JSW Energy Limited. JSW Steel will acquire 26% stake in each of those SPVs, which will set up renewable power facilities with an aggregate capacity of 958 MW, of which 225 MW was commissioned in April 2022.

In FY 2021-22, JSW Steel became the first steel company globally to issue a US$500 million Sustainability Linked Bond (SLB). The Company raised a cumulative of US$1 billion bond in two tranches of US$500 million each, with tenures of 5.5 years and 10.5 years. The 10.5-year tranche was linked to the Company’s GHG emission target.

1st sustainability-linked US dollar bond in global steel sector

JSW Steel has been driving product sustainability as a business imperative and product eco-labelling is one such area. In FY 2021-22, the Company obtained Environmental Product Declarations (EPD) – Type III eco-labelling for all finished long and flat products from its three integrated steel plants

During the year, JSW Steel entered the S&P Dow Jones Sustainability Index for Emerging Markets, becoming one of the 15 companies from India and one of the three steel companies from Emerging Markets to do so, among the 108 companies comprising the Index.

JSW Group joins 200 forward-thinking companies as the newest member of the World Business Council for Sustainable Development (WBCSD)

JSW Steel maintains A- (Leadership band) rating in CDP Climate Change assessment

JSW Steel issues a USDdenominated Sustainability Linked Bond, the first in the steel sector globally

JSW Steel recognised as worldsteel Sustainability Champion for the fourth consecutive year

All finished flat and long products from the three integrated plants received Type III eco-labelling

FY 2021-22: Fortifying the promise of a ‘Better Everyday’

Resilient performance

During the year, the Company achieved 89% capacity utilisation and reported the highest-ever annual consolidated crude steel production of 19.51 MnT, a growth of 29% y-o-y. The sales volume reached 18.18 MnT, improving by 21% y-o-y, driven by ramped up production and increase in overall steel demand. The Company ramped up mining operations at Odisha and Karnataka, contributing to 43% of the total iron ore requirements.

The Company’s consolidated revenue from operations increased by 83% to ₹146,371 crore due to growth in volumes and elevated prices.

Highest-ever consolidated operating EBITDA

Diversified product portfolio

As a continuing commitment to delivering high quality and innovative products to the customers, the Company enhanced its focus on R&D initiatives and developed 58 new grades during the year. The sales margins have also improved considerably as value-added and special products (VASP) accounted for 60% of total sales volumes for the year.

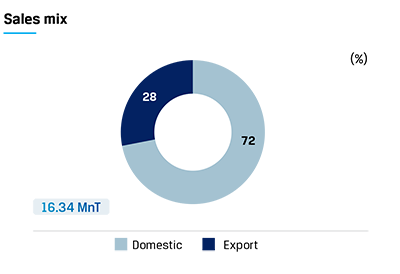

JSW Steel has established many strong brands over the years which enjoy considerable market share; in FY 2021- 22 branded products sales stood at 47% of total retail sales. The Company exported 4.57 million tonnes of steel during the year, an increase of 8% y-o-y and exports accounted for 28% of total sales.

Note: All figures are in million tonnes. Total sales comprises JSW Steel Indian operations excluding BPSL and JVs, and after netting-off intercompany sales

In sync with India’s growth story

JSW Steel doubled its crude steel capacity in Dolvi to 10 MTPA, with integrated steel operations being commenced at the 5 MTPA brownfield expansion. The Company is on track to completing the capacity expansion at Vijayanagar’s CRM-1 complex and the commissioning of the 0.3 MTPA colour coating line.

The modernisation and enhancement of downstream capacities at Vasind and Tarapur have also been completed. The Company is making continued progress on all capacity enhancement projects across downstream facilities.

Robust financial profile

The Company improved on its leverage ratios considerably during the year. The consolidated net gearing (Net Debt to Equity) stood at 0.83x at the end of the year (vs. 1.27x at the end of FY 2020-21) and Net Debt to EBITDA stood at 1.45x (vs. 2.83x at the end of FY 2020-21). The weighted average interest rate improved to 5.67% at the end of March 31, 2022 vs 5.83% at the end of March 31, 2021. Keeping in with the Company’s continued focus on optimal capital allocation, the debt increased by only ₹4,035 crore post a capital expenditure spend of ₹14,599 crore and BPSL acquisition debt of ₹10,278 crore.

Fitch upgraded JSW Steel’s credit rating to BB stable from BB negative. CARE Ratings Ltd. has upgraded the Company’s rating for Long Term Bank Facilities and Non- Convertible Debentures to 'CARE AA' Stable Outlook. ICRA Limited has upgraded the Company’s rating for Long Term Bank Facilities and Non-Convertible Debentures to '[ICRA] AA' Stable Outlook.

During the year, JSW Steel completed the acquisition process of BPSL and turned around operations at BPSL, recording an EBITDA of ₹6,423 crore during the year.

The coated steel business generated an EBITDA of ₹3,082 crore, registering a growth of 97% y-o-y. The US operations recorded a turnaround with an operating EBITDA of US$200 million. JSW Steel Italy operations reduced its losses and reported steady growth during the year. The operations are expected to perform better in the next fiscal. JSW Ispat Special Products Limited recorded a turnaround of the business operations, generating an operating EBITDA of ₹472 crore during the year.

Net Debt to Equity vs. 1.27x in FY 2020-21

Net Debt to EBITDA vs. 2.83x in FY 2020-21

A future-ready steel company

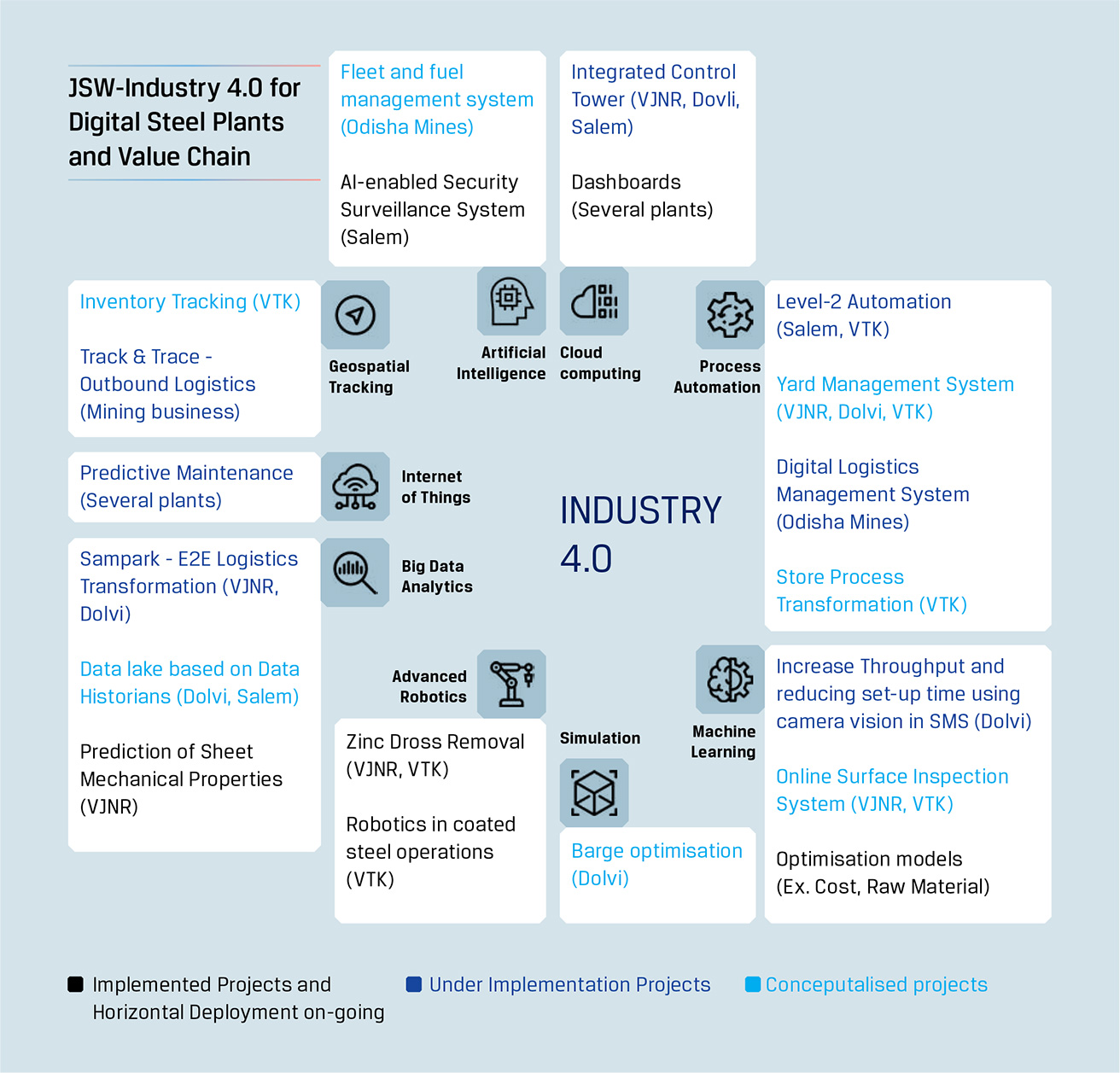

JSW Steel, as one of the leading steel manufacturing companies, remains committed to growing responsibly, with minimal impact on the environment. The Company is cognisant that its operations are energy intensive, and has thus set several Environmental, Sustainability and Governance (ESG) targets to ensure optimum utilisation of resources, preservation of environment and continued value creation for its stakeholders. The operations have also been sufficiently embedded with digitalisation and technology to optimise processes and ensure more efficiency. Some of the end-to-end digitalisation and Industry 4.0 projects are nearing completion, resulting in benefits across operations.

In FY 2021-22, JSW Steel became the first-ever Company in the global steel sector to issue US$500 million Sustainability Linked Loan (SLB) bonds. The Company also obtained Environmental Product Declarations (EPD)— Type III eco-labelling for all finished products from its three integrated steel plants and flagged off its first-ever electric vehicle (EV) for material transfer. JSW Steel received an A- band from CDP for the number of best practices the Company is implementing to mitigate climate change.

The Company remains focused on transitioning to renewable power usage with the commissioning of the 225 MW of solar capacity in Vijayanagar, in collaboration with JSW Energy Limited.

Economic overview

2.1 Global economy

Growth moderates on geopolitical tension, inflation

The global economy staged a strong rebound at the start of CY 2021 driven by accelerated vaccination and opening of economies. It was short-lived, though, as rising infections and reimposition of lockdowns dampened sentiments in the second quarter. Governments and central banks in major economies continued to extend policy support to stabilise the economy and boost private investments and consumption. However, supply chain disruptions leading to commodity inflation, energy price volatility coupled with rising freight and shipping costs, enhanced the risk of inflation. The Baltic Dry Index—a gauge for international shipping costs—rose to its multi-year highs in September 2021.

In the last quarter of CY 2021, the world economy started weakening once again while inflation rose much sharply than anticipated due to doubling of energy prices over the year, localised wage pressures, rising food prices and lingering supply constraints. Further, a resurgence in COVID-19 cases in Europe and Japan held back a broader recovery. In China, fresh COVID-19 outbreaks, weak real estate investments, and a faster-than-expected withdrawal of fiscal emergency measures played spoilsport. On the positive side, international trade made strong gains and services activity surprised on the upside. According to the International Monetary Fund's (IMF) World Economic Outlook (WEO) April 2022, global economic output grew 6.1% in CY 2021, following a 3.1% contraction in CY 2020.

The weakness in the fourth quarter spilled over into CY 2022, as new virus variants emerged and localised mobility restrictions were imposed. Further, rising energy prices, supply side disruptions, higher and broad-based inflation, withdrawal of the ‘Build Back Better’ package in the US, drawn out retrenchment in China’s real estate sector, tightening of monetary policy globally and weak recovery in private consumption have limited growth prospects. Furthermore, the breakout of the Russia-Ukraine conflict in February 2022 kept the world on edge. The imposition of economic sanctions by US and its NATO allies on Russia pushed up global energy prices, as the country is one of the largest exporters of natural gas. In addition, Europe relies heavily on Russian gas to meet its domestic requirements while Ukraine is the world’s largest producer and exporter of sunflower oil.

| Region | Year-on-Year (%) | Difference from January 2022 WEO | ||||

|---|---|---|---|---|---|---|

| Projections | ||||||

| 2021 | 2022 | 2023 | 2021 | 2022 | 2023 | |

| World Output | 6.1 | 3.6 | 3.6 | 0.2 | –0.8 | -0.2 |

| Advanced Economies | 5.2 | 3.3 | 2.4 | 0.2 | –0.6 | -0.2 |

| United States | 5.7 | 3.7 | 2.3 | 0.1 | –0.3 | -0.3 |

| Euro Area | 5.3 | 2.8 | 2.3 | 0.1 | -1.1 | -0.2 |

| Japan | 1.6 | 2.4 | 2.3 | 0 | –0.9 | 0.5 |

| United Kingdom | 7.4 | 3.7 | 1.2 | 0.2 | –1 | -1.1 |

| Emerging Market and Developing Economies | 6.8 | 3.8 | 4.4 | 0.3 | –1 | -0.3 |

| Emerging and Developing Asia | 7.3 | 5.4 | 5.6 | 0.1 | –0.5 | -0.2 |

| China | 8.1 | 4.4 | 5.1 | 0 | –0.4 | -0.1 |

| India 1 | 8.9 | 8.2 | 6.9 | -0.1 | –0.8 | -0.2 |

| ASEAN-5 2 | 3.4 | 5.3 | 5.9 | 0.3 | –0.3 | -0.1 |

| Russia | 4.7 | –8.5 | -2.3 | 0.2 | -11.3 | -4.4 |

1 For India, data and forecasts are presented on a fiscal year basis and GDP from 2011 onward is based on GDP at market prices with fiscal year 2011/12 as a base year.

2 Indonesia, Malaysia, Philippines, Thailand, Vietnam.

Source: World Economic Outlook- April 2022, International Monetary Fund

Advanced Market Economies (AMEs)

The US economy grew by 5.7% in CY 2021 with a rebound in demand and normalisation of economic activities, though inflation remained on the higher side. In Europe, industrial production was impacted by supply bottlenecks and higher energy prices as well as rising COVID-19 cases in the second half. The Euro Area grew 5.3%. Japan grew 1.6% owing to the state of emergency from July to September as COVID-19 infections hit a record level.

Emerging Market and Developing Economies (EMDEs)

In CY 2021, inflationary pressures persisted in emerging markets and developing economies, due to their larger dependence on oil and gas imports in some economies and continued supply chain disruptions. However, stable consumption trends and continued fiscal support helped sustain growth, estimated at 6.8%. China is likely to have grown by 8.1% on the back of rising exports and record trade surplus, partially offset by its stringent zero-COVID strategy, supply chain bottlenecks and structural issues within its housing sector.

Outlook

The IMF has moderated its CY 2022 global economy growth forecast by 80 bps to 3.6%, from the estimated 4.4% growth forecast published in January 22, due to the Russia–Ukraine conflict, inflation and monetary policy tightening and supply bottlenecks.

Although the probability of a full-blown geopolitical crisis is low, the world remains on tenterhooks as it closely watches the evolving scenario. Inflation is expected to rise more than anticipated, demanding more aggressive policy responses. The IMF sees downside risks to the growth estimates owing to the possibility of the emergence of new COVID-19 variants, renewed economic disruptions, supply chain instability, energy price volatility, and localised wage pressures. Moreover, the economic sanctions imposed by developed economies on Russia following the war with Ukraine, are likely to lead to realigning of trade relations, thereby impacting the global supply chain.

In the United States, the excess savings, strong household balance sheet and robust labour markets are positive for near-term consumption. Despite the ongoing healthy economic recovery, high inflation and aggressive monetary policy tightening by the Federal Reserve is expected to impact growth. The Fed raised interest rates in March 2022, its first hike since December 2018, and announced faster tapering of its asset purchases. However, employment gains are likely as the economy gathers steam, leading to healthier household balance sheets and improved consumer confidence.

The European Union has been more severely impacted by supply chain disruptions and higher energy costs emanating from the Russia-Ukraine crisis. This along with possible rate hikes by European Central Bank as early as July 2022, will impact growth. In the UK, the Bank of England continued with monetary policy tightening, raising its policy rate for the third time in March 2022. This coupled with the disruptions in energy supplies from Russia is expected to lead to moderate growth for Europe in CY 2022.

Japan continued with its economic recovery, with downside risks due to global headwinds. The Bank of Japan remains accommodative despite uptick in inflation.

The Zero COVID Strategy adopted by China has led to severe lockdowns and has impacted economic activity since March 2022. As the Chinese economy witnesses decline in consumption and industrial production, business sentiment remains weak. The recent easing by the People's Bank of China (PBOC) is a positive, with further fiscal and monetary stimulus expected going forward, to stimulate the economy.

Emerging and developing Europe, including Russia, is expected to decline by 2.9% in CY 2022. Developing Asia is likely to witness the unwinding of emergency measures and a gradual shift to fiscal consolidation.

The global economy continues to face headwinds due to rising inflationary pressures and geopolitical tensions. Moreover, conflict between Russia and Ukraine has led to many countries announcing trade sanctions, thereby resulting in a reconfiguration of trade relations across the globe. Even as the aforementioned has led to uncertainty across financial and commodity markets, it also provides newer avenues for many emerging economies to build trade relations. Besides, better healthcare measures and more widespread vaccinations should help stabilise activity across economies.

2.2 Indian economy

Steady growth; inflation a short-term drag

As India prepared to leave the worst of the pandemic behind, a more intense second wave of COVID-19 emerged in the first quarter of FY 2021-22, overwhelming the nation’s health infrastructure and prompting lockdowns, albeit locally. However, with learnings from navigating the first wave, the government and policymakers were much better prepared and the economy demonstrated its structural strength once again. The Government of India rightly accelerated the world’s largest vaccination drive to beat back the pandemic and restore normalcy earlier than anticipated. Till June 23, 2022, over 1.96 billion vaccination doses have been administered.

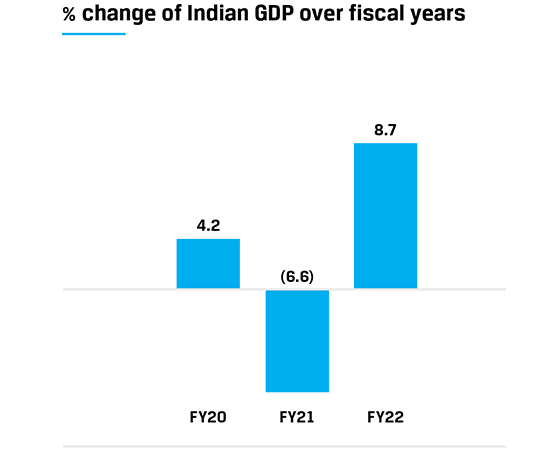

With the lifting of restrictions in the second quarter, the economy staged a sharp rebound. The government significantly increased capital expenditure on infrastructure projects, which boosted domestic demand and investment sentiment. Despite facing multiple headwinds, key economic indicators pointed towards a broad-based recovery. The Indian economy grew 8.7% in FY 2021-22, despite a significant moderation during the fourth quarter, on account of the pandemic-led disruptions, rising domestic inflation, and the ongoing Russia-Ukraine conflict. Gross value added (GVA) at basic prices increased 8.1%. Industrial production, as indicated by the IIP, grew by 11.3%, staying in the positive territory since March 2021. Gross Fixed Capital Formation (GFCF), a proxy for investments, expanded 15.8%, as the government focused on ‘crowding in’ private capex through its mega expenditure push. Private consumption, which has the highest contribution to GDP, increased 7.9%.

Source: Ministry of Statistics and Programme Implementation (MOSPI)

Robust export growth of both value-added and raw material products

India’s merchandise exports were at US$42.2 billion in March 2022, registered a growth of ~20% on a y-o-y basis. Merchandise exports for the fiscal stood at US$419.6 billion, up 43.8% y-o-y and above the US$400 billion target set for FY 2021-22.

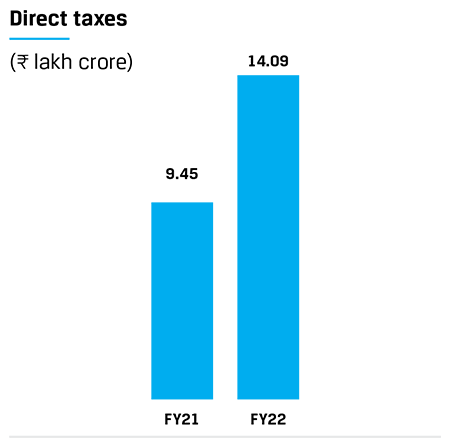

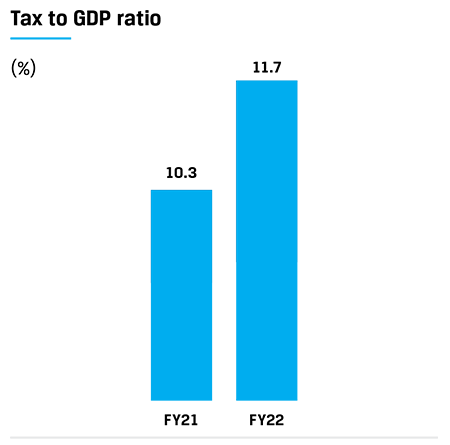

Spurt in direct and indirect tax revenues

Gross fiscal deficit for FY 2021-22 stood at 6.7% of GDP, an improvement over the revised budget estimate of 6.9%, owing to buoyant tax collections. In the last fiscal ended March 31, 2022, India's net direct tax collections (income tax and corporate tax) reached an all time high of ₹14.09 lakh crore in financial year 2021-22 against ₹9.45 lakh crore collections in FY 2020-21.

Central Government tax collections: April 2021 - February 2022

Sources: Income Tax Department

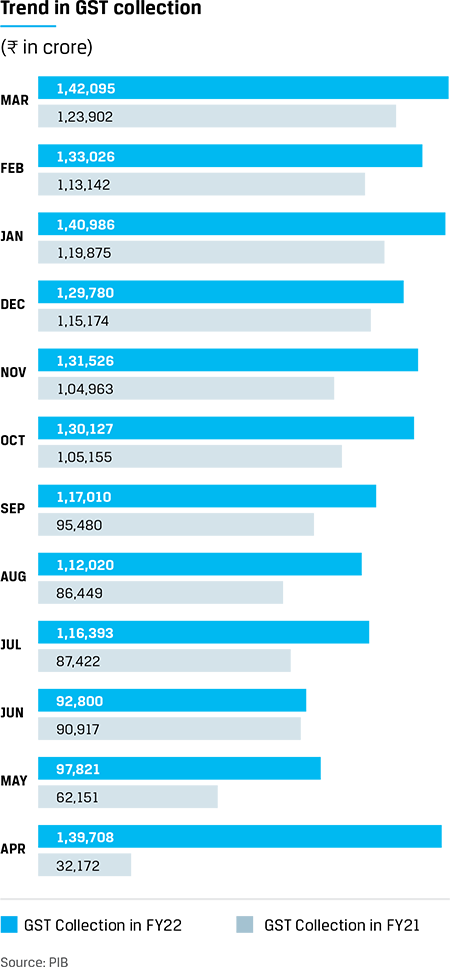

In March 2022, GST collections rose 15% y-o-y to reach an all-time high of ₹1,42,000 crore, which was 46% higher than the pre-COVID level of March 2020. GST collections increased sequentially during the year on the back of economic recovery, anti-evasion activities as well as continued rate rationalisation.

Monthly GST revenue

Inflation worries persist

Though economic indicators improved, rising inflation remains a consistent worry. India's Consumer Price Index (CPI) jumped to a 17-month high of 6.95% in March 2022 from 6.07% in February 2022, breaching the central bank’s comfort level at 4% (with a margin of +/-2%). This prompted the Reserve Bank of India (RBI) to resort to an off-cycle hike in policy rate by 40 bps in April 2022. The apex bank’s action, its first rate hike since the onset of the pandemic in March 2020, was a clear indicator that inflation moderation has returned at the top of its policy agenda.

2.2.1 Policy impetus

The Government of India has its sights squarely set on using infrastructure as the force multiplier to drive economic growth. In line with this strategy, the Government announced a series of programmes during FY 2021-22, which outlines a clear roadmap until 2047 to make India one of the top three economies globally, when the nation celebrates the centenary of its independence.

Continuing high outlays in infrastructure

FY20

FY21

FY22

FY23

2 Union Budget 2022-23

The PM GatiShakti National Master Plan for multi-modal connectivity envisions to reduce logistics costs, thereby improving India’s overall competitiveness. As a digital platform, GatiShakti will lead to integrated planning and coordinated implementation of infrastructure connectivity projects including roads, railways, airports, ports, mass transport, waterways and logistics. The project, to be completed in phases, will entail an expenditure of ₹100 lakh crore.

The government announced a four-year National Monetisation Pipeline (NMP) worth ₹6 lakh crore across 12 key sectors to unlock capital for investing in infrastructure projects under the National Infrastructure Pipeline (NIP). The NIP, which will be implemented over 2020-25, acts as an enabler for India’s infrastructure development, with a projected investment of ₹111 lakh crore, and targets an annual investment between ₹20-22 lakh crore. In its first year, assets worth ₹96,000 crore were monetised under NMP, ahead of target, while the target for FY 2022-23 is set at ₹1.62 lakh crore through asset monetisation.

The Vande Bharat train project expansion is on the cards, with a possible investment of ₹50,000 crore over the next three years. The National Highways network is proposed to be expanded by 25,000 kms, which is nearly double the cumulative length achieved in the past five years. The proposed spend on urban infrastructure, housing and ports was maintained at FY 2021-22 levels, with additional outlay for the creation of water infrastructure. On the affordable housing front, 80 lakh houses are to be completed under the PM Awas Yojana in FY 2022-23, covering both rural and urban families and receiving a ₹48,000 crore budgetary allocation.

The targeted scale of India’s infrastructure development has the potential to create a high multiplier effect on economic growth, and in turn, on the standards of living of millions of Indians. And steel is integral to ushering in this transformational change, building an enduring and sustainable future.

2.2.2 Outlook

The headwinds notwithstanding, India is likely to remain the fastest growing major economy, with the expansion of economic output pegged at 7.2% (Source: RBI). Withdrawal of COVID-19 restrictions and normalisation of the economy has led to a broad - based recovery across sectors. Most sectors, excluding services, are now at pre-COVID levels.

Infrastructure and manufacturing initiatives by the government are supportive of growth, and healthy tax collections provide the government with enhanced flexibility. Realignment of global supply chains will continue to provide opportunities to grow exports. Outlook for auto sales, especially Passenger Vehicles, remains healthy with the easing of the chip shortage, and the production of Medium and Heavy Commercial Vehicles is expected to be healthy, driven by infrastructure spending and mining. The real estate market remains strong despite rising interest rates. Healthy power consumption growth is expected to aid the addition of renewable energy capacities.

The vaccination programme having covered majority of the population, massive infrastructure spending, benefits of supply-side reforms, easing of regulations, robust exports and the availability of fiscal space to ramp up spending across several key sectors, provides a platform for witnessing higher economic growth.

However, a prolonged Russia-Ukraine conflict, higher energy costs, elevated commodity prices resulting in higher inflation and rate hikes by the Reserve Bank of India (RBI), will be dampeners to growth.

The Government has consistently focused on curbing inflation with various fiscal policy measures. In May, the Centre announced a steep cut in excise duty on fuel which effectively brought down petrol prices by ₹9.5 per litre and diesel prices by ₹7 per litre. In May, the Finance Ministry also imposed export duty on 11 iron and steel intermediates and lowered import duty on three key raw materials for steel production and on three inputs for making plastic items. In order to reduce the cost of domestic steel production, the Finance Ministry reduced import duty on coking coal and anthracite and also coke and semi-coke. To ensure local availability of iron ore and concentrates, export duty was raised to 50% and in the case of iron ore pellets, export duty of 45% was imposed. In the case of nine other classes of iron ore and steel intermediates, a 15% export duty has been imposed. This includes flat-rolled products of iron or non-alloy steel. The duty revision on iron and steel and their raw materials was initiated to tame prices.

As the announcement of imposition of export duty on steel, made by the Finance Ministry, came in the backdrop of spiralling inflation in the country, the move is expected to be temporary and the industry is hopeful of its withdrawal at the earliest.

JSW Steel’s View

Gearing up to become the sector of the future

With the redefinition of global trade in the wake of the Russia-Ukraine conflict, many developing economies have an opportunity to fill the trading void for many categories of commodities, which also includes high-quality finished steel and semis. Moreover, China’s economy continues to show vulnerability, dragged down by the impact of widespread COVID-19 infections, which has led to the imposition of lockdowns across many regions. With uncertainty surrounding the revival of economic activity and environmental goals of the country, business sentiment is expected to be subdued through the year. This may impact steel manufacturing output and may also drive down consumption estimates. Thus, Indian steelmakers have a boosted avenue to cater to the global steel consuming markets like Europe and the US.

Even as the global economy is witnessing headwinds arising out of inflationary pressure and global geopolitical developments, India is expected to grow at a moderated pace, supported by a gradual recovery in private consumption, steady rise in exports and the government’s continued investments.

The IMF World Economic Outlook, April 2022 projects India to be the fastest growing major economy at 8.2% in CY 2022 and at 6.9% in CY 2023. India’s high frequency indicators have recorded a robust performance at the start of the financial year. The monthly value of merchandise export in May 2022 was around US$37.29 billion, an increase of 15.46% over US$32.30 billion in May 2021. India’s merchandise export in April-May 2022-23 was US$77.08 billion with an increase of 22.26% over US$63.05 billion in April-May 2021-22. The growth in overseas shipments was driven by petroleum products, electronic goods and readymade garments (RMG). Export of steel and steel containing goods can contribute significantly as witnessed in the last two years to the growth momentum of India’s exports once the imposition of export duty is withdrawn.

JSW Steel is in sync with the domestic economy’s growth possibilities and is focused on contributing towards its overall growth. The Company’s capacity expansion plans are on track and are aligned with the anticipated growth in India’s steel consumption.

Moreover, GoI’s initiatives to promote manufacturing and import substitution is driving growth of steel sector. These include PLI scheme for specialty steels, which provides impetus to steelmakers to create high-quality products for the global market. The Government’s vehicle scrappage policy will enable an ecosystem of steel scrap collection and recycling, giving a fillip to environment-friendly EAF- based steel production.

How is JSW Steel responding to this opportunity:

Projected domestic steel capacity in FY 2024-25

Share of VASP sales in FY 2021-22

Total planned CAPEX over next three years

Industry overview

3.1 Global steel industry

Moderating growth with pockets of demand surge

The global steel industry witnessed a recovery in demand in the first half of CY 2021, leading to a double-digit rate increase in production. The steel consumption witnessed a strong revival owing to widespread vaccination programmes across developed economies. The global steel industry was supported by an uptick in economic activity and improved business sentiment. As the year progressed, demand weakened with the slowdown witnessed in China and elsewhere, due to supply chain disruptions, increasing energy prices and Omicron-related curbs.

According to worldsteel's Short Range

Outlook for April 2022, global steel

demand for CY 2021 stood at roughly

1,833.7 MnT, up 2.7% from CY 2020.

In CY 2021, total crude steel production stood at 1,911 MnT, up 3.6% y-o-y. The global steel production weakened towards the end of CY 2021, as the world’s largest steel producer China recorded a 3% y-o-y decline in production, partly offset by higher production in the other top steel producing countries, excluding Iran. China’s steel production schedules were affected by fiscal tightening, poor demand, uncertainties in its property sector and surging coal prices.

| Top 10 steel-producing countries (MnT) | 2020 | 2021 | % Change from 2020 |

|---|---|---|---|

| China | 1064.7 | 1,032.8 | (3.0) |

| India | 100.3 | 118.1 | 17.8 |

| Japan | 83.8 | 96.3 | 14.9 |

| United States | 72.7 | 86.0 | 18.3 |

| Russia | 71.6 | 76.0 | 6.1 |

| South Korea | 67.1 | 70.6 | 5.2 |

| Turkey | 35.8 | 40.4 | 12.7 |

| Germany | 35.7 | 40.1 | 12.3 |

| Brazil | 31.4 | 36.0 | 14.7 |

| Iran | 29.0 | 28.5 | (1.8) |

Source: worldsteel (all figures for period January-December 2021 & January-December 2020)

Steel demand in the US grew 21.3%

y-o-y, as a solid rebound in demand

led to higher capacity utilisation.

The European Union (EU) too witnessed a sharp increase in steel demand at 16.8% y-o-y, as industrial activities rebounded. In Asia ex-China and Oceania, steel output remained flat even as the key steel producers, India, Japan and South Korea, ramped up production. Meanwhile, steel prices maintained the uptrend that began in 2020 before reaching a tipping point in the December 2021 quarter, as the demand-supply dynamics turned unfavourable. More importantly, input costs remained elevated in 2021, as coking coal and iron ore prices hit an all time high during CY 2021.

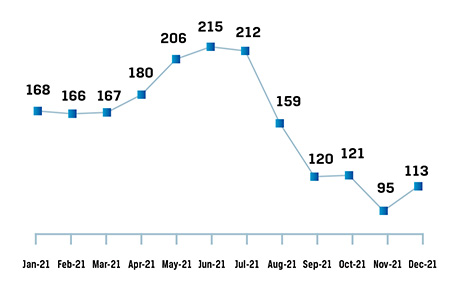

3.1.1 Input prices

At the beginning of the year, iron ore prices increased owing to pent up demand driving business sentiments. Around August 2021, the prices came under pressure following China’s real estate crisis. In the second half of the year, the prices continued to be volatile. Iron ore prices closed the year on a decline as the Chinese government’s carbon emission policy directing steel plants to slash output, weighed heavily on trade sentiments.

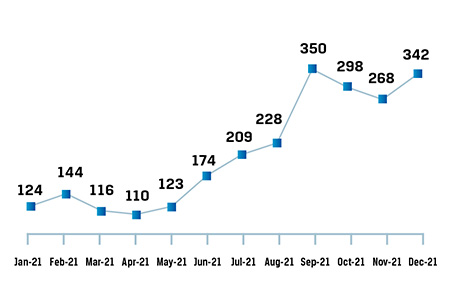

Faster than expected recovery in global demand and tight supply drove Australian coking coal prices to extremely high levels in September 2021. With supply tightness easing in Q4 of CY 2021, especially in China, prices gradually slid from record highs. However, prices remained on the higher side through the year. Even as China had announced an informal import restriction on Australian coal, the commodity recorded staggering demand from markets like India, Japan, South Korea and the EU.

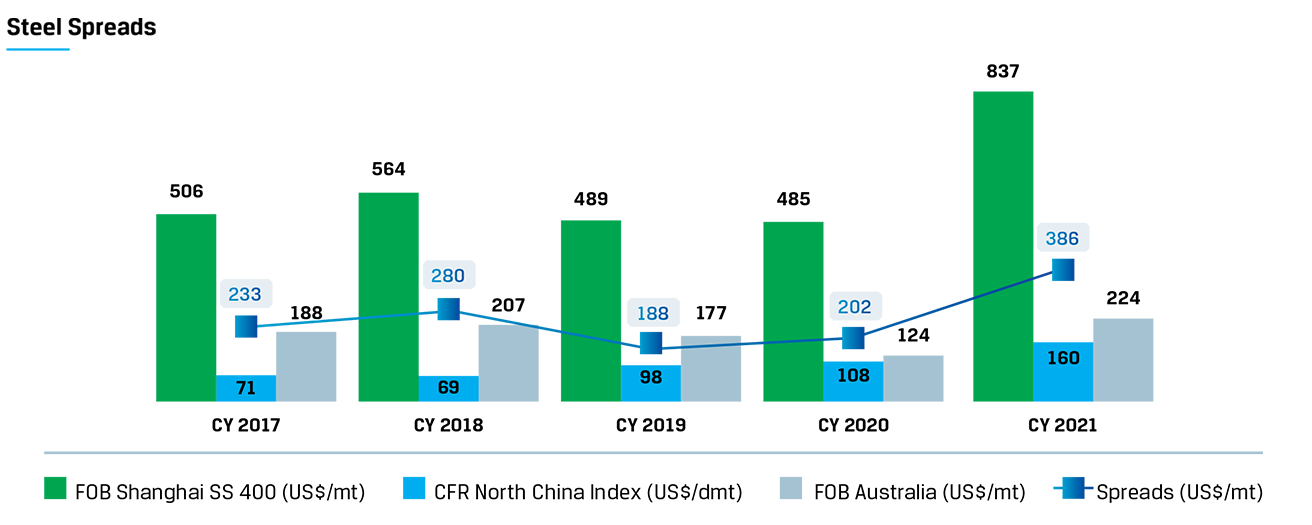

CFR North China Index (US$-dmt)

FOB Australia, (USD$-mT)

On the pricing front, steel prices remained elevated for most part of CY 2021. In CY 2021, overall steel spreads increased owing to a steep rise in steel prices with a lag in rise in input prices. Chinese HRC spot prices continued to outpace iron ore and coking coal costs. Steel prices rose sharply in April 2021 and the prices remained stable through the year, owing to robust demand and low steel inventory levels.

3.1.1 Outlook

Global steel output and demand to remain stable

Global steel demand for CY 2022 is expected to stay flat at 1,840.2 MnT, and expected to grow moderately by 2.2% to reach 1,881.4 MnT in CY 2023. Worldsteel stated that the latest forecast is made against the backdrop of the Russia-Ukraine conflict. Energy and commodity prices are likely to remain volatile, especially for nations with direct trade and financial exposure to the sparring countries.

World steel demand excluding China is expected to drive the demand, by recording a growth of 0.7% (~6.5 MnT) in CY 2022. On the other hand, China’s steel demand is expected to remain flat in CY 2022, owing to the Chinese government’s environmental policies, continuing disruptions due to COVID-19 infections and other structural issues in its real estate sector.

In CY 2022, steel demand growth in US is expected to rise by 2.8% driven by pent-up demand and the US$1 trillion Infrastructure Bill. In the EU recovery in CY 2022 is expected to be impacted heavily by the ongoing Russia-Ukraine war and steel demand is estimated to contract by 1.3%. As European economies pass sanctions closing trade relations with Russia, the resultant supply side shortage, liquidity tightening and market volatility may act as downward risks and weigh on investment sentiments.

High backlog orders combined with a rebuilding of inventories and further progress in vaccinations in developing countries, will drive steel demand in CY 2022. However, rising inflation, and further growth deceleration in China, owing to recent Coronavirus lockdowns, can pose risks to forecasts.

| Particulars | Demand (MnT) | Growth (%) | ||||

|---|---|---|---|---|---|---|

| 2021 | 2022 (f) | 2023 (f) | 2021 | 2022 (f) | 2023 (f) | |

| World | 1,833.7 | 1,840.2 | 1,881.4 | 2.7 | 0.4 | 2.2 |

| China | 952.0 | 952.0 | 961.6 | -5.4 | 0.0 | 1.0 |

| World (Excl.China) | 881.7 | 888.2 | 919.9 | 13.2 | 0.7 | 3.6 |

| India | 106.1 | 114.1 | 120.9 | 18.8 | 7.5 | 6.0 |

| European Union | 163.6 | 161.5 | 167.9 | 16.8 | -1.3 | 4.0 |

| Russia & other CIS countries + Ukraine | 58.5 | 44.6 | 45.1 | 1.5 | -23.6 | 1.1 |

| US | 97.1 | 99.8 | 102.1 | 21.3 | 2.8 | 2.4 |

| Japan | 57.5 | 58.2 | 58.8 | 9.3 | 1.2 | 1.0 |

| Korea | 55.6 | 56.2 | 56.8 | 13.5 | 1.2 | 1.0 |

Source: worldsteel Short Range Outlook -April 2022, f-forecast

In developed economies, demand growth is expected to moderate due to continued disruptions in the global supply chain, which may undermine demand from these sectors. In developing economies, demand growth is expected to be muted, supported by global trade and government infrastructure programmes. Global steel prices are expected to progressively moderate in CY 2022 on account of slower growth in industrial production, softening input prices and slight easing in supply tightness.

High input costs for steel production and continued supply chain disruptions is expected to keep costs elevated for the global steel industry. Furthermore, financial market volatility and heightened uncertainty along with increasing ESG considerations will undermine investment, especially in developed economies.

Demand outlook for consumption sectors

Automotive

In CY 2021, the global automotive sector witnessed lower than expected growth. The pent up demand and increased household savings did help drive some volumes. However, the semi-conductor shortage led to a short-term downturn. Going forward, with the geopolitical tensions and the trade sanctions announced by some economies, supply chain is expected to be impacted. Hence, global automotive industry may witness some headwinds to recovery.

On the other hand, many economies are increasingly promoting the use of electric vehicles (EV) to help achieve long-term environmental targets. Hence, demand for specialty alloy steel is expected to remain stable.

Construction and infrastructure

Global construction sector recovered during CY 2021 and witnessed a growth of 3.4%, despite the slowdown in China’s real estate sector. The growth was driven by infrastructural spends announced by economies across the globe.

The sector is expected to contribute to global steel demand, as several countries, including the US, have announced massive investments in infrastructure projects. However, continued supply chain disruptions and rising inflation may pose downside risks to the sector.

Capital goods

With improved business sentiment and steady consumption growth, capital goods sector witnessed a firm revival in CY 2021. With incremental focus on increasing the domestic production across most economies, capital machinery is expected to drive demand for steel, going forward.

The additional demand from renewable sector as part of energy transition initiative and expected higher outlays on defense spending by Europe in the context of the ongoing war between Ukraine and Russia will supplement the growth in steel demand globally.

3.2 Indian steel industry

All-round positive growth as core sector demand picks up momentum

Steel is a champion industry with growing domestic demand and an opportunity to leverage the space vacated by Russia and Ukraine in the global market through exports. India remained a net importer of steel for several years. However, starting 2017, fuelled by large-scale capex projects and the National Steel Policy, the country started contributing to the global steel markets more than ever, with nearly 18 MnT steel exported in FY 2021-22. India is now racing to build steel capacities that meet the domestic demand and at the same time can supply to the global markets. India is thus, on its path to becoming an integral part of the global supply chain. In response to PLI Scheme announced by Government of India for speciality steel products, the steel industry is geared up to create capacity in this space.

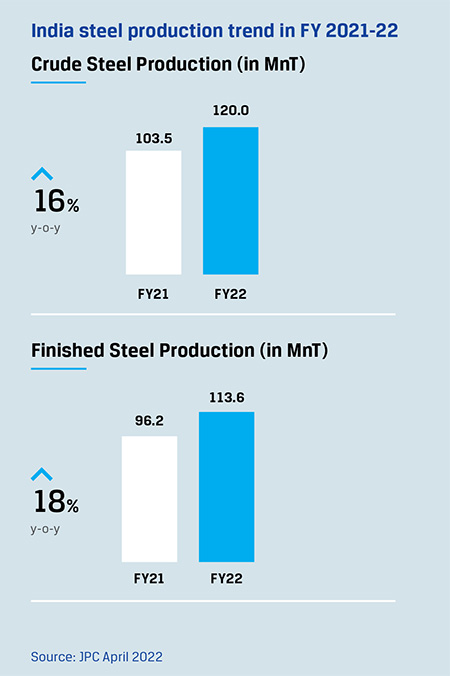

The Indian steel industry recorded crude steel production of 120.01 MnT in FY 2021-22, despite pandemic-induced disruptions in Q1 FY 2021-22. Led by a sharp recovery in demand in developed markets and production cuts in China, steel prices rose sharply in H1 FY 2021-22 in domestic as well as global markets. Prices moderated in Q3 FY 2021- 22 and have remained volatile following the start of the Russia-Ukraine crisis.

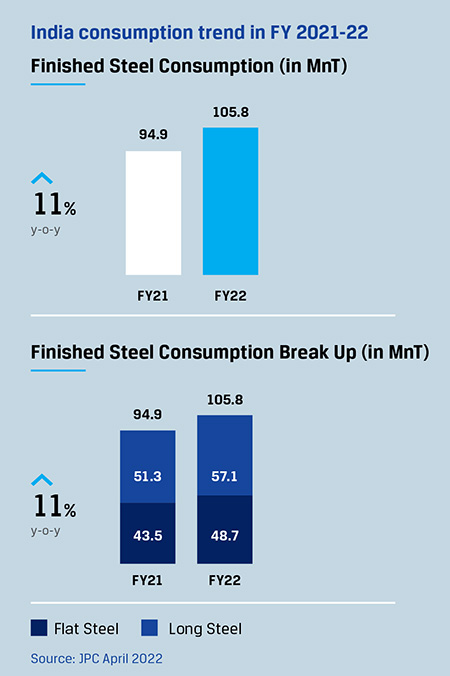

Steel production showed a solid recovery and domestic finished steel consumption continued to grow. Finished steel consumption surpassed pre-pandemic levels and was supported by the government’s improved infrastructure investments. Demand from the auto sector was temporarily weak, due to the semi-conductor shortage. However, the industry closed the year on a positive note and recorded 11% growth in finished steel consumption.

Domestic finished steel production rose 18.1% y-o-y to touch 113.6 MnT. Finished steel consumption stood at 105.8 MnT, up 11.4% y-o-y, driven by the government’s infrastructure spending and the resumption of projects stalled due to the pandemic.

Sectoral demand trends

Construction and infrastructure

Automotive

Engineering and capital goods

The demand from the engineering and capital goods segment remained robust backed by a healthy order book at ~ ₹2.3 lakh crore (1.7 times of FY 2020-21 revenues). Orders from sectors like industrial goods, infrastructure, railways, construction and mining equipment are rising, while those from the power and heavy electrical sectors remained sluggish.

3Source: Mercom

4Source: ICRA

India steel exports and imports

Exports

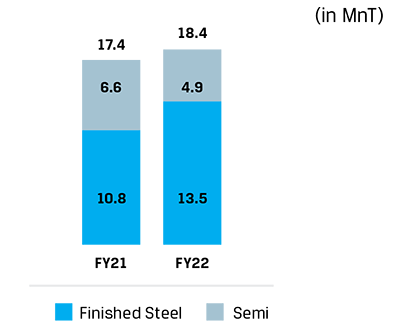

A swift recovery in demand from developed countries and fall in exports from traditional steel exporting countries contributed to growth in India’s finished steel exports, which were up 25% y-o-y in FY 2021-22. Steel firms increased their share of exports leveraging the opportunity in export market while ensuring the availability of steel in the local market. Semis exports declined by 26% due to base effect as steel manufacturers exported slabs following the onset of the pandemic in India.

Even though the export duty introduced in India is primarily to curb inflation, the steel mills in India would need to continue their exports of atleast value added steel, to retain their customers and also additional capacity is created over the year to meet export demand and this surplus cannot be absorbed in the domestic market in the short term.

Imports

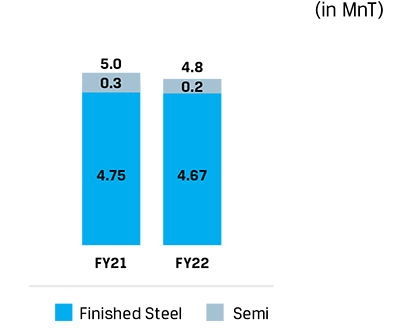

Finished steel imports stood at 4.67 MnT in FY 2021- 22 versus 4.75 MnT in FY 2020-21. The fall in imports is due to greater import substitution and development of comparable indigenous production lines in response to the government’s call for building a self-reliant India. Imports are projected to decline even further as steel mills take advantage of the PLI scheme for specialty steel.

Outlook

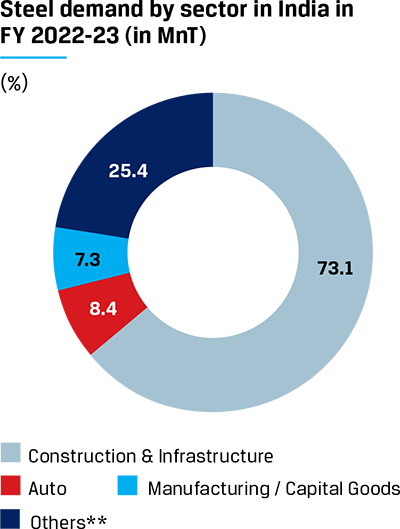

India has consistently witnessed steel imports declining, and exports and consumption increasing, and steel capacities being created. The industry is getting increasingly competitive and catering to an ever-evolving global user industry. The future looks bright for India’s steel industry, with incremental growth expected across the core sectors and multiplier impact likely to be triggered across subsidiary industries. Domestic consumption will continue to be robust, and apparent consumption of steel will continue to grow. With the government’s increased investments on public infrastructure, the real demand is also expected to be steady. Sectors such as appliances, housing and government projects are expected to contribute towards 7-8% growth in steel demand in FY 2022-23

India’s consumption is expected to increase to 114 MnT in FY 2022-23 5 , up 7.5% from a year ago. This growth will be driven largely by the government’s enabling policy initiatives and supplemented by a very healthy revival in the country’s domestic demand. Strong positive trends are noticeable across real estate, infrastructure, automobiles, white goods and engineering goods, and the solar energy sector. Domestic demand will see further increase as more and more industries leverage the economic incentives offered under the PLI scheme to reduce the country’s imports.

Export demand is also likely to be robust, both in the short-term and in the long run, as India benefits from the spillover impact of the Russia-Ukraine crisis and moves up the steel value chain. China’s diminishing steel production and the burgeoning China +1 policies adopted by many in the developed world present strong growth opportunities, if tariff and other trade restrictions are well negotiated.

5worldsteel

Key sectors driving steel demand

*FY 2021-22 data

Construction and infrastructure

Budget announcements

The outlay for capital expenditure in the Union Budget has been stepped up sharply by an enormous 35.4%. In rupee terms, the allocation has gone up from ₹5.54 lakh crore in 2021-22 to ₹7.50 lakh crore in 2022-23.

Government initiatives

In addition to the capital outlays announced in Budget 2022-23, several large-scale infrastructure initiatives have also been unveiled, which carry the prospects of multi-year, multi-crore investments in creating national infrastructure. The PM Gati Shakti National Masterplan was launched in October 2021 with the aim of faster and synchronised execution of key projects covering roads, railways, airports, ports, mass transport, waterways and logistics infrastructure.

The PLI scheme for solar module manufacturing will fast- track India’s capabilities for manufacturing the necessary infrastructure indigenously, to meet the goal of 280 GW of installed solar capacity by 2030. The solar module manufacturing scheme carries an outlay of ₹19,500 crore.

Renewable energy

With a large project pipeline of 55 GW, the outlook for renewable energy capacity addition looks strong. It is estimated that India will add 16 GW of capacity in FY 2022- 23. The push towards capacity creation in renewable energy is in line with India’s announcement at COP26 of increasing non-fossil fuel power capacity to 500 GW and meeting 50% of the country’s energy capacity from renewable sources by 2030.

Automobile

Strong orderbook, new model launches and a shift in customer preference towards SUVs auger well for PV demand. The semi-conductor shortage is expected to gradually ease, which will help OEMs increase production. The CV segment is expected to be the best performing segment on the back of revival in real estate demand, increased infrastructure spending and mining activities. Factors such as improving cashflows of fleet operators, and easy availability of finance are aiding the recovery. The passenger carrier segment will see a revival in demand, as offices and schools reopen with the pandemic significantly waning. Overseas demand also looks strong as key export markets including Bangladesh, Nepal and the Middle East remain less affected by the COVID-19 pandemic.

The PLI scheme for the automobile sector is expected to bring in new investments, further boosting steel demand, as it establishes India as the leading exporter of auto components. The two-wheeler segment is going through several transformational changes, as there is a move towards electric mobility. Going forward, this segment will recover slower than other auto segments.

Consumer durables

The semi-conductor shortage and high input costs are key concerns for the industry heading into FY 2022-23, even as the industry hopes to record double digit sales growth for this financial year. Extension of PLI benefits for consumer durables companies will remain the key enabler for this sector in the near term.

JSW Steel’s view

Indian steel

producers

in a sweet spot

Global steel production in the first quarter of CY 2022 has trended below last year’s comparable period level by 5.9%. The decline is primarily due to lower production in China, the largest steel producing country in the world, as well as lower production in Europe. The Russia-Ukraine conflict is expected to reduce the supply of steel in global trade by ~40-50 MnT in the short- to mid-term. This will likely create supply chain disruptions, especially in Europe. At the same time, production in China is expected to remain subdued and decline by ~50 MnT, which may create demand-supply imbalances.

Global steel consumption is expected to remain relatively unchanged and increase marginally in CY 2022 and grow in low-single digits in CY 2023. Therefore, the production shortfall from China and the ongoing Russia-Ukraine crisis has created an opportunity for steel producing countries like India, to tap deeper into export markets, in geographies like Europe, the Middle East and the US.

Business review

Multi-segment sales, share of value-added products forges new highs

JSW Steel strives for excellence by leveraging its strengths and capabilities, which includes its differentiated product mix, state-of-the-art manufacturing facilities, and a successful track record of executing large, capital- intensive and technically complex product solutions. The Company is progressing across all processes with innovation, digitalisation and sustainability as its key anchors. With efficient integrated operations and a clear vision for the future, JSW Steel is executing its strategic growth plan in line with the growing steel demand and supported by a strong steel cycle.

Key business highlights FY 2021-22

Highest ever

VASP sales

Share of retail in

domestic sales

Highest ever growth in

Coated steel sales

Growth in

automotive sales

Growth in appliance

sales

Growth in sales to

solar segment

Steel supplied to solar projects of 9.1 GW

Steel supplied to wind projects of 620 MW

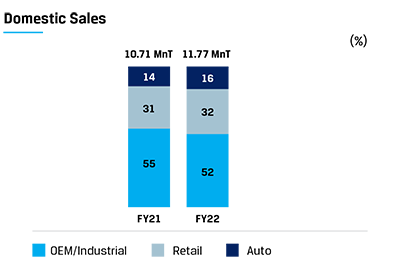

Domestic sales to exports ratio over the past two years has remained constant at 72:28, despite the volatile macro environment both within and outside the country.

Exports performance

4.1 Product performance

JSW Steel strategically focuses on strengthening its market share in the Value-added and Special Products (VASP) segment and invests in continuous product upgrades. The share of VASP in the overall sales mix was at 60% in FY 2021-22. This performance was driven by increased domestic sales in the automotive, solar and appliance segments.

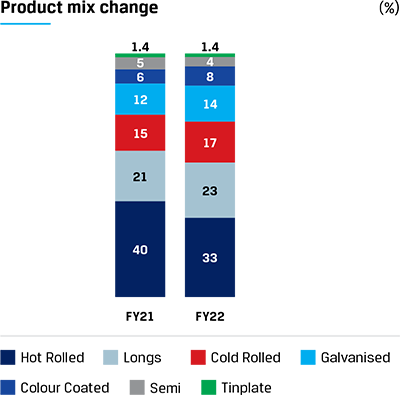

4.1.1 Flats

Flats continue to make up the core of the Company’s business. The portfolio of flat products, comprises hot rolled, cold rolled, galvanised and colour coated, constituted 73% of the total product portfolio in FY 2021-22. The segment reported 8% y-o-y growth. The segment also reported better sales margins as most of the increase in volumes was driven by sales growth of value-added flat products.

Hot Rolled (HR)

Hot Rolled products constituted 33% share of the total product mix.

Manufactured in the Company’s state-of-the-art hot strip mills at Vijayanagar and Dolvi, JSW Steel’s HR coils, plates and sheets are of the highest quality, delivered using the latest technology. The Vijayanagar plant uses sizing presses and an automatic line inspection facility, while the Dolvi unit uses a combination of advanced Conarc process and thin slab casting technology to produce HR coils. As a result, these HR products have thinner gauges and a finer surface quality. HR products are always used in situations where welding and construction is involved and has traditionally fulfilled material requirements for infrastructure projects of national importance.

Growing market reach

» New Mangalore

» Ennore

» Mundra

Cold Rolled (CR)

The Vijayanagar plant has the widest cold rolling mill in India where the CR closed annealed sheets and coils are manufactured. Cold rolled products make up 17% of its product mix driven by the increased automotive requirement and localisation of grades. During the year, the highest ever Hot Rolled Pickled and Oiled (HRPO) sales was achieved in the domestic market, with a 20% y-o-y increase.

Sales growth

Cold Rolled Close Annealed (CRCA)

The cold rolled close annealed (CRCA) category makes up a robust part of the total share of flat product sales. In FY 2021-22, demand driven by the PV segment enabled the CRCA category to sell its highest ever volumes. JSW Steel has taken an early lead in collaborating with auto majors to develop new grades of steel. The Company has developed the HSLA and AHSS , which are specialty steel grades that go into impact resistance and light weighting. These new grades enable auto OEMs to respond to customer demand for eco-friendly vehicles by using lightweight steel that increases fuel efficiency.

Sales growth

Growth in sales to auto sector

Electrical steel

The electrical steel products portfolio comprising Cold Rolled Non-oriented (CRNO) and semi-processed varieties continue to support the Atmanirbhar Bharat mission, for the manufacturing of industrial motors, fractional horsepower motors, generators, pumps, domestic appliances and small transformers. Continuous development and customisation of products and services make JSW Steel a preferred partner to support the growth ambitions of valued customers. JSW Steel is the only ISP in India supplying High quality, thin gauge, low loss electrical steel for two and three wheeler EV traction motors supporting Atmanirbhar Bharat initiative in achieving Carbon Neutrality targets.

Sales growth

New grades were developed during the year in response to the dual needs of import substitution and specialised sectoral demand. These include:

Colour Coated

JSW Steel is the market leader in colour coated product offerings and has been steadily gaining market share. The Company has taken a differentiated growth strategy for this segment continuously offering new products and solutions to the industry.

Sales growth

The Company has been focusing on:

In collaboration with JSW Paints new coating variants like Anti- Dust, Hi Gloss and cool Roof have been launched. Keeping sustainability in mind, Cool- Roof paint system has been developed which due to better heat reflectivity ensures reduced temperature inside buildings thereby resulting in less heat load on AC systems. Anti-Dust variant has been developed for public infrastructure projects to ensure long and better aesthetics even in tough environment. Anti-Dust variant has been supplied to recently commissioned lines of Mumbai Metro.

Maintaining a strong focus & its leadership in the appliance business the company has offered a variety of new colours and coating combinations to its customers. Company is expanding its products in line with the expansion plans of its customers through Early Vendor Involvement process. JSW Steel is working with its Multi-national customers to start supplies to their Global operations.

Working on developing grades that help in import substitution, enhance domestic demand and also support the ‘Make in India’ initiative. Collaborating with customers to locally source high-quality material for their various end-use applications and have also undertaken specific localisation projects to help clients.

JSW Steel continues to supplying colour coated products for some of the prestigious projects of national and international importance.

Delivering on the auto opportunity

JSW Steel continues to maintain its focus and leadership position in the automotive segment through value added product offerings and continuous product upgrades across flat and long products for critical automotive applications, fulfilling requirements of import substitution & specialised sectoral demand.

JSW Steel’s automotive products offer entire range of steel grades from its state of the art hot rolling, cold rolling, coated steel manufacturing facilities at Vijayanagar Works and special alloy steel grades from its Salem Works.

Investments in advanced technology and product development capabilities with a clear vision for the future has enabled JSW Steel to become one of the largest and preferred supplier of High Strength (HSS) and Advanced High Strength steel (AHSS) grades in hot rolled, cold rolled and coated (galvanealed, galvanised) products. Galvanised and galvanealed combined grew by 72% Y-o-Y in FY 2021-22.

The tighter emission policies, transition from internal combustion engine (ICE) to electrical and demand for fuel efficient vehicles with better crash worthiness, have driven the trend change in product mix towards enhanced usage of HSS & AHSS steel grades. Most of the new launches of PV have passed the 5 star safety rating with the HSS and AHSS offering by JSW steel.

JSW Steel worked closely with Indian automakers in offering the desired value added products and setting up of state-of-the- art service centers with capabilities to cater to the dynamic requirements of automotive segment.

Participated in New vehicles grade approval, localisation and increased share of business in five-star safety rating for various auto majors

Galvanised and Galvalume

Galvanised and galvalume products constituted 14% share of the total product mix.

Galvanised and galvalume products constituted 14% share of the total product mix. The category has seen an increase in domestic sales by 27% y-o-y. Keeping in mind sustainability, the company has been continuously working with its customers to promote Galvalume products. Due to superior corrosion resistance & heat reflectivity, Galvalume, with same coating weight offers a much longer life. JSW Steel is country’s largest producer of Galvalume products has been contributing to sustainability by ensuring higher life of its products. Constant R&D is done to keep extending the usability and functionality for end-use customers. JSW offers unparalleled range of Galvalume products. Due to superior properties Galavalume is finding preference in Roofing & cladding end uses.

The solar segment continues to see a considerable surge in demand over the years, and new grades are being developed to answer emerging needs as the sector sales growth broadens its customer base. The JSW Galvos brand address the needs that solar panel installations have to typically face, where the structures are embedded in the ground and need to withstand harsh outdoor conditions. Galvos is specially equipped to withstand challenging alkaline and corrosive environments in conjunction with epoxy/PU layer and has been doing well in this segment.

During the year, new grades that have been developed in response to the multiple needs of import substitution, specialised sectoral demand and international demand. To address needs of Solar trackers, as an industry first, few HSLA grades have been developed for making torque tubes for Indian and exports markets. These HSLA grades have been approved by major global solar players for their installations in India and Abroad. JSW steel is working with Global Developers to offer these solutions across the globe

Tinplate

Tinplate recorded an incremental growth of 11% y-o-y.

Tinplate is a sustainable packing material and has immense potential as it is infinitely recyclable. Its eco- friendly credentials are far superior than a host of other competing materials. It is is one of the highest value-added downstream products in the flat steel segment. JSW Steel envisages global demand for this category to steadily grow due to increased demand for sustainable packaging materials worldwide.

JSW Steel has expanded its capacities to ensure zero dependence on imports for all kinds of tinplate and tin-free steel. Domestic demand has been improving steadily due to growing urbanisation, changing food habits favouring packaged food and increasing options in food retail. Strong demand for the Company’s tinplate brand, JSW Platina, contributed to a healthy share in the overall sales of value-added products. Tinplate from JSW Steel's state of the art facility at Tarapur has been exported to discerning customers throughout the developed markets. Post commissioning of the second tinplate line of 0.25 MnT at Tarapur (likely by July 2022), JSW steel will have the largest tinplate capacity in India. Tinplate constituted 1% share of the total product mix in FY 2021-22.

4.1.2 longs

JSW Steel's long products segment has grown from strength to strength in the last fiscal. The product caters to fast-growing sector of construction and infrastructure. In FY 2021-22, JSW Steel sold 3.84 MnT of long products with an overall growth rate of 22% y-o-y.

TMT (OEM/Industrial)

Long products are input materials for large-scale infrastructure projects, with the major end segments being road constructions, laying of metro and rail infrastructure, bridges, power and nuclear plants. During the year, the Company has supplied steel to landmark projects across the country, such as:

JSW Steel is supplying its TMT

products to more than 571 ongoing

projects of national importance.

Wire Rods

Wire rods recorded. an overall sales growth of 63% y-o-y.

Production of wire rods surged significantly during the year on the back of a rebounding economy. Wire rods have a very wide applicability and are used across categories like automobiles, general engineering, cold drawing, cold forming, spring applications, welding, machining and bearings, to name a few.

Alloy Steel

Sales of alloy longs grew by 33% during the year.

During the year, a special alloy steel for bearing applications and Oil/Gas application was developed to fulfil customer demand as an import substitute. The PLI scheme by the government to promote import substitution of specialty steel products is expected to boost this category in terms of product development and faster prototyping, with applications now being accepted. Customer demand already exists for different grades of alloy steel and JSW is looking at fulfilling that. Different grades of alloy steel are manufactured at the Salem plant which includes round bars, round-cornered squares in straight bars, round and hexagonal wire rods as coils, hexagonal and flat sections, straight bars, and bright bars. The key end-markets for alloy steel are auto, railways, agriculture, defense, oil and gas and general engineering.

4.2 branding initiatives

JSW Steel’s marketing strategy underpins its organisational strategy of becoming a premier producer of specialised, valued-added and branded products with high customer engagement and recall.

Our ability to build strong brands that have a meaningful presence in consumer’s lives has led us to be announced as one of the ‘The Economic Times Best Brands 2021’ . This recognition is a testament to our efforts on building the JSW Steel Brand on strong differentiating platforms of technology and innovation.

Ensuring high brand recall

Through differentiated and meaningful marketing actions, JSW Steel has built brands that command mind awareness, instant recall, popularity and benefit of instant association.

The Indian cricketer Rishabh Pant continued as the Company’s celebrity endorser, helping to launch new marketing campaigns for 'JSW Neosteel' — pure TMT bars range and 'JSW Colouron+' — premium colour coated roofing sheets range. The campaign was aired during both legs of IPL 2021.

A 360-degree marketing campaign was carried out during the IPL season with high-visibility ads across a variety of media including in- stadium display, social media and commercials on TV and OTT platforms.

The high-impact campaigns for JSW Neosteel and JSW Colouron+ reached 78 million and 88 million people, respectively, and performing well on target parameters.

Customer centricity through new product launch and delivering enhanced benefits

New products

Galvanised roofing sheets provide a cost-effective solution to the customer that is both strong and durable. JSW Steel's customer research indicated a need gap for more resilient, weather-proof sheets. Thus, the Company's subsidiary, JSW Steel Coated Products, launched Silveron+, a premium category roofing sheet with Al-Zn coating that offers enhanced corrosion resistance, better heat reflectivity and longer life. The product comes with a 7-year warranty which will further build the consumer’s trust in the brand.

Enhanced customer benefit

With an objective to widen consumer choice and to meet performance expectations, three new variants of Colouron+ (High Gloss & Anti Dust, Cool Roof, High Gloss) were launched in the market. To provide consumers a complete peace of mind based on our strong product features, a warranty of 10 years has been announced on Colouron+.

Retail initiatives

JSW Steel’s retail marketing strategy aims to engage strongly with the retail network and influencers to ensure a great buying experience for the consumers. The Company has one of the largest retailing and distribution networks in the country encompassing more than 16,000 exclusive and non-exclusive retail outlets, 376 distributors, spread across more than 602 districts and more than 1400 towns in India.

Maintaining a high customer connect at the retail level

The Company launched two new retail initiatives to deepen the connect with customers.

JSW Shoppe and JSW Shoppe Connect Branded format stores aims to widen the customer base and provides a better retail experience to the customers. JSW Steel continued to expand their branded footprint with 500+ new stores launched during the year, taking the total to 1300+ stores across 470 towns in the country.

Building relationships with the influencer community

In the retail segment, low customer awareness and minimal engagement with branded steel products is common. This leads to the influencer community of masons, fabricators and contractors playing a significant role in terms of conversions and brand building.

JSW Privilege Club, the Influencer Connect programme, addresses this segment and was further expanded in FY 2021-22. ~15,000 influencers were added during the year, taking the total count to 32,000+ across the country. The engagement programme enlists masons, fabricators and contractors with appropriate training, skill development and reward programmes, as well as with personal care initiatives like providing free medical insurance, loss of wage coverage during hospitalisation and scholarship schemes for their children.

The depth of the work done by JSW Steel with influencers on their well-being and upskilling is appreciated across industries and we were honoured as the Best Channel Loyalty Program award.

Operational review

Vijayanagar Works

Vijayanagar Works is JSW Steel’s flagship plant with a capacity of 12 MTPA and is one of the largest steel plants globally. Constantly evolving to stay ahead of the curve, Vijayanagar has embraced a host of new technologies across functional areas – from production process improvements to 100% waste utilisation. It has successfully turned these innovation-led optimisations to its competitive advantage and emerged as one of the lowest cost steel producer in India. Given the long-term demand for carbon-light steel, Vijayanagar is already augmenting capacities for green steelmaking.

Competitive strengths

Year in review

Cost reduction projects

Capacity expansion

Quality management initiatives

Digitalisation initiatives

The fourth wave of digitalisation is underway at Vijayanagar Works. The suite of Industry 4.0 technologies has been used to automate activities like raw material handling. This is being done by digitising the actions of shop simulators and schedulers and other equipment. Real-time and dynamic control across the plant’s equipment gives a slew of benefits like lowering costs, value-addition of grades, improved advanced planning for logistics operations and mining activities. Some of the key digital initiatives during the year were:

Future roadmap for the digitalisation of Vijayanagar Works

Rollout of the Integrated Control Tower (ICT) is on the anvil, with the first phase to be launched. In the second phase of the ICT rollout, sustainability and energy management data will also be mapped. The safety function will be digitalised with tools like augmented reality/virtual reality. Other features to be included are digital trackers, geo-fencing, improved man-machine interfaces. The sustainability- related digital projects will cover online tracking and monitoring of water, gases emanated and by-products generated; carbon emissions and will also help with water conservation and management.

Environmental initiatives

Reducing environmental impact is a continuing priority for JSW Steel. In FY 2021-22, Vijayanagar Works continued its efforts towards sustainable development through conservation of natural resources, reduced emissions, achieved and sustained zero discharge, and efficiently recycled and reused solid waste to reduce its impact on the environment and preserve the biodiversity across its operations.

Health and safety

During the year, Vijayanagar Works launched several new initiatives to achieve health and safety goals of the Company. These include:

Strategic initiatives for FY 2022-23

Vijayanagar Works has placed sustainable growth at the core of its future outlook and strategy for expansion. It is actively working on decarbonising its largest production facility through various initiatives which inter alia includes increasing share of renewable energy. The plant will focus on completion of its capacity debottlenecking project as well as progress on its plan to increase its capacity to 19.5 MTPA by FY 2024-25.

Enhancing safety using virtual reality

The impact of digitalisation on the Safety function is demonstrated by the use of virtual reality (VR) to train plant workers in handling complicated fire management equipment. Fire is a major hazard in built environments, even more so in a hazardous process environment like a steel plant. The safety team in Vijayanagar Works always felt the strong need to build preparedness among shop floor employees so that response was immediate and on-target. But the training is costly, requires a lot of space and causes significant CO 2 emissions. These were proving to be a barrier.

The smart Virtual Reality (VR) training solution for firefighting used VR within an experiential immersive learning environment to recreate a broad range of fire emergencies, so that the trainees could respond in real time and with authentic spatial understanding of the danger at hand.

The desired outcome was achieved at low cost, with no

injury, no additional space and zero emissions.

The VR enhanced module made training possible anywhere, anytime, without any requirement for travel or location change.

JSW Dolvi Works is a 10 MTPA integrated steel plant, located strategically on the west coast of Maharashtra. The facility is connected to a jetty with an annual cargo handling capability of up to 30 MnT and caters to sectors ranging from automotive and industrial to consumer durables. Dolvi Works is the first plant in India to adopt a combination of Conarc technology for steelmaking and compact strip production for producing hot rolled coils, providing the unit with flexibility to use a combination of solid charge and liquid hot metal.

Competitive advantage

Year in review

Cost reduction projects

Environmental initiatives

In FY 2021-22, Dolvi unit implemented several initiatives to improve its environmental performance. It commissioned a Dry Gas Cleaning Plant and an LD Convertor waste heat recovery boiler to improve waste heat recovery and implemented Coke Dry Quenching to reduce specific water consumption and water footprint. Waste management efforts have led to better utilisation of solid wastes. To improve air quality, measures were undertaken to reduce dust emissions for a clean shop floor environment and to control fugitive emissions.

During the year, the unit continued with mangrove development in Dolvi to stabilise the coastline by reducing soil erosion caused by surges, waves and tides, and to also reduce saline ingression and prevent flooding. Furthermore, this initiative will provide shelter to a range of wildlife species including birds, as well as benefit the local community.

Health and safety

JSW Dolvi Works launched many initiatives during the fiscal year, in line with the Company’s Health and Safety goals.

Strategic initiatives for FY 2022-23

JSW Steel’s Salem plant is its largest specialty steel plant in India, with a production capacity of 1.0 MTPA. JSW Salem plant has created a unique market for its products. The plant has rigorously kept in step with the technological upgradations made by its key customers and their demand for specialised grades. This has helped to create a high-value niche for JSW Steel and a strong market position within the sector.

Competitive advantage

Year in review

During the year, Salem Works achieved several marquee production milestones.

Health and Safety