Steel industry holds high levels of significance as the global pace in infrastructure and manufacturing picks up. There is increasing demand for greener and cost-effective materials to satisfy this demand, and being an affordable and nearly infinitely recyclable material, steel is the natural choice. Several trends shape the steel industry, and most notable and relevant trends in JSW Steel’s operating environment are given below.

Robust growth of Indian economy to drive progress

Evaluated over the period 2000-2022, steel demand has had a strong correlation of 0.61 with economic growth along with an elasticity in excess of 1.15. During, the last two decades, global steel trade was impacted severely by two major shocks of the global financial crisis between 2008 and 2009 and the COVID-19 pandemic beginning in CY 2020 along with the trade downturn of 2015.

The global financial crisis started in 2008 with the global economy contracting by 0.086% in CY 2009. During the crisis, the world lost around $3.4 trillion and the Advanced Market Economies (AME) witnessed contraction of 3.3%, while Emerging Market Economies (EME) expanded by 2.8%. In the aftermath of GFC, India continued to grow from $1.224 trillion economy in 2008 to a $3.0 trillion economy in 2021.

With the COVID-19 pandemic impacting global economies, the global GDP contracted by $2.3 trillion or 3.1% in CY 2020. However, with a view to curb global slowdown resulting from COVID-lockdowns, supply disruptions and demand meltdown, economies across the globe announced various stimulus measures through monetary easing. This led to a sharp and significant global economic recovery during CY 2021 with World GDP up by $11.1 trillion or 6.1% to reach $96.3 trillion.

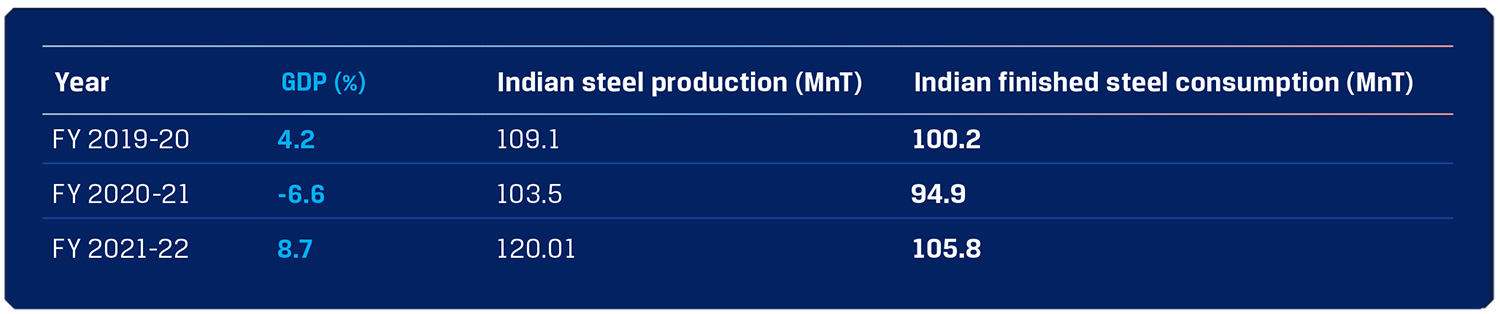

With regards to the Indian economy, in FY 2020-21 owing to the impact of the COVID-19 pandemic, the GDP growth contracted by 6.6% with Gross Fixed Capital Formation (GFCF) sharply down by 10.4% and private consumption expenditure down by 6%. Likewise, Indian steel production too recorded a sharp contraction by 5.3% to 103.5 MnT with finished steel demand contracting by 5.3% to 94.9 MnT and per-capita steel demand at 70 kg (down from 74.7 kg.).

In FY 2021-22, Indian GDP grew by 8.7% on a lower base of FY 2020-21 with GFCF up by 15.8% while private consumption up by 7.9%; Indian merchandise export increased by 44.6% y-o-y from $292 billion in FY 2020-21 to $422 billion in FY 2021-22 (v/s target of $400 billion). During this period, Indian steel production increased by 15.9% to 120 MnT and apparent steel consumption rose by 11.3% to 105.7 MnT. Per capita consumption of steel increased to 77.2 kg.

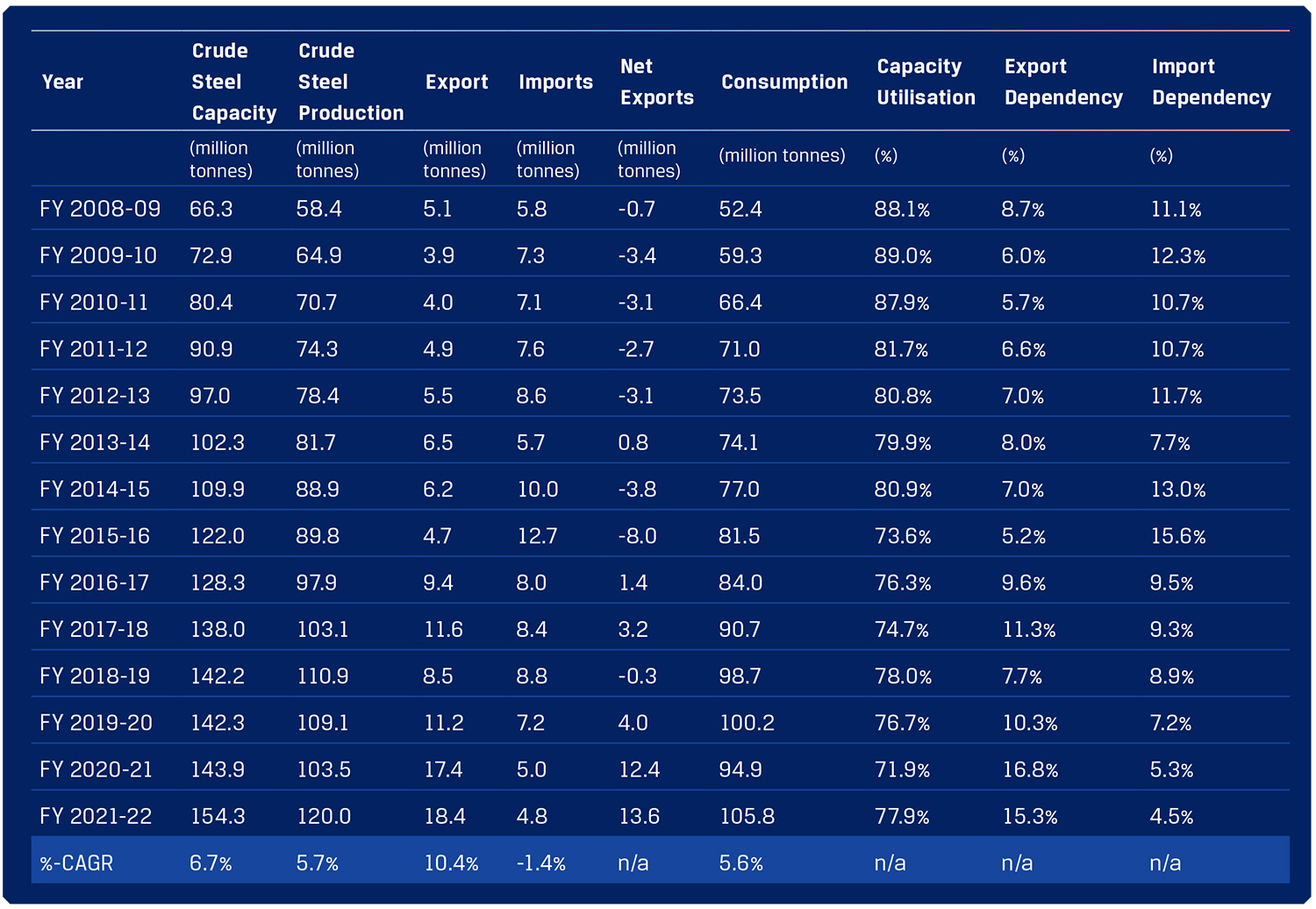

Evolution of the Indian steel industry from net importer to net exporter

In FY 2020-21, as domestic economic activity was impacted by the COVID-19 pandemic, domestic demand remained muted. Hence, the steel industry focused on finished steel exports increasing from 11.2 MnT in FY 2019- 20 to 17.4 MnT in FY 2020-21 while imports reduced from 7.165 MnT in FY 2019-20 to 5.042 MnT in FY 2020-21. This rendered India as a net steel exporter.

In the consecutive year, with increasing private consumption and improved business sentiment, the steel industry continued to witness growth in steel trade. Finished steel exports continued to gain focus, especially in an environment full of volatility and uncertainty recording historic high tonnage at 18.4MnT with imports down to 4.8MnT. Engineering exports also recorded a sharp increase by 46% from $77 billion in FY 2020-21 to $112 billion in FY 2021-22.

India has large demand potential – however integrated steel capacities have been added in blocks which are far larger than the volumes the domestic market can absorb immediately, compelling the steel industry to explore the export market. However, the long-term growth story for steel is robust and the Indian steel industry is continuously exploring investment options to create and expand capacities to meet the country’s rising demand potential. However, the industry would continue to have the challenges of mismatch of capacity vis-à-vis domestic demand, leading the industry to explore the export options – both directly as well as through the exports of steel intensive manufactured goods.

India steel data

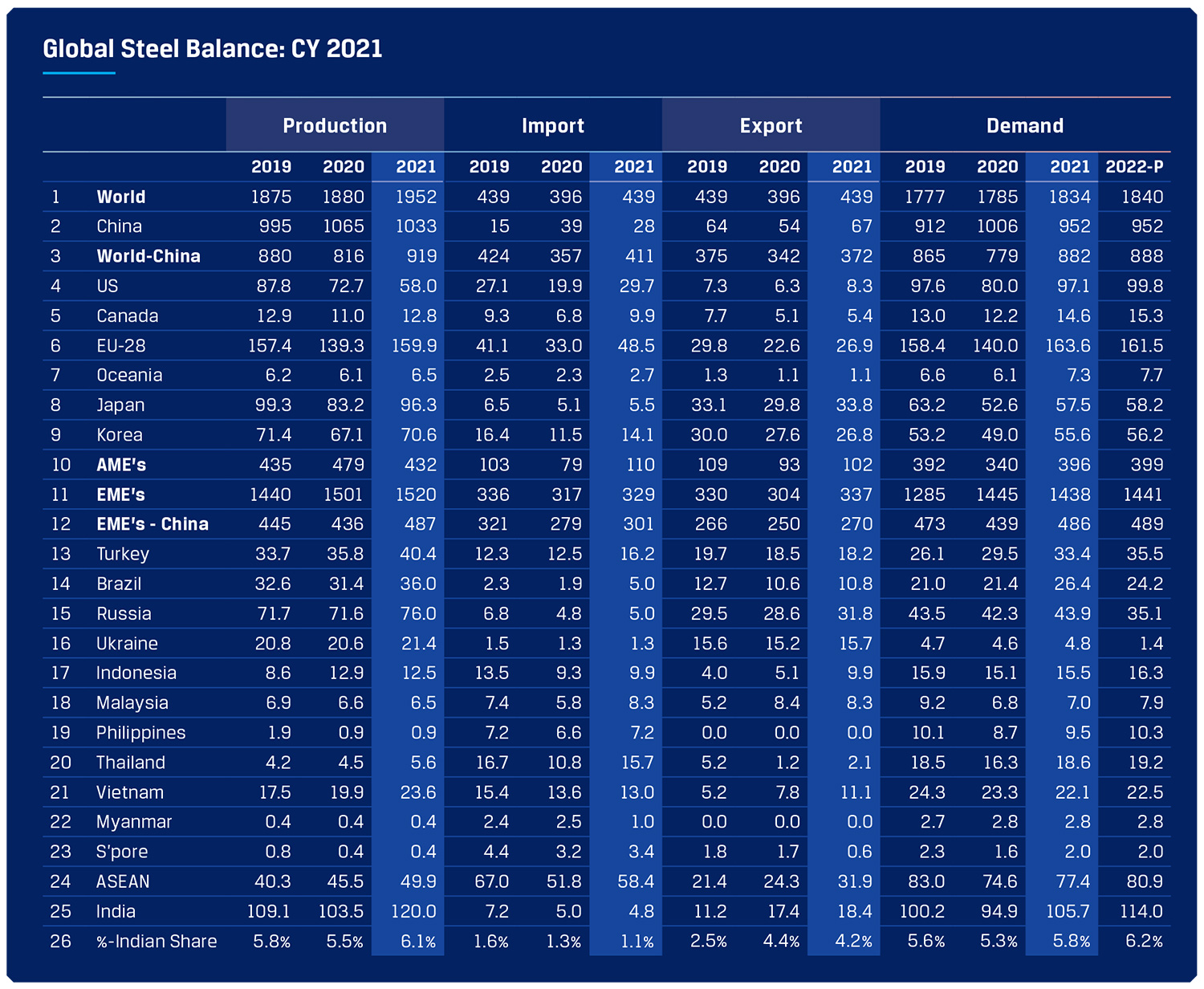

Indian steel industry in a sweet spot

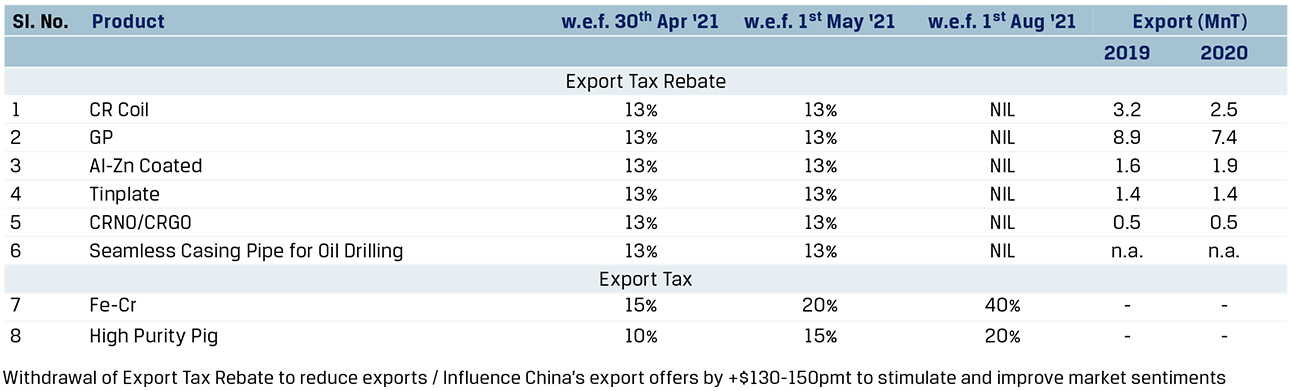

An analysis of the top steel importing countries and top steel exporting countries will show us that the opportunity landscape for India is quite clear. Japan, Korea and China are top steel exporting countries. Even though China has witnessed some growth in steel exports in CY 2021, the country’s focus to achieve its environmental targets may impact the growth. The country has already reduced the Export Tax Rebate to discourage exports of steel products which is perceived to be resource-intensive, capital intensive, energy-intensive and emission-sensitive. Japan and Korean products are not particularly competitive and Russian steel is more or less embargoed by key importing countries/blocs such as the EU and the US. India can ably fill this gap, and this will require the country to create more steel capacities.

China: Withdrawal of Export Tax Rebate

Driving growth in user industries

Export volumes from user industry like engineering, has doubled in the period FY 2018-19 to FY 2021-22. There has been a steady rise in indirect steel trade, of the 18.4 MnT export volume around 11 MnT is through indirect sale.

Indian steel industry is focused on exporting higher quantities of specialty steel and steel intensive manufactured goods to promote more and more valueaddition, employment and economic development and growth of the country. The Industry has prioritised supplies to the domestic value-addition market including MSMEs for promoting manufacturing activities of steel intensive engineering goods – both for domestic as well as exports, through special schemes supporting both value and volume for MSME’s.

Going forward, the infrastructure sector will be a focus area for growth as government estimates to spend ` 7.5 lakh crore in capex spending as per Budget estimates for FY 2022-23. Auto sector and capital good and consumer durable are also expected to back domestic steel demand growth.

Total Demand Distribution

Source: Joint Plant Committee (%-sectoral distribution is based on CRISIL-JPC study published in March, 2020)

Indian steel prices to remain competitive

Globally, economies are focusing more and more on resource conservation. Steel manufacturing in an energy intensive industry and has necessitated that the global steel industry focusses on reducing the overall carbon footprint of its operations. On the other hand, quality of iron ore is increasingly declining. Hence, steel manufacturers have to consistently look at technologies to enable utilisation of low quality iron ore and also optimise the use of coal without much environmental impact. The same has led to increased operational costs and impacted steel prices.

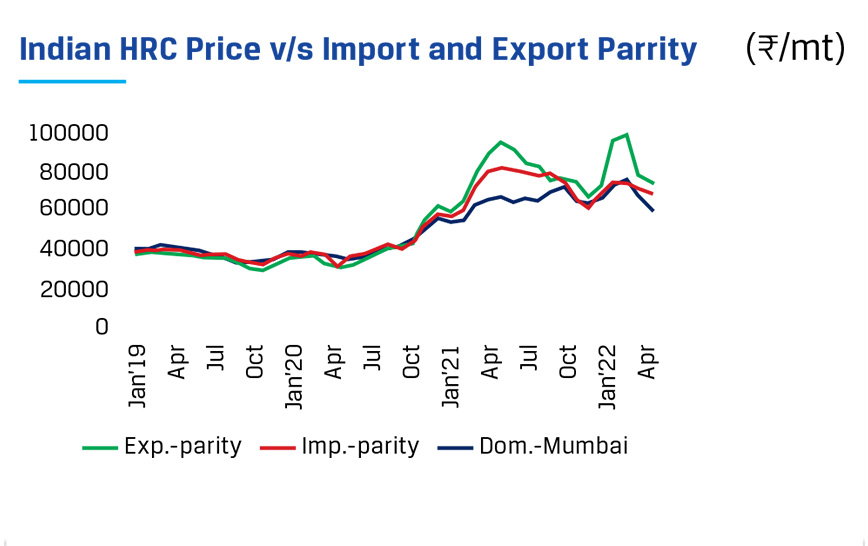

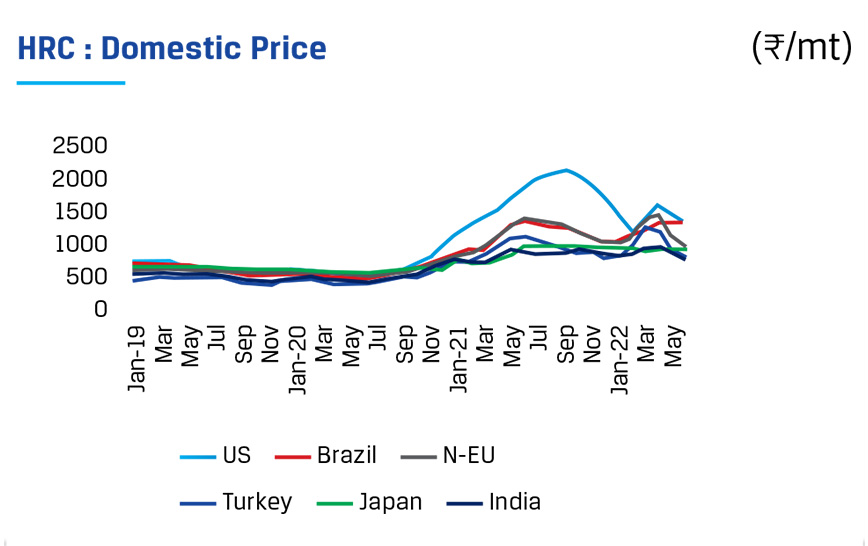

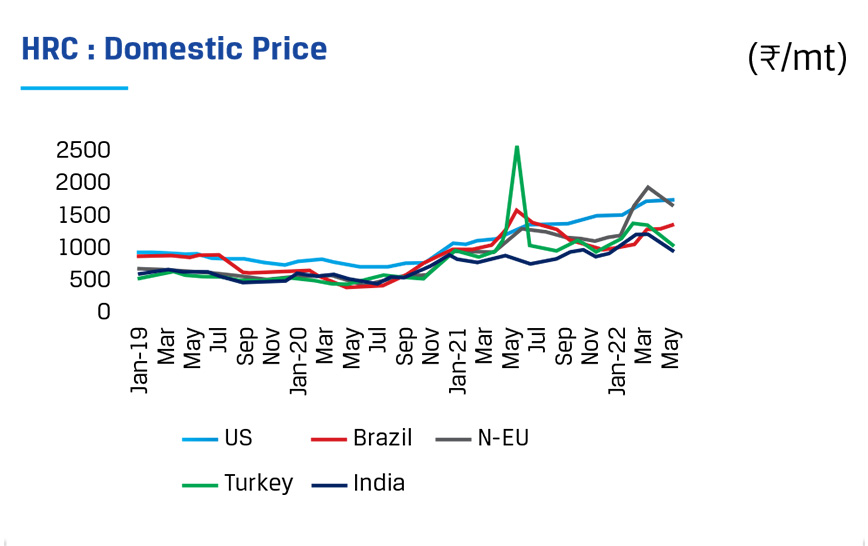

In FY 2021-22, volatile and steadily increasing input prices also drove the steel prices higher. Indian steel prices are a reflection of global steel prices with a strong correlation of 0.97 with import and export parity. Approximately, 15-20% of Indian steel capacity is currently dedicated for exports of steel and steel intensive manufactured goods. However, comparatively, domestic steel prices have remained lower than most of the other countries including Europe, US, Turkey, Brazil, Japan – indirectly making the Indian exports of engineering goods also globally competitive.

Treading the export duty mandate

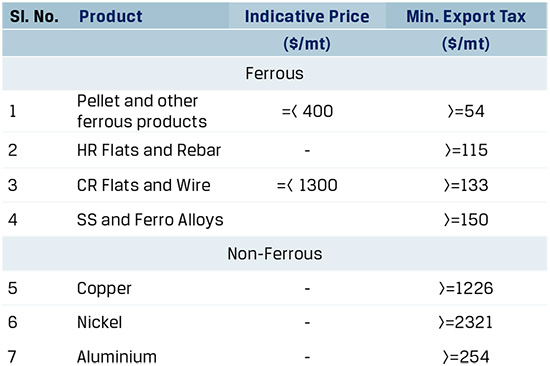

China, Russia and India, are the only three countries in the world to have imposed export duty on steel. Recently, China has removed export incentives and has not added export duty. Russia has also removed export duty on steel.

No other economy has so far announced an export duty on steel products or manufactured product – which are viewed as the value chain products.

The Government has enforced measures to address inflation. The imposition of export duty on 11 steel and iron intermediaries will help domestic metal availability for Infrastructure development which constitutes a critical part of public spending and remains one of the key economic enablers. Indian steel has a pivotal role in country’s economic development constituting 60-65% share in Infrastructure and Construction, 20-25% in General Engineering and Capital Goods, 10-12% in Automobile and Appliances along with special steels for Indian Defence and other miscellaneous activities.

The National Steel Policy (2017) has projected the country’s steel capacity to grow by two-folds from current levels of 154 MnT (as on December 2021) to 300 MnT by FY 2030-31, along with production to increase from 120 MnT FY 2021-22 to 255 MnT in FY 2030-31 and projection for exports initially targeted at 30 MnT. Thus, steel would continue to remain the metal of choice during the country’s economic transformation from current GDP levels of $3 trillion to $10 trillion during the next eight to ten years, for supporting the manufacturing led economic growth with thrust on infrastructure and construction.

Russian Export Tax on Ferrous and Non-Ferrous Metals

Trade barriers on exports from India

| Type of Investigation | Product description | Duty Rate | Date of Definitive Imposition |

| United States | |||

| Anti Dumping | Corrosion resistant steel products | 3.05%-22.57%

(22.57% for JSW) |

25th Jul 2016 (in-force since 5 years) |

| Anti Subsidy | Corrosion resistant steel products | 11.30%-588.43%

(11.3% for JSW) |

|

| Anti Dumping | Cold-rolled steel flat products | 7.60% (for JSW) | 20th Sep 2016 (in-force since 5 years) |

| Anti Subsidy | Cold rolled flat steel products | 10.00% (for JSW) | |

| Anti Dumping | Certain Hot-Rolled Carbon Steel Flat Products | 0%-38.72% (0% for JSW) | 3rd Dec 2001 (in-force since 19 years+) |

| Anti Subsidy | Certain Hot-Rolled Carbon Steel Flat Products | 68.77%-215.54%

(215.54% for JSW) |

|

| Anti Dumping | Cut-To-Length Carbon Steel Plate | 72.49% | 10th Feb 2000 (in-force since 20 years) |

| Anti Subsidy | Cut-To-Length Carbon Steel Plate | 12.82% | |

| Section 232 | All steel products incl. Semis | 25.00% | 23rd March 2018 |

| European Union | |||

| Safeguards | Multiple steel products (Semis & Longs excl.) | 25% over and above quota | 18th Jul 2018 |

| United Kingdom | |||

| Safeguards | Multiple steel products (Semis, HR,CC & Longs excl.) | 25% over and above quota | 18th Jul 2018 |

| Canada | |||

| Anti Subsidy | Hot Rolled Steel Sheet and Strips | Rs. 3150 per mt | 17th Aug 2001 |

| Anti Dumping | Corrosion Resistant Steel (except Colour Coated) | 40% | 21st Feb 2019 |

| Australia | |||

| Anti Dumping | Zinc Coated (Galvanized) Steel | 12% | 16th Aug 2017 |

| Anti Subsidy | Zinc Coated (Galvanized) Steel | 4.3% (Effective rate 12.8%) | 16th Aug 2017 |

| Thailand | |||

| Anti Dumping | Hot Rolled Flat Steel Products | 26.81%-31.92%

(31.92% for JSW) |

27th May 2003 |

| Indonesia | |||

| Anti Dumping | Hot Rolled Coil | 12.95%-56.51% (22.25% for JSW) | 2nd Mar 2008 |

| Taiwan | |||

| Anti Dumping | Carbon Steel Plate | 32.82% | 22nd Aug 2016 |

| Morocco | |||

| Safeguards | HR Coils and Sheets | 25% | 19 Jun’20 |