India’s largest steel producer by capacity

JSW Steel, the flagship of the JSW Group, is India’s largest and geographically most diversified steel producer. The Company retains its market leadership through agile operations, a strong product portfolio, advanced technology, efficient project execution, and sustainable sourcing. Lower conversion costs, better raw material security, and a future-ready workforce further strengthen its position.

With fully integrated operations spanning mining, raw material processing, steel production and downstream value-added manufacturing, JSW Steel today has an installed capacity of 35.7 MTPA across India and overseas (including 1.7 MTPA under commissioning at JVML). Aligned with India’s strong long-term steel demand growth outlook, JSW Steel has launched a capital expenditure programme covering growth projects, mining and cost savings initiatives, value-added product facilities, modernisation of overseas facilities and sustaining capital expenditure. JSW Steel has set a target to reach 51.5 MTPA capacity by FY 2030-31.

At a glance

WSD’s World-class Steelmaker ranking

Global ranking on production volumes

Total installed capacity

Domestic installed capacity*

* Including 1.7 MTPA under commissioning at Vijayanagar by JSW Vijayanagar Metallics Limited, a wholly owned subsidiary of the Company.

Reinforcing cost leadership through integrated manufacturing

JSW Steel’s global leadership in conversion costs stems from its efficient operations, strategically located plants, cutting edge manufacturing technologies, high manpower productivity and resilient business model. The Company is an integrated manufacturer of a diverse range of products, utilising various industry-leading technologies. Its integrated operations span from raw material processing units, such as beneficiation plants, pelletisation and sinter plants, to downstream value-addition capabilities, such as production of cold rolled, galvanised and colour-coated products. The facilities are well connected to rail, roads and ports, which provides natural competitive advantages in terms of reliable and cost-efficient sourcing of raw materials and delivery of finished steel products to the market.

JSW Steel’s cost-reduction initiatives during FY 2024–25 included a focus on regional sourcing of iron ore, enabling the Company to reduce inbound logistics costs through shorter haulage routes and multi-modal transport strategies. The Company also optimised the coking coal blend to reduce overall coke production costs and increased Pulverised Coal Injection (PCI) to lower fuel costs. Additionally, optimum utilisation of Blast Furnace gas and Coke Oven gas helped generate power and meet heating requirements.

JSW Steel is in the process of implementing plans to increase the usage of renewable energy in its operations and is actively engaged in the strategic integration of renewable energy sources into its operational framework and in exploring innovative avenues to incorporate clean energy solutions into every facet of its business, from manufacturing to logistics. By optimising its energy footprint and embracing renewables, JSW Steel is mitigating the environmental impact while future-proofing the business against volatile energy markets and regulatory uncertainties. This transition to renewable energy also provides cost savings in terms of lower energy costs compared to thermal power costs.

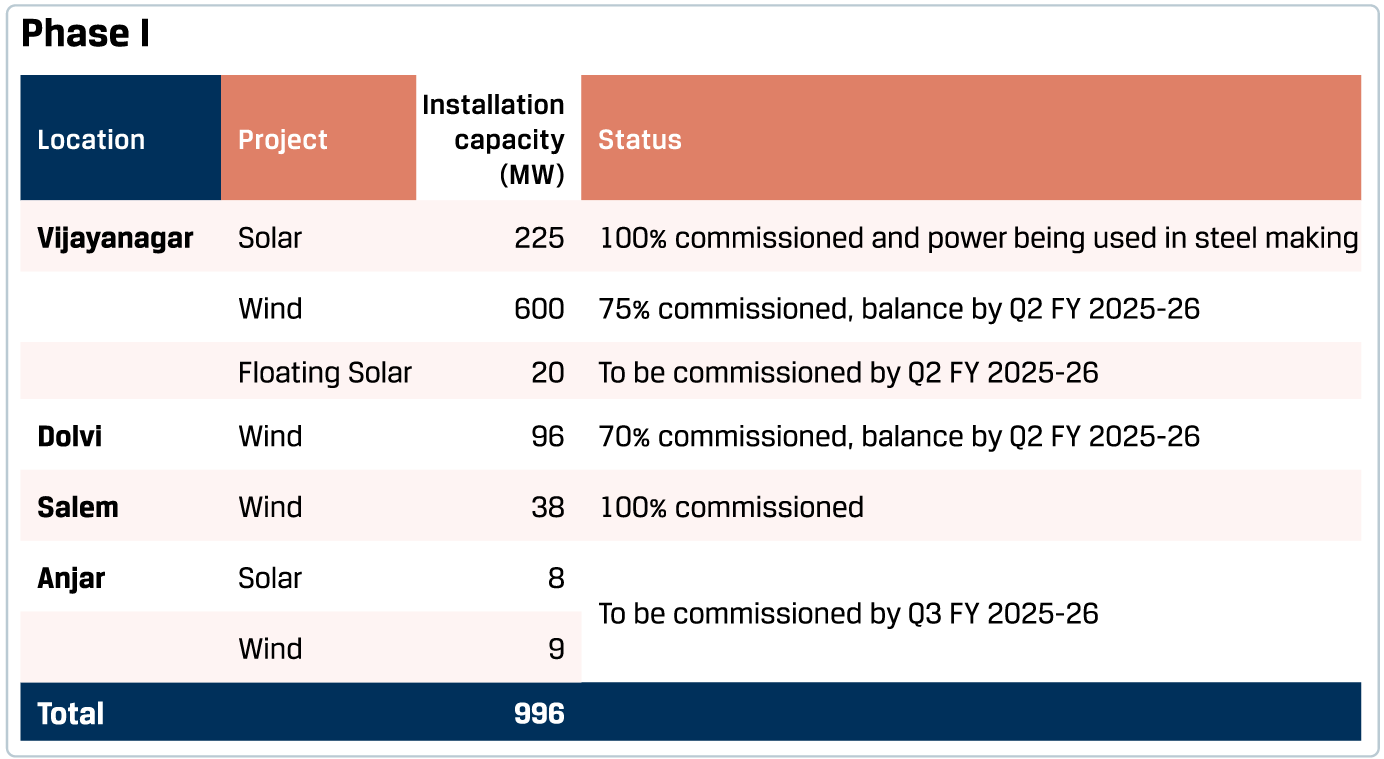

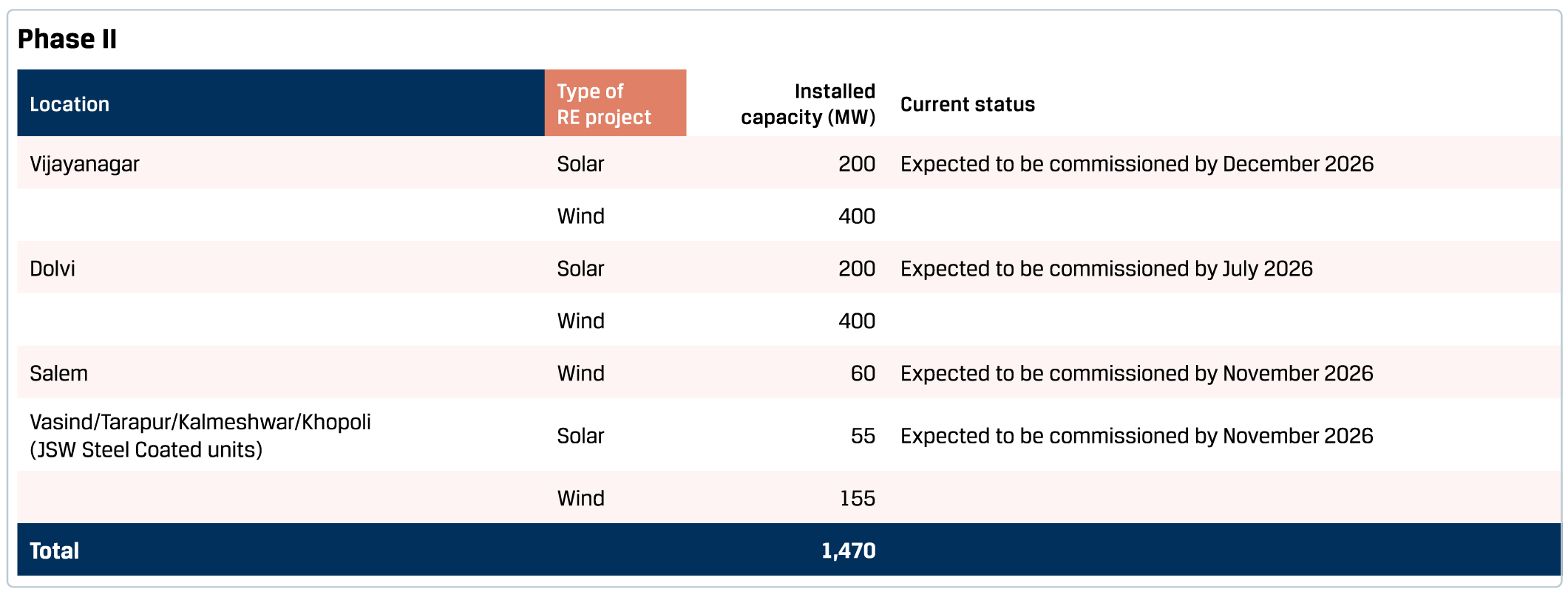

In line with its vision to increase the share of renewables in its overall power requirements, JSW Steel has entered into a power purchase agreement with subsidiaries of JSW Energy Limited to procure wind and solar power of 996 MW in Phase I and 1,470 MW in Phase II.

By FY 2026-27, a 30 MTPA slurry pipeline to Jatadhar port and an 8 MTPA Odisha pellet plant will enhance logistics efficiency and raw material security. The planned coke oven facilities and expansion projects across plant locations will drive economies of scale and fortify its cost competitiveness and operational resilience.

Securing raw material, a strategic priority

The Company continues to deepen backward integration, securing 23 iron ore and three coking coal mines in India via auctions in India to boost self-sufficiency and reduce external dependencies. Of its 23 iron ore mines, 12 are operational in Karnataka and Odisha, the rest are in various stages of commissioning.

JSW Steel is targeting to source 25% of the coking coal requirements captively and this can be achieved by establishing domestic coking coal linkages by acquiring mines under auction and setting up or acquiring coal washeries.

JSW Steel has secured two coking coal mines in Jharkhand, Parbatpur Central Coal Mine (0.9 MTPA), and Sitanala Coal Mine (0.3 MTPA). In addition, the Company secured 2.06 MTPA of Non-Regulatory Sector (NRS) coking coal (purchased through long-term linkage) and a washery, i.e., Dugda Coal washery, which comes with a 2 MTPA of Fuel Supply Agreement (FSA) linkage. Raw coal availability from these sources including Moitra Coal Block (1 MTPA) secured earlier, is 6.26 MTPA. Beyond India, the acquisition of Mozambique’s Minas de Revuboe mine (800 MnT of hard coking coal), along with a 20% stake in Australia’s Illawarra coal mines, which would provide ~1.2 MTPA of coking coal, further diversifies the Company’s raw material sourcing.

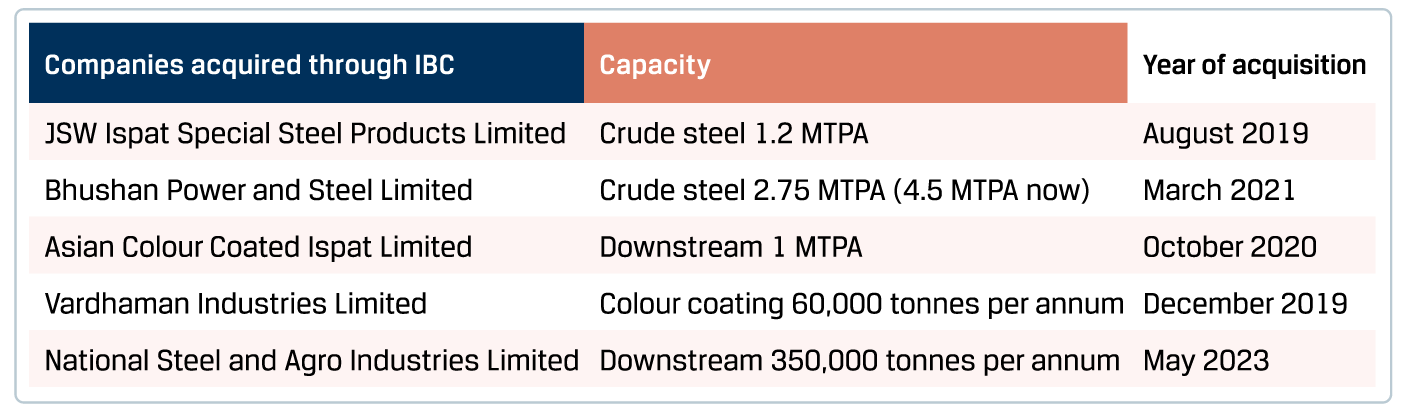

Strategic acquisitions/partnerships to boost capacity and capabilities

JSW Steel has forged strategic joint ventures and equity partnerships to enhance its value-added offerings, global presence, raw material security and technological edge. The Company’s key collaborations include a 50:50 JV with Severfield UK for structural steel solutions and another with Marubeni-Itochu for Just In Time (JIT) steel services across key Indian markets.

Value-added and special steel products

JSW Steel offers an extensive and diversified product portfolio that meets varied market needs worldwide. As India’s leading value-added steel producer, the Company operates one of the country’s largest galvanising and coated steel capacities, having export footprints in over 100 countries. In FY 2024-25, 91 new steel products were developed/ customised, in JSW Steel standalone, while securing 48 product approvals.

62%

Share of VASP in sales mix (Excluding JVML volumes)

5%

Increase in VASP volume

In February 2024, JFE and the Company had established J2ES, with the aim of setting up an integrated greenfield project for manufacturing GOES in India by 2027. Through this acquisition, J2ES achieves instant market access and can promptly establish an integrated system from manufacturing to sales of GOES in India.

Jsquare Electrical Steel Nashik Private Limited, a wholly owned subsidiary of JSW JFE Electrical Steel Private Limited (J2ES), which is a 50:50 joint venture between the Company and JFE Steel Corporation (JFE), has acquired 100% equity interest of Thyssenkrupp Electrical Steel India Private Limited (subsequently renamed to JSW JFE Electrical Steel Nashik Private Limited) (J2ESNPL). The associated technology package from the Thyssenkrupp group has been licensed/transferred to the Company. The total purchase consideration for the transaction (including closing adjustments) is ₹4,159 crore.

J2ESNPL is one of the first manufacturers of Grain Oriented Electrical Steel (GOES) in India with a manufacturing capacity of 50,000 tonnes per annum. The CRGO manufacturing facility is situated at Nashik in Maharashtra. The acquisition provides the Company with access to cutting-edge technology, thereby aligning with its strategy of enhancing its value-added portfolio.

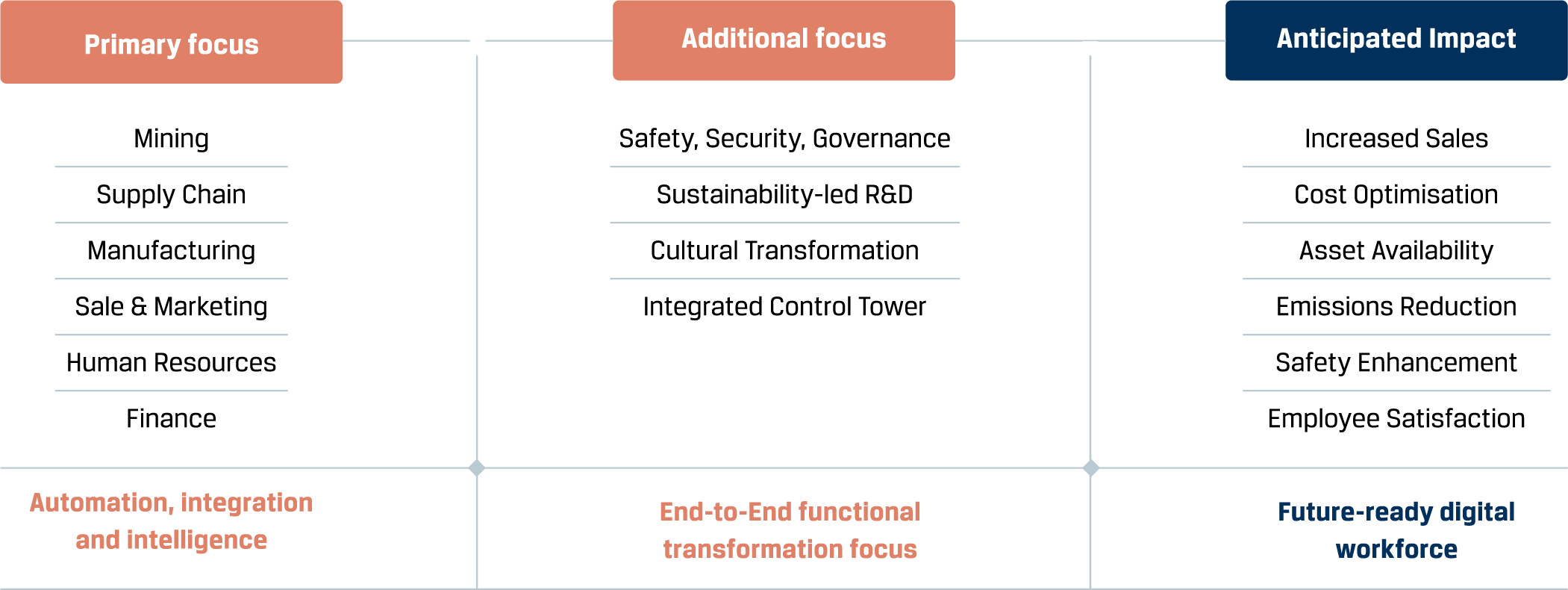

JSW steel’s digital focus areas

Investing in green steel

The Company has also commissioned a pilot green hydrogen project at Vijayanagar, providing a strategic edge for future expansion.

Increasingly, upcoming regulations across the world are expected to source steel with low carbon footprint. The Carbon Border Adjustment Mechanism (CBAM) implementation by the European Union (EU) and the Government of India's initiatives to bring down carbon emissions in the steel industry with a target to reach Net Zero by 2070 are likely to develop a global market for green steel. Government projects are likely to mandate the purchase of steel with low carbon emissions in a phased manner in the near future.

To support its strategy of manufacturing low-carbon steel for export markets and adopting green technologies such as hydrogen-based DRI, JSW Steel transferred its Salav unit, comprising a 0.9 MTPA DRI plant and auxiliary units to JSW Green Steel Limited. This move enables separate tracking of CO2 emissions and aligns with the Company’s long-term sustainability goals. The green steel facility at Salav will be developed in two phases, expanding capacity from 0.9 MTPA to 4 MTPA. The transfer was executed through a slump sale, with JSW Steel investing ₹2,233 crore in JSW Green Steel Limited.

Focus on sustainability

Sustainability lies at the heart of JSW Steel’s growth strategy, guiding every aspect of its operations. The Company is committed to achieving carbon neutrality across all operations under its direct control by 2050. JSW Steel has identified 17 key focus areas, based on stakeholder consultations during materiality assessment, setting ambitious targets to drive continual improvement and measurable progress. The Company’s sustainability efforts are overseen by its Board-level Business Responsibility and Sustainability Committee, ensuring accountability at the highest level.

Environment

JSW Steel is focused on addressing the interconnected challenges of climate, nature, and inequalities. In FY 2024-25, the Company reduced its Scope 1 and 2 emission intensity by ~3% and specific energy consumption by 3.5% from the previous year. JSW Steel is also strategically integrating renewable energy into its operations, enhancing resilience against energy market volatility and regulatory changes. This year, the Company expanded its cumulative renewable energy capacity to 782 MW, with the target to reach 1 GW in the near term, further reducing its carbon footprint. In the second phase, JSW Steel is planning to source additional renewable power of 1.5 GW. Its focus on sustainable practices extends to waste and water management, with waste recycled and reused at 99.98%. These initiatives not only reflect JSW Steel’s responsibility to shape a greener tomorrow but also strengthen resilience and future readiness.

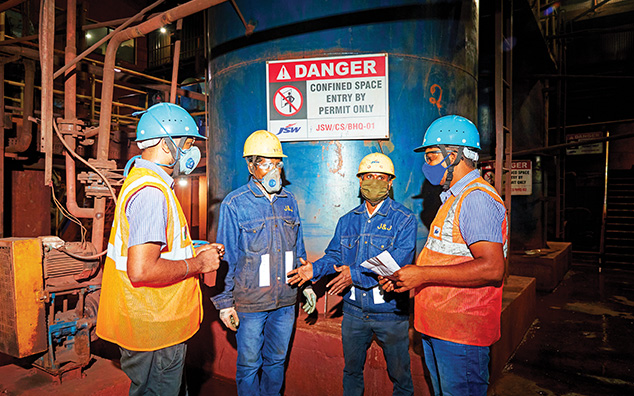

Read more in the 'Environment' chapterWorkforce and community

JSW Steel is creating an inspiring and vibrant workplace where talent is recognised, nurtured and empowered to drive operational excellence and long-term growth. As an equal opportunity employer, the Company ensures a culture of diversity and inclusion, with women accounting for 7.0% of its workforce. Safety remains a non-negotiable value for JSW Steel, embedded in every decision and action. The Company’s commitment to achieving a 'Zero Harm' environment resulted in 5.5 lakh safety observations this year. JSW Steel’s talent strategy focuses on identifying and developing future-fit leaders, mapping unique strengths and ensuring robust succession planning with 252 high-potential leaders identified during the year. Its CSR initiatives have positively impacted more than 30 lakh lives across key focus areas, with a CSR spend of ₹363 crore in FY 2024-25 including ₹117 crore deposited in escrow account for CSR spending in coming years.

Read more in the 'Social' chapter2.1 Global economy

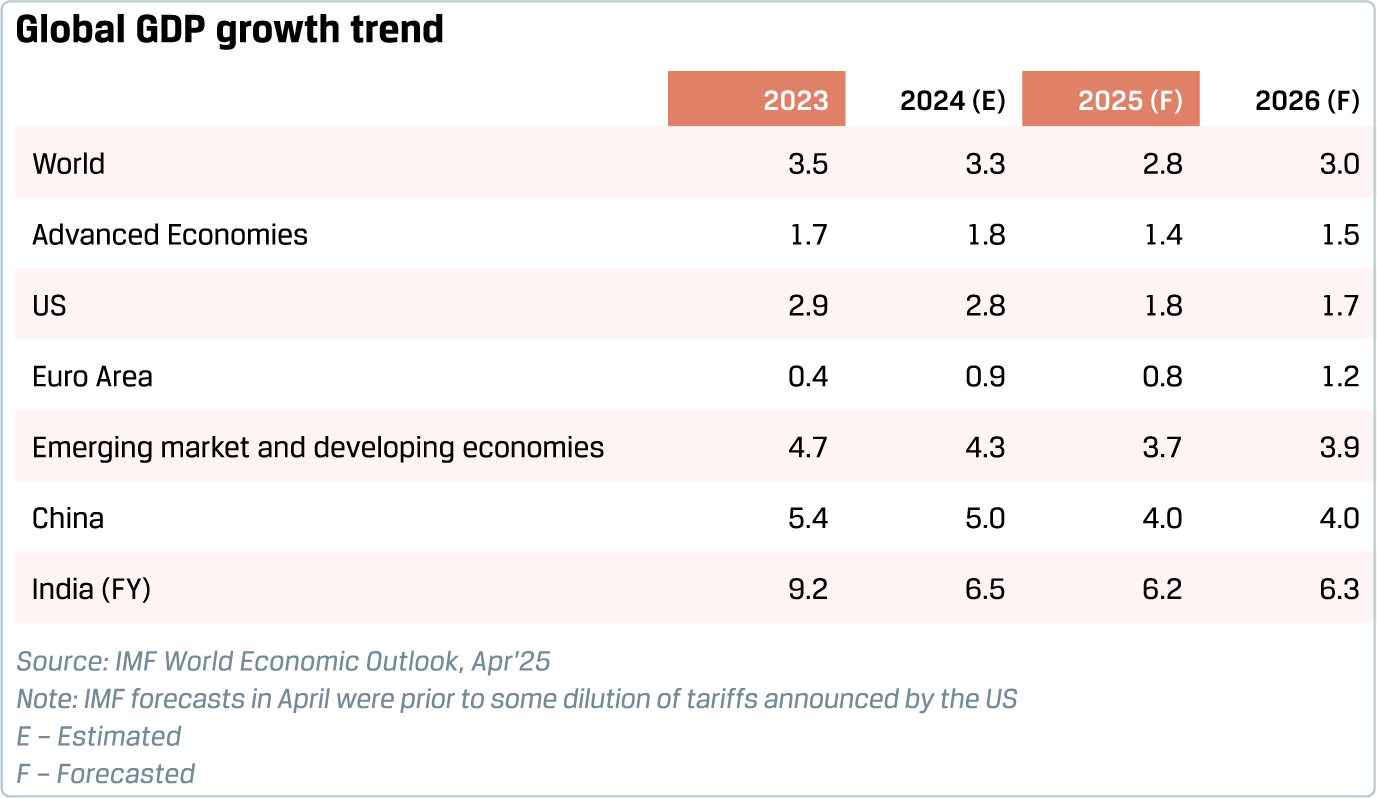

The global economy was resilient over the last year, stabilising from the shocks witnessed in the beginning of the decade, amid the continued overhang of geopolitical risks. As per IMF estimates, world GDP growth eased to 3.3% in 2024 from 3.5% in 2023, with the slowdown seen in EMDEs (Emerging Markets and Developing Economies).

The US economy recorded strong momentum at 2.8% with robust demand conditions and labour market, while growth was subdued in the Euro area and Japan. China managed to meet its growth target of 5% on the back of policy stimulus, despite a weakening property sector.

A key positive feature of the global economy was a gradual moderation of inflation in advanced economies, opening the space for easing of the monetary policy that was tightened earlier during the high-inflation phase. According to the IMF, average inflation in advanced economies fell from 4.6% in 2023 to 2.6% in 2024. This was helped by the normalisation of supply chain pressures, from elevated levels after the outbreak of the Russia-Ukraine war.

World GDP growth in 2024

The outlook for 2025 has been impacted by the trade tensions, sparked by the tariff policies of the new US administration. The initially announced tariffs by the US in early April have been subsequently diluted through various announcements and bilateral trade discussions. Some of the dilution has been in the form of a 90-day pause, the continuation of which would be contingent on further negotiations. Nevertheless, US tariffs are likely to stay elevated in comparison to the levels prevailing before the start of the year. Further, the policy uncertainty is adversely affecting business and consumer confidence.

The eventual tariff scenario may still take time to settle down. Accordingly, sectoral and geographical effects of tariffs may evolve in a complex manner as differential tariffs vis-à-vis different countries could lead to trade diversions and second-/third-order effects for different sectors/geographies.

Apart from trade tensions, geopolitical risks remain significant with continuing conflicts between Russia and Ukraine, and in the Middle East. Amid the heightened uncertainty, the IMF projected world GDP growth to slow substantially to 2.8% in 2025 and 3% in 2026, lower-than-trend growth but still above the mark typically associated with recessionary conditions. IMF forecasts were released before some of the tariff dilution by the US. Accordingly, while the directional drift of IMF forecasts could be instructive, the forecasts may be revised after the trade scenario becomes clearer.

Trade policy effects are deemed by the IMF to be adverse almost across the world, with more severe impacts on the US and China, which are the most affected by tariff escalations. Tariffs could push inflationary tendencies in the US, complicating the future trajectory of US Fed rates. The Fed has adopted a wait-and-watch stance amidst the risks to both sides of its mandate, viz. inflation and employment, and indicated that it would wait for more data on the economy’s direction before changing interest rates.

The IMF projects China’s growth to slow to 4% in 2025, even as the Chinese government is targeting 5% growth and is undertaking fiscal and monetary policy support to meet the target.

Some of the positive impulses seen in the early months of 2025 included: advancing of export orders to beat tariffs, some pick-up in fixed assets investment other than in the real estate sector in China and reasonably solid labour market conditions in the US. Japan recorded a second straight year of strong growth in wage negotiations, which could support consumption. In Europe, plans to boost defence and infrastructure spending are being initiated, which could be a supportive factor in the medium term.

Broader global growth concerns are likely to weigh on commodity prices, in general. Financial markets remain vulnerable to potential risk-aversion episodes in this macro backdrop, besides continuing geopolitical risks. However, in case of a significant dilution in trade frictions through trade deals resulting out of the ongoing bilateral negotiations by the US administration, the global economic outlook could get re-rated upwards.

- Tariff-related policies weighing on global outlook – impacting through trade and investment channels.

- Moderating inflation a positive, though tariff effects need to be watched.

- China’s policy support and potential dilution of tariff concerns through trade deals are possible upsides.

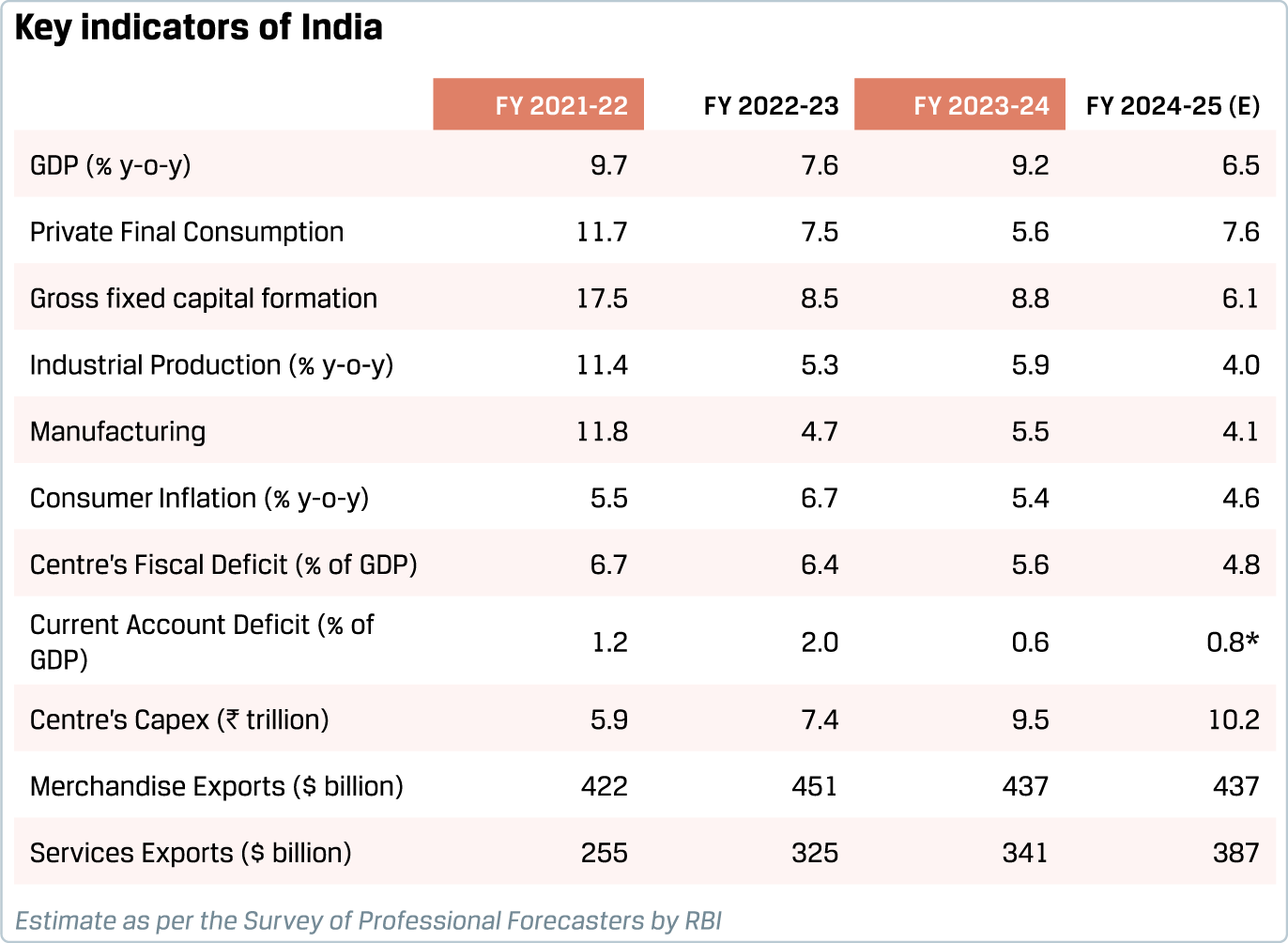

India’s growth outlook for FY 2025-26 is likely to be supported by resilient domestic drivers, even though the overhang of global headwinds remains. Consumption will be buoyed by personal income tax cuts, easing food inflation, positive monsoon outlook and the RBI’s rate cuts. The Union Budget announced cuts in personal income tax amounting to ₹1 trillion. The Indian Meteorological Department (IMD) has forecast monsoon rainfall to be above normal in 2025, which bodes well for continued rural recovery. Consumer confidence has shown an uptrend, and the RBI’s policy easing and liquidity support will aid consumption demand.

Central government capex is budgeted at ₹11.2 trillion for FY 2025-26, versus the revised estimate of ₹10.2 trillion for FY 2024-25. Rising trends in capacity utilisation in the manufacturing sector, along with strong balance sheets of banks and corporates, are expected to support private capex, though the impact of global trade frictions on confidence levels needs to be watched. While the US tariffs scenario could take some time to solidify, early indications suggest that the realignment of global supply chains could benefit India in the medium term.

Lower international oil prices are expected to bolster India’s macroeconomic fundamentals, along with the continued fiscal consolidation and adequate forex reserves. The RBI has projected India’s consumer inflation to soften further to 4% in FY 2025-26.

With some likely softening of external demand, the IMF expects India’s economy to grow at 6.2% (this forecast was based on original April tariff announcements by the US), whereas the RBI has projected growth to be steady at 6.5% during FY 2025-26. These projections reflect a potentially modest dent to India’s growth performance due to the global slowdown, even as the domestic growth impulses remain supportive.

2.2 Indian economy

India continues to be one of the fastestgrowing major economies. The Indian economy is estimated to have recorded a solid growth of 6.5% in FY 2024-25, on top of a strong 9.2% growth in the previous year. Private consumption expenditure accelerated during the year, whereas gross fixed capital formation decelerated.

Growth was slower in the first half of the year, with the election-related code of conduct slowing down public capex and heatwave incidences impacting consumption, along with the elevated food inflation. Growth recovered in the second half of the year.

Retail inflation eased from 5.4% in FY 2023-24 to 4.6% in FY 2024-25. Inflation fell below the 4%-mark in the last quarter of the fiscal, as food inflation declined substantially. This opened the space for policy rate cuts by the RBI; policy rate was cut by a combined 50 basis points in February and April 2025 meetings. Liquidity conditions that had tightened in early 2025 have eased with a slew of liquidity measures by the RBI.

India’s macroeconomic situation continues to be resilient with fiscal consolidation on track, a healthy level of foreign exchange reserves and current account deficit well within prudent levels. Merchandise exports stagnated in FY 2024-25 while services exports remained buoyant. Accordingly, despite a widening of merchandise trade deficit, the overall current account deficit is estimated to be contained. Thanks to buoyant tax collections and increased transfers from the RBI, the central government’s fiscal deficit reduced by nearly 0.8 percentage points to 4.8% of GDP in FY 2024-25.

6.5%

Estimated growth of the Indian economy in FY 2024-25

- India’s macroeconomic position resilient; well positioned to navigate global challenges.

- Tax cuts, easing inflation, healthy monsoon outlook and RBI’s rate cuts to support consumption.

- Central government capex target at `11.2 trillion, which will maintain traction in infrastructure development.

- Private capex to be supported by improving capacity utilisation and strong balance sheets.

3.1 Global steel industry

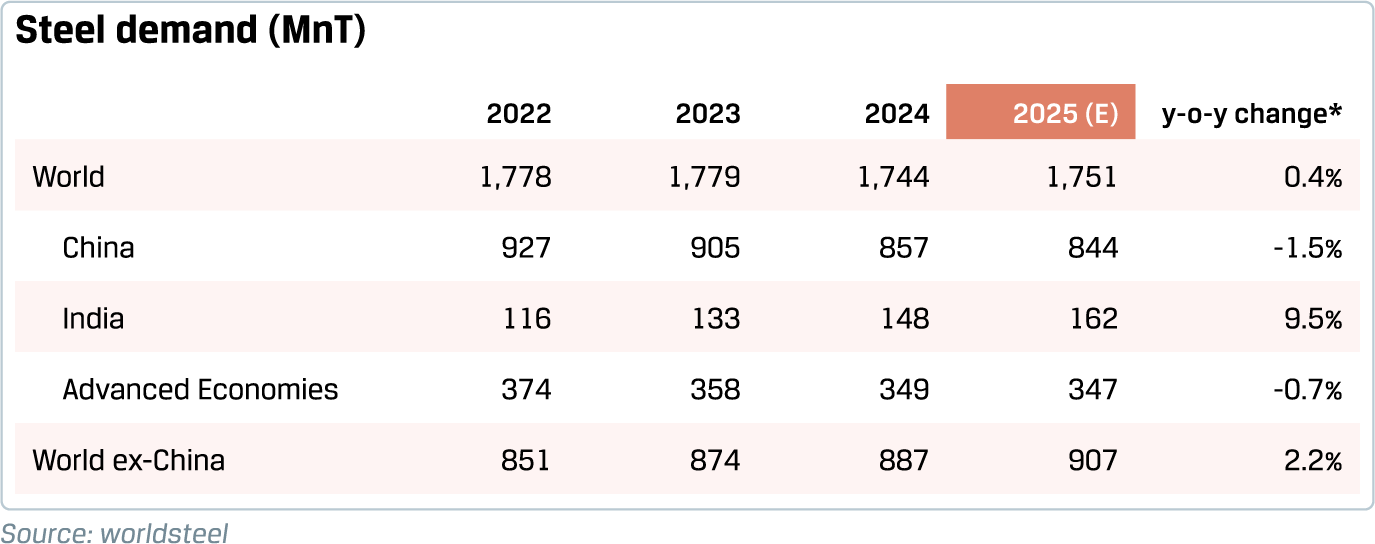

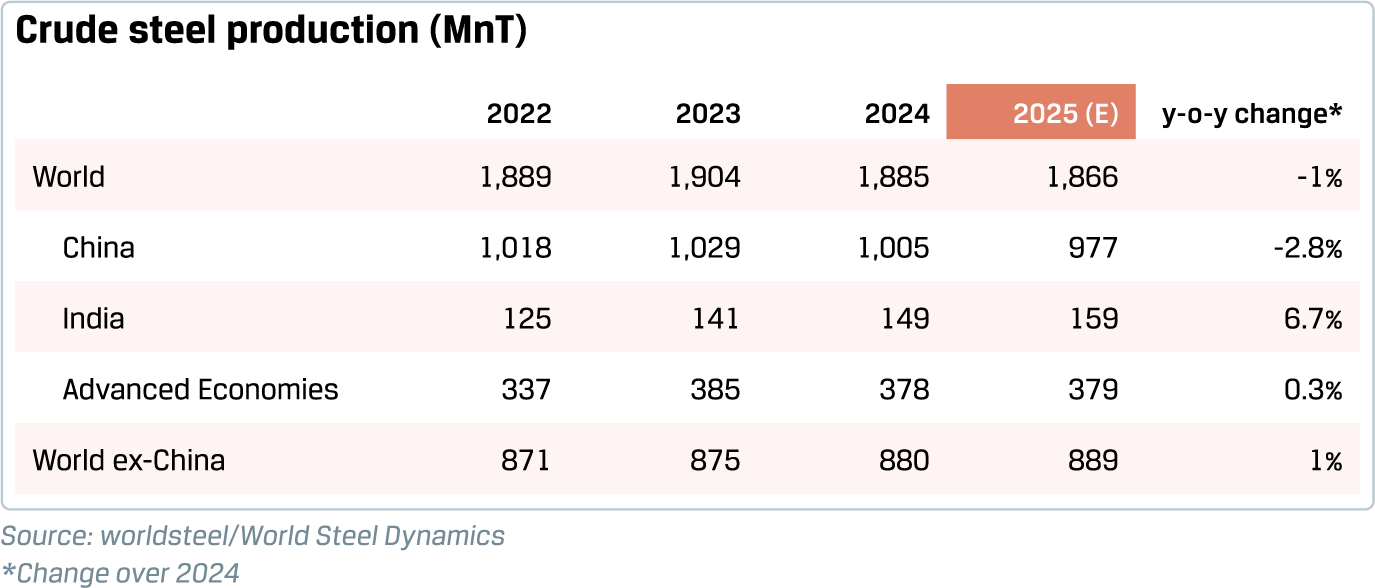

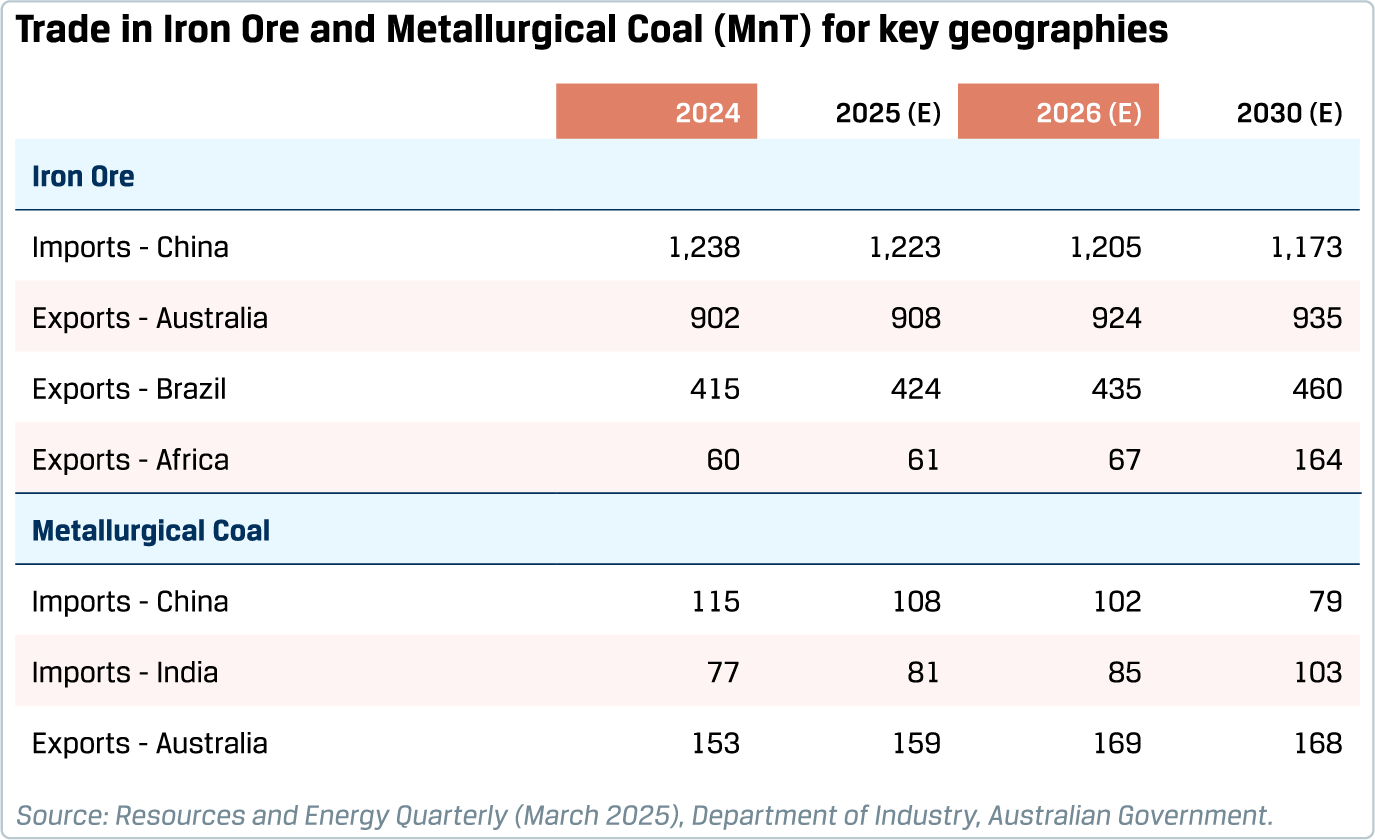

World finished steel demand and crude steel production declined marginally by 2% and 1%, respectively, in 2024. In the last five years, global steel demand has moved sideways. However, these global numbers hide wide variations across different markets.

China, which accounts for nearly half of the world's steel industry, recorded a 5% decline in consumption in 2024, mainly due to the structural challenges that its real estate industry is witnessing. India has been a key driver of global steel demand growth in recent years. Developed economies, including the US, the EU, Japan and Korea recorded a contraction last year, while demand increased in ASEAN, GCC, Turkey and Vietnam. Broadly, similar geographical divergences were observed in terms of crude steel production as well in 2024. World crude steel production stood at 1,885 MnT in 2024.

The US administration has removed exemptions on its 25% tariff on steel imports (under section 232 for national security reasons) and brought derivative products under the coverage of tariffs. Tariff on steel products in the US is currently on par for most exporters, other than China, though a subsequent trade deal with the UK could possibly exempt the country’s steel exports from the duty. Countries like Japan and Korea have lost their erstwhile preferential access to the US steel market (though one needs to watch out for the outcomes of US’ bilateral trade talks for a clearer picture), which could lead to trade diversions. From an India perspective, the direct impact of the tariff action is likely to be negligible on steel exports, but there could be indirect effects of trade diversions and of increased tariffs on exports of steel-intensive manufacturing sectors, besides the negative macro impulse of tariffs on global steel demand.

Worldsteel Association’s estimates suggest that China’s steel demand could marginally decline in 2025 at a lower pace than last year. While the downturn in China’s housing market is likely to continue, the pace of decline is likely to be contained amid various targeted measures by the Chinese government. China’s fiscal and monetary policy stance is likely to be supportive, which would support demand from other sectors, particularly infrastructure.

Robust growth in steel demand is expected in India, Turkey and MENA in 2025, while the trade-related concerns could weigh on the steel demand outlook in ASEAN and Latin America. The outlook for steel demand in Japan and Korea is clouded by constraints on domestic demand, including high costs, low affordability and labour scarcity, besides the weak external environment. In the US and Europe, easing of financial conditions and a weak base could support bottoming out of demand, though the trade-related developments need to be watched.

At a global level, steel demand is likely to be broadly flat to slightly improving, depending on the ongoing progress of trade negotiations.

Demand outlook for major consumption sectors

Residential/Construction

Residential construction activity in key markets like the US and the EU is expected to be supported by easing financial conditions and persistent housing deficits in some of the markets. China’s housing activity may continue to moderate, albeit at a slower pace, helped by government measures.

Automotive

Automotive markets may expect modest demand with the introduction of new, more accessible EV models and the untapped market potential in developing markets like India. However, tariffs may adversely affect affordability and consumer confidence in developed markets.

Manufacturing

Investments in manufacturing facilities and public infrastructure could see some headwinds from challenged business confidence and normalisation of the fiscal support in the US. However, possible stimulus measures in China and the recent shift to an expansionary fiscal stance in the EU will be supportive factors. The realignment of global supply chains may also support investments in manufacturing in some countries.

- Structural challenges faced by China’s real estate industry adversely affected steel demand; pushing exports further higher. Chinese government’s policy measures likely to support demand in 2025.

- India expected to continue to be a key driver of global steel demand growth.

- Global steel demand likely to be broadly flat to slightly improving, amidst negative impulse of tariffs.

- Potential trade diversion impact of tariffs a key monitorable.

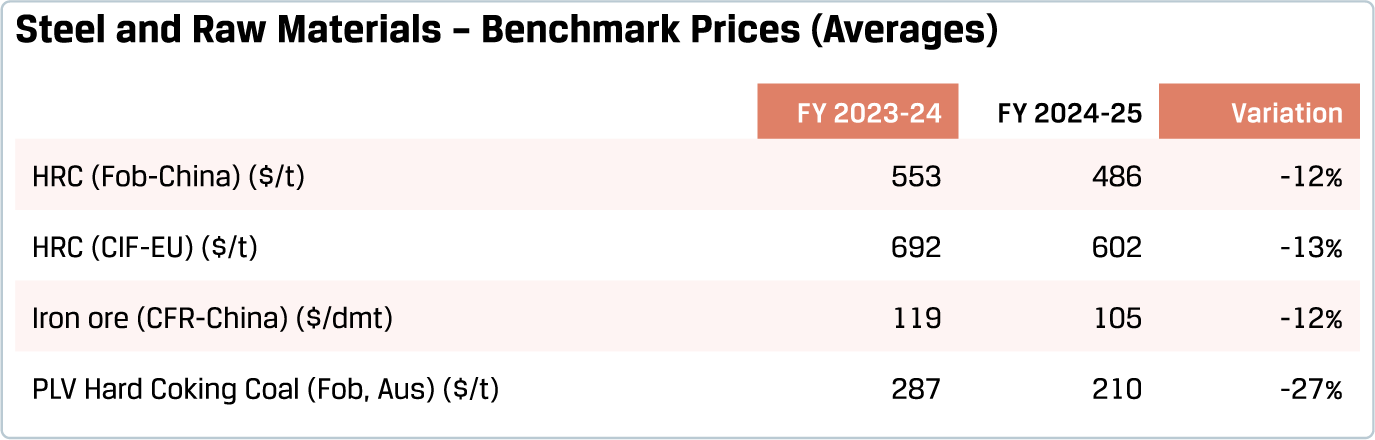

3.1.1 Steel prices and raw material costs

Steel and raw material prices were broadly lower in FY 2024-25 compared to the previous year. This reflected the weak macro sentiment through much of the year. With China’s production not adjusting adequately to the moderation in its steel demand, China’s steel exports continued to trend upwards in 2024. China's exports of semi-finished and finished steel hit an all-time high of 111 MnT in 2024, up 23% over the previous year. This exerted downward pressure on steel prices. Estimates based on market benchmarks suggested that a median Chinese steel mill operated with negative spreads through a substantial part of the year. In the US, however, steel prices increased towards the end of FY 2024-25, mainly reflecting the tariffs. In case of iron ore and coking coal, besides the steel-related dynamics, relatively low incidence of adverse weather events and broadly improving supply conditions helped ease prices compared to the previous year.

The macro impulse for commodity prices in FY 2025-26 is likely to be softer, on account of concerns over the impact of tariffs and weak risk sentiment. Many countries have initiated trade actions against China, and China’s industry body has expressed the imperative for curtailing production. While China’s steel exports continued to increase in the first four months of 2025, one could expect some moderation of production and exports from China. If such a moderation occurs, it could support steel prices. Any significant stimulus measures from China could also help improve the sentiment for steel pricing.

The price outlook for iron ore and coking coal in FY 2025-26 is expected to be tilted towards moderation, with favourable supply conditions. A new, large iron ore mine in Guinea is expected to commence production in 2025. Improved connectivity from Mongolia to China and expected growth in Australia’s exports could keep the coking coal market well supplied.

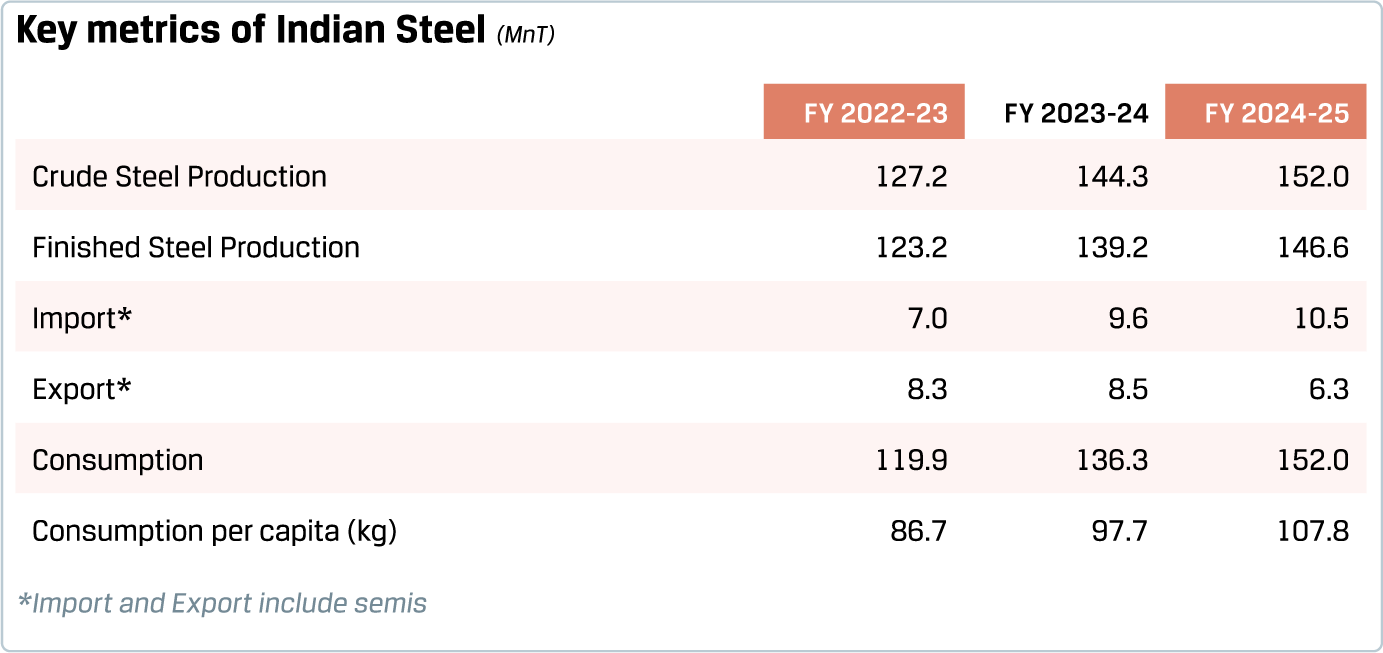

3.2 Indian steel industry

India, the second-largest steel producer globally, has been a key driver of growth for the global steel industry. India’s steel consumption recorded a robust growth of 11.5% in FY 2024-25, the fourth consecutive year of double-digit growth. In the four years ending FY 2024-25, India’s GDP at constant prices increased 37% while steel consumption grew 60%. Over this period, the elasticity of steel consumption to economic growth (computed as the ratio of growth in steel consumption to growth in real GDP) was recorded at 1.5, compared to an elasticity of 0.8 during the decade before the pandemic. Such a step-up in elasticity of steel consumption reflects the phase of nation-building in India, characterised by a strong pick-up in infrastructure building and robust structural underpinnings of consumption, viz. urbanisation and rising penetration of consumer durables. This phase is expected to continue into the medium term, heralding a strong backdrop for growing steel consumption.

Although the consumption scenario in India was robust, domestic steel pricing was under pressure in FY 2024-25 amidst elevated levels of imports and weak global prices. Domestic iron ore prices were, however, range-bound, reflecting strong demand conditions.

11.5%

Growth of India’s steel consumption in FY 2024-25

CRISIL (March 2025 forecast) has projected India’s steel consumption growth to remain robust at 9-10% in FY 2025-26 with flat steel products (projected growth of 12-14%) leading the demand growth, in comparison to long steel products (projected growth of 5.5-7.5%). The following sectoral factors will have a bearing on India’s near-term steel consumption outlook:

- The trend of rising public capex on infrastructure is expected to continue. The central government has budgeted a capex of H11.2 trillion in FY 2025-26. Long-term interest-free loans for capex purposes to state governments would boost their capex spending. Modernisation of railways and development of high-speed highway corridor projects are thrust areas in the development of transport infrastructure.

- Residential real estate launches are expected to accelerate in FY 2025-26, with reduced inventory of units. Commercial real estate is witnessing strong traction, helped by the rapid growth of Global Capability Centres and Data Centres.

- The public housing programme has received a renewed thrust with the extension of the PM Aawas Yojana (PMAY) with a target of building 2 crore additional houses over five years. Guidelines under the extended phase of PMAY were finalised last year, and the scheme’s implementation is expected to gather momentum in FY 2025-26.

- Private capex is being supported by the government’s production-linked incentive schemes, improving trend in capacity utilisation, strong balance sheets and easing monetary policy. While global trade concerns create some overhang over business confidence, the realignment of global supply chains is supportive in the medium term.

- The demand outlook for consumer durables is broadly positive, with recovery in rural consumption, improving trend witnessed in consumer confidence, lower interest rates and easing of food inflation.

- Auto industry growth is expected to be steady amid the launch of new models (especially EVs), increased infrastructure activity, replacement demand and government incentives for e-buses. Auto exports have robust medium-term prospects, though the near-term trade-related concerns may need to be watched.

- The imperative for defence preparedness, government policy thrust on indigenisation of India’s defence procurement and expected increase in defence spending globally are likely to support growth in defence-related manufacturing and exports.

While India’s domestic steel demand growth scenario continues to be robust, trade-related developments need to be watched. Import of finished steel (including semis) was elevated at 10.5 MnT in FY 2024-25, whereas exports slowed amid rising protectionist measures in other countries.

Accordingly, India was a net importer of steel for the second consecutive year in FY 2024-25, with the magnitude of net imports being the highest in several years, barring the exception of FY 2015-16.

The provisional safeguard duty, enforced with effect from 21 April 2025 for 200 days, is expected to act, to some extent, as a speed bump for the import of steel into India, though any possible trade diversions arising out of the removal of exemptions for steel import duty by the US, the productiondemand imbalance in China and the trade remedial measures by other jurisdictions (especially against China) need to be watched carefully.

In order to increase the availability of iron ore in line with the National Steel Policy, more than 120 mines have been auctioned in India since 2016. The government is also trying to improve the domestic availability of coking coal by setting up coking coal washeries.

The Indian steel industry is estimated to have added more than 50 MTPA capacity in the last five years. The momentum of investments is expected to continue into the coming years, for capacity building to meet additional demand, for value addition and for decarbonisation. The government has created a green steel taxonomy, which has been an important step to catalyse the industry’s decarbonisation efforts. Broadly, the outlook for the Indian steel industry for FY 2025-26 is one of cautious optimism, with resilient domestic demand drivers and monitorable global dynamics.

- Robust steel consumption growth in India to continue with thrust on infrastructure and real estate.

- India was a net importer of steel for the second successive year in FY 2024-25, pressuring steel pricing.

JSW Steel remains steadfast in its pursuit of excellence by leveraging its world-class, fully integrated manufacturing facilities and a diverse, high-value product portfolio. The Company focuses on efficient capital allocation, cost leadership through resource optimisation, enhanced raw material security and continuous innovation driven by R&D. Embracing technology-led transformation and digitalisation, it is preparing to meet the future with confidence, supported by a robust financial profile and strong credit ratings.

In FY 2024–25, the Company achieved consolidated production of 27.79 MnT and sales of 26.45 MnT, meeting the revised volume guidance announced in Q3 FY 2024-25. The average capacity utilisation was at 91% in India. The Company aims to maintain its Value-Added Steel Products (VASP) share above 50%+, supporting sustainability initiatives across packaging, roofing, lightweight materials for automobiles and energy transition. Achieving ~100% self-sufficiency in coke and pellets, the Company has optimised its coking coal blend and expanded waste-based energy generation. Further, to enhance its raw material security, JSW Steel is developing coking coal assets across the globe.

FY 2024-25 was marked by record-breaking performance across key customer segments. The Company achieved its highest-ever industrial sales, registering a 20% y-o-y growth, led by exceptional gains in GI/GL, Colour Coated, Longs, CR and HR. The Auto Segment also saw peak sales with a 7% y-o-y growth, enabled by strong contributions from CR, GA/GI and Longs. Appliance Segment sales soared by 54% y-o-y, driven by GI, Colour-Coated and GL. Meanwhile, the Renewables sector (Solar + Wind) hit a new high with a 40% y-o-y growth, enabled by standout growth in Magsure and GL.

FY 2024-25 highlights

Consolidated sales

7% y-o-y

7% y-o-y

Coated steel sales

10% y-o-y

10% y-o-y

Total JSW India Domestic sales*

15% y-o-y

15% y-o-y

Branded Sales

15% y-o-y

15% y-o-y

Highest-ever industrial sales

20% y-o-y

20% y-o-y

Sales in Auto sector

7% y-o-y

7% y-o-y

Value Added and Special Products Sales

5% y-o-y

5% y-o-y

* Against domestic consumption of 152 MnT with JSW SoB at 15.5%

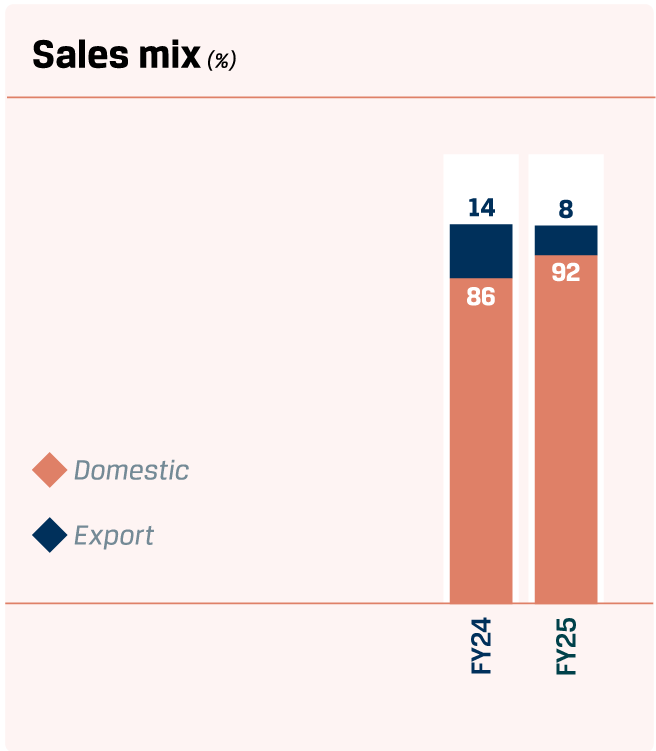

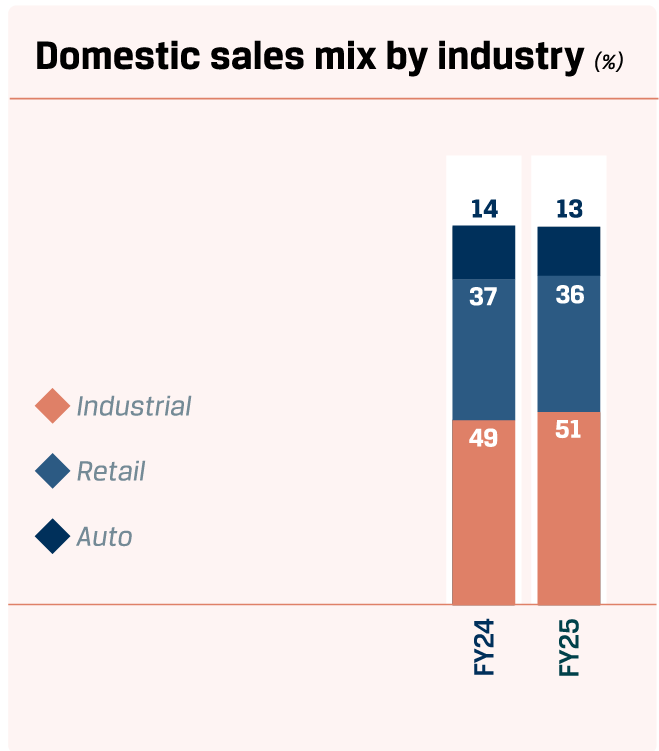

Domestic performance

In FY 2024–25, domestic sales remained the cornerstone of the Company’s performance, contributing a robust 92% to the overall sales mix, with volumes rising by an impressive 15% y-o-y. This was further bolstered by record-breaking achievements in Value-Added & Special Products (VASP) portfolio, which reached an all-time high of 15.40 MnT. Value added sales also reached an all-time high at 11.24 MnT, reflecting a strong 9% y-o-y increase.

The share of VASP in consolidated sales stood at a remarkable 62%, underlining the Company’s focus on high-margin, differentiated products. JSW Steel’s manufacturing efficiency remained consistently strong, with its India operations achieving 91% capacity utilisation during the year. Notably, the newly commissioned JVML Blast Furnace reached over 90% utilisation in March 2025.

y-o-y growth in supplies to key sectors

India’s ambition to become a developed nation by 2047 rests heavily on the strength of its infrastructure, vital to shaping liveable, climate-resilient and inclusive cities that fuel sustained economic growth. In FY 2024–25, the Company’s contributions to this national vision grew stronger with a 5% annual increase in supplies for key infrastructure projects across the country. The Company is proud to have supported landmark developments such as the Mumbai–Ahmedabad Bullet Train, the Mumbai Trans-Harbour Sea Link, the Versova–Bandra Sea Link and metro projects across Mumbai, Pune, Nagpur, and Chennai. Its footprint also extends to major energy and pipeline initiatives, including partnerships with NEOM, GAIL and CGD. These efforts are yet another step towards building India’s core infrastructure and enabling cleaner mobility, enhanced connectivity and energy security, cornerstones of a modern, developed India.

Market share held by JSW Steel*

y-o-y growth achieved in steel supplied to Auto industry

* y-o-y market share increased by 1% in FY 2024-25

# As per SIAM auto production data for FY 2024-25

The Indian auto industry achieved a remarkable milestone in FY 2024-25 the 31-million-unit mark registering a 9.1% y-o-y growth. This momentum was primarily driven by growth in PV, Two wheeler and Three wheeler segments. PV grew by 3.3% with EV PV penetration at 2.0%, 2Ws grew by 11.3% with EV 2Ws penetration at 4.7% and 3Ws grew by 5.5% with EV 3Ws penetration at 44.0%. The overall EV penetration stood at 6.2%. JSW Steel registered a 7% y-o-y growth in steel supplies to the automotive sector in FY 2024–25, surpassing the industry growth rate in the 4W Passenger Vehicle (PV) segment, its core area alongside Commercial Vehicles (CVs).#

JSW Steel’s market share gain in the solar space

Highest-ever sales to the overall renewable segment with

y-o-y growth

In FY 2024-25 the Renewable Energy (RE) sector in India grew by 33% with major growth in Solar segment while JSW Steel's sales to the overall renewable segment recorded its highest-ever growth at 40% y-o-y. In FY 2024–25, steel supplies to the solar sector soared by 87% y-o-y. This momentum reflects India’s exponential rise in solar capacity, powered by falling photovoltaic (PV) technology costs, a favourable investment landscape and over 300 sunlit days a year. With a national ambition to reach 280 GW of solar capacity by 2030, forming a major share of the broader 500 GW renewable energy target, the sector is poised for transformative growth.

The Company’s proactive approach has paid off with a 9% market share gain in the solar space, driven by the strategic introduction of Magsure alongside its trusted GL and GI offerings. Backed by robust government support through financial incentives and regulatory clarity, solar projects are becoming more viable than ever. Positioned at the intersection of innovation and sustainability, JSW Steel is proud to be contributing to India's low-carbon journey.

Key projects

- Chennai Thermal Power plant

- Mukhyamantri Saur Krushi Vahini Yojana

Exports performance

In FY 2024-25, the Company remained firmly anchored in the domestic market, while maintaining a steady foothold in exports, striking a strategic balance that reinforced both competitiveness and resilience across geographies.

Awards and recognition

JSW Steel has been recognised with the prestigious ET Edge Best Organisation in Customer Experience 2024 award

JSW Steel’s World MSME Day film won Silver in the Thought leadership category at AFAQ’S Digies Awards held in February 2025

JSW Steel has been honoured with the Best localisation award in the Steel category by Hyundai Motors for second consecutive year

JSW Steel recognised and awarded for its efforts in the category Electrical Steel by BHEL in SAMVAD 4.0

Data Visionary award for Project Kshitij

JSW Steel has been awarded as 'Excellence in Cooperation and Support' by KIA Motors

4.1 Product performance

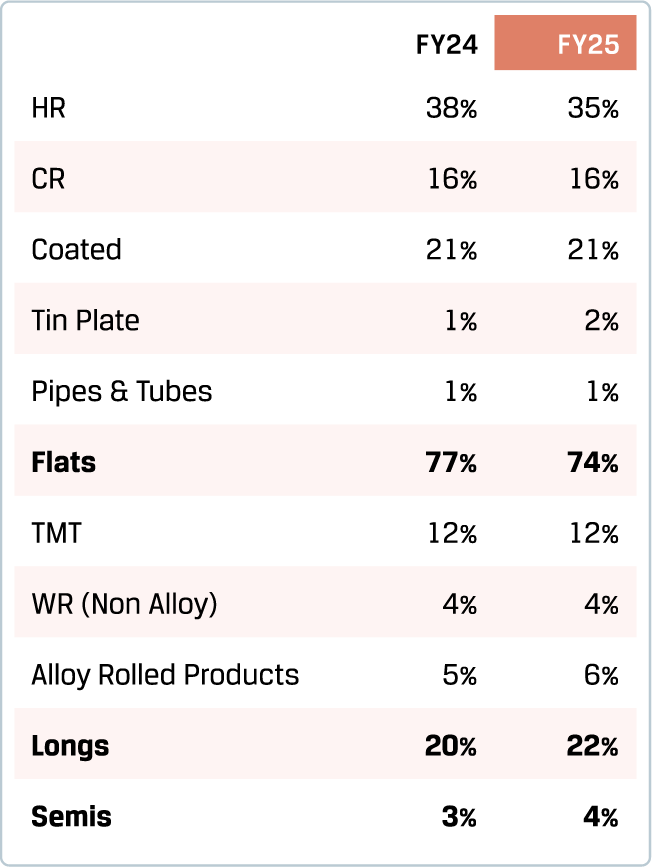

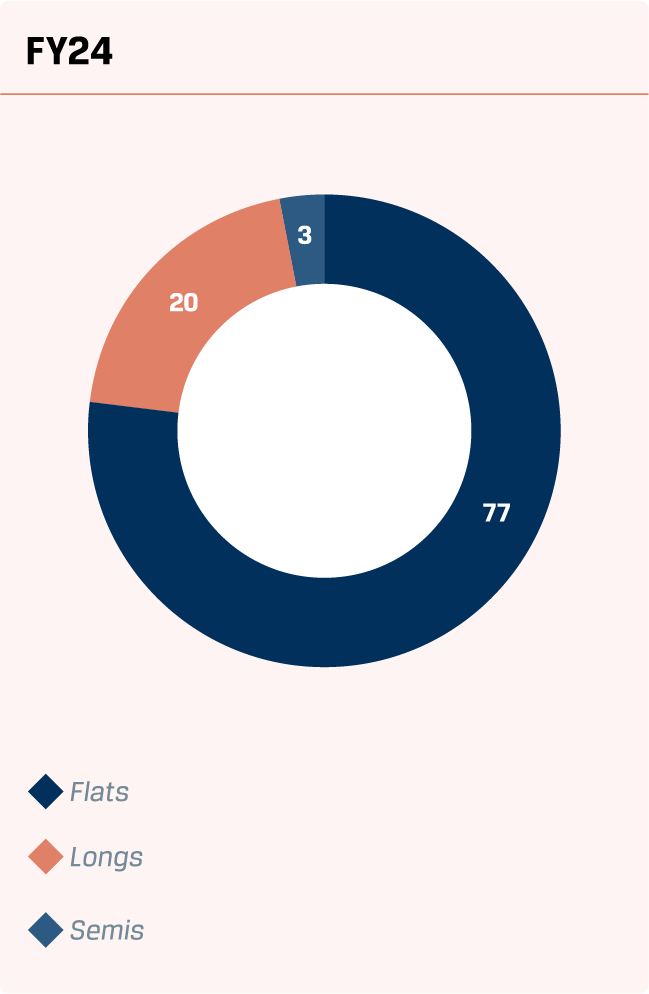

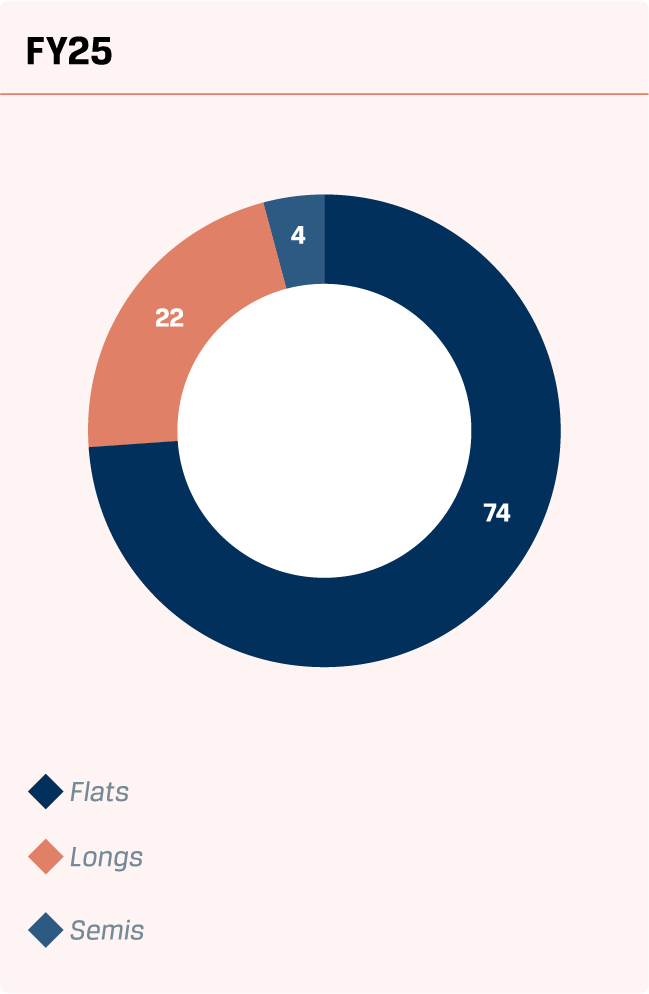

JSW Steel has strategically prioritised increasing the share of value-added and special products (VASP) within its overall sales mix, backed by robust investments in product innovation. This focused approach yielded significant results in FY 2024-25, with VASP sales volumes rising by 5% y-o-y. As a result, the contribution of VASP to the Company’s total sales mix grew to 62% (excluding JVML volumes).

Product mix (%)

Mix (%)

4.1.1 Flats

Flat products include Hot Rolled, Cold Rolled, Colour Coated, Galvanised and Galvalume, contributing a robust 74% to the top line in FY 2024-25. This segment recorded a 4% y-o-y growth, reinforcing its critical role in the Company’s revenue mix.

74%

Contribution to overall product portfolio

4%

y-o-y growth

Plates

JSW Steel's Anjar plate mill in the West has been playing a pivotal role in supporting India's ambitious plan in the hybrid renewable energy sector. The facility has also boosted the Indian infrastructure projects through production of thicker plates, contributed to energy segment through supply of plates for boiler applications and has developed capabilities to produce steel grades for defence sector applications.

Hot Rolled

JSW Steel is widely recognised for the superior quality and reliability of its hot-rolled products. Manufactured using cutting-edge technology at Hot Strip Mills in Vijayanagar, Dolvi, BPSL and PM Plate mill at Anjar, catering to a broad spectrum of applications from structural and general engineering to Infrastructure projects. Serving core sectors such as Industrial & Engineering, Automotive, Energy and Capital Goods, hot-rolled products accounted for a substantial 35% of its overall product portfolio in FY 2024-25.

10%

Domestic y-o-y sales growth

35%

Of overall product portfolio

Key projects served in FY 2024-25

Water pipeline

Contributed to ~2,182 km water pipeline constructions

Major projects served

- Gujarat & Narmada river linking project

- Rajiv Gandhi Canal Project, Rajasthan

- Aurangabad water supply project

- MP water linking project

- Telangana & Karnataka water irrigation projects

Oil & Gas

Contributed to ~888 km pipeline constructions

Major projects served

- NEOM

- GAIL & CGD projects

Cold Rolled Close Annealed (CRCA)

During the year, the Automotive sector drove the Company’s CRCA sales to record levels. JSW Steel partnered with top automakers to develop advanced steel grades like HSLA and AHSS, engineered for high impact resistance and reduced weight. The Company also achieved the highest level of localisation by a domestic steel mill for a major auto Original Equipment Manufacturer (OEM), leading to significant import replacement. Additionally, the Company made a breakthrough by developing steel supplies for Defence vehicles through JSW Gecko, the first such effort in the country.

10%

Overall y-o-y sales growth

11%

Domestic y-o-y sales growth

Electrical steel

JSW Steel has the first integrated mill to produce superior core loss material substituting imports. Electrical Steel continues to play a vital role in boosting energy efficiency across motors, pumps, fans, appliances, power generators and transformers. Continuous development of CRNO grades now cater to fast-growing segments like EVs and AC compressors. The Company has also maintained its position as a trusted partner in Wind Energy and Railway Traction Motors by consistently delivering high-performance, energy-efficient electrical steel solutions to power a greener tomorrow.

3%

Overall y-o-y sales growth

Coated

Coated steel, prized for its anti-corrosive properties, is witnessing rapid growth, particularly in galvanised, Galvalume and colour-coated segments. With India’s per capita consumption at just 7 kg which is far below the 50–60 kg seen in the US and Europe, growth prospects are immense, especially across rural areas. Demand is set to grow at a steady rate, outpacing both steel and GDP. JSW Coated Steel leads with flagship brands like Vishwas, Colouron+, Radiance, Galvos, Galveco, Silveron+, Everglow, and Pragati+.

Colour-coated

JSW Steel’s colour-coated steel, known for its corrosion resistance and aesthetic appeal, caters to construction, warehousing and roofing needs. With a dominant 49% market share and 1.44 MnT in domestic sales, JSW Steel is the only player offering a full brand spectrum from super-premium Everglow to mass-market Indradhanush. The colour-coated segment grew 5% y-o-y, supported by innovations like Anti-Dust, Hi-Gloss and sustainable Cool Roof paints, developed in partnership with JSW Paints. These coatings enhance thermal efficiency and long-term durability. The Company continues to strengthen its presence in the appliance market with new colours and finishes and support global clients through Early Vendor Involvement. By aligning with the ‘Make in India’ movement and driving import substitution, JSW Steel is enhancing domestic supply chains through localisation and global collaborations. The Company has the only Indian mill qualified for premium PCM grade in refrigerator doors.

49%

Market share

5%

Domestic y-o-y sales growth

Galvanised and Galvalume

Galvanised and Galvalume products accounted for 14% of its overall product mix in FY 2024-25. As India’s largest Galvalume producer, JSW Steel is renowned for roofing and cladding solutions with superior corrosion resistance and heat reflectivity. With rising demand from the solar sector, the Company introduced innovative grades under the Galvos brand, designed to endure corrosive, alkaline environments. Notably, the Company pioneered HSLA torque tube grades for solar trackers which are approved by global players. Domestically, GI has 33% and GL has 72% market share, with a 14% rise in sales y-o-y. For the first time, the production or sourcing of Galvalume steel used in switchgear panels has been done locally. Galvalume has also seen increased adoption in the HVAC and solar heating sectors, supported by the introduction of advanced coatings such as Magsure and ZAM.

14%

Overall y-o-y sales growth

33%

Market share of GI

72%

Market share of GL

JSW Magsure

India’s first indigenously designed and patented Zinc-Magnesium-Aluminium alloy coated steel offers five times the corrosion resistance of conventional galvanised iron, even in the harshest conditions. Produced at Vijayanagar and Vasind Coated plants, it’s trusted across solar structures, cooling towers and water storage applications. With standout features like exceptional chemical resistance, enhanced workability and eco-friendliness, Magsure is India’s first Zinc-MagnesiumAluminium product for the renewable sector, engineered for performance in demanding environments, making it a durable and sustainable solution for a wide range of industrial and infrastructure needs.

Tinplate

JSW Platina, a Tinplate product, is a highly sustainable packaging material, offering endless recyclability, making it more eco-friendly than many alternatives. It is one of the most valuable downstream products in the flat steel segment. With rising global demand for sustainable packaging, domestic consumption is growing, driven by urbanisation, changing food habits and diverse retail options.

The Company has seen a 38% y-o-y growth in premium tinplate, capturing 55% of the domestic market. Strengthening its foothold further, the brand has forayed into the Cable Armour segment, targeting a 50% market share. This expansion is fuelled by the growing momentum of localisation, reinforcing JSW Platina’s position as the go-to choice for high-performance, homegrown solutions.

55%

Domestic market share

38%

Overall y-o-y sales growth

4.1.2 Longs

Long products are crucial for key infrastructure projects, including roadworks, metro and rail development, bridges and power plants. During the year, JSW Steel achieved sales of 5.66 MnT of long products, reflecting a 15% growth y-o-y.

22%

Contribution to overall product mix

15%

Overall y-o-y sales growth

TMT

TMT bars, crafted from virgin iron ore for unmatched purity, offer exceptional strength and flexibility. Manufactured using the advanced HYQST process through the METCS system, these bars are known for superior quality, weldability, corrosion resistance and malleability. With rising demand driven by infrastructure development, the Company supplies TMT products to various marquee projects including roadworks and metro rail, contributing to large-scale initiatives in sectors like construction, power and nuclear energy. The Company has a patent from the Patent Office, Government of India, for high corrosionresistant TMT bars with yield strength of 600 MPa. The Company has seen a 12% y-o-y growth in TMT sales, capturing 6% of the domestic market share.

6%

Domestic market share

12%

Product mix FY 2024-25

Key projects served in FY 2024-25

- Mumbai – Ahmedabad High speed rail project.

- Metro projects across Chennai, Mumbai, Pune and Nagpur.

- Kundankulam Nuclear Power project.

- Navi Mumbai Airport.

- GAIL & CGD projects.

Wire rods

Engineered with advanced technology for exceptional quality, manufactured at Vijayanagar, JSW Steel’s wire rods cater to industries like automotive, engineering, welding and machining. As India’s automotive and industrial sectors expand, the demand for these versatile products continues to rise. The Company sharpened its focus on Electrode and High Carbon grade steel, achieving an impressive annual growth of 20% and 31% respectively. These specialised grades continue to meet the evolving demands of the electrode manufacturing and auto component industries. The Company has seen a 12% y-o-y growth in WR sales, capturing 12% of the domestic market share.

12%

Overall y-o-y sales growth*

Low relaxation prestressed concrete steel strands

JSW Steel introduced its cutting-edge Low Relaxation Prestressed Concrete (LRPC) Steel Strands at the Vijayanagar– Neotrex facility with an annual capacity of 144,000 tonnes. Designed to optimise structural performance, LRPC reduces project costs, enables longer spans and supports sleeker, safer designs. In its debut year, the product swiftly gained market traction, securing a 29% market share in FY 2024–25. It now plays a pivotal role in landmark infrastructure projects, including the Mumbai-Ahmedabad Bullet Train and key NHAI road developments.

29%

Domestic market share

62%

Overall y-o-y sales growth

Key projects served in FY 2024-25

- Mumbai – Ahmedabad High speed rail project.

- Bangalore – Chennai, Kanpur – Lucknow, Delhi – Vadodara Expressway.

- Metro projects across Chennai, Mumbai, Pune and Nagpur.

* Non-alloy wire rods of Vijayanagar considered

Alloy steel

JSW Special Alloy Steel, produced at Salem and BPSL plants witnessed a 21% rise in alloy longs sales in FY 2024-25, making up 4% of the product mix. Further, sales of Bearing Steel grew 11%. New grades cater to automotive, textile machinery and general engineering.

Salem secured various product approvals across sectors like automotive, oil & gas and mining. Its strategic location ensures lower transport costs and faster deliveries. Additionally, the successful development of Boron Wire Rod grades at the Company’s Vijayanagar plant has further enhanced its product portfolio.

In alignment with the growing acceptance of BPSL products, the Company is in the process of securing necessary approvals from leading automotive manufacturers, including Maruti, Ashok Leyland, VE Commercial Vehicles, and Daimler India to name a few.

~30%

Market share held by us in the domestic Bearing Steel market

21%

Overall y-o-y sales growth#

Key projects served in FY 2024-25

- Seamless tube grade developed for ONGC through Maharashtra Seamless Tube.

- Grade developed and commercialised for defence shell bodies.

- Grade approved by RDSO for Vande Bharat railway suspension spring.

#Alloy rolled long products from Salem and BPSL considered

applications

While the Company’s steel is already being supplied to various key sectors for critical applications, its strategic growth plans are increasingly aligned with sectors of national importance. JSW Steel aims to contribute to these priority areas by delivering high-quality, reliable steel that fully meets the demanding application requirements, thereby supporting the nation’s development objectives.

Railways

Steel for railway wagons are specifically designed to ensure exceptional strength and durability, meeting the stringent performance requirements of heavy-duty rail transport operations.

Key applications

- Wagon

- Springs for Railway Coach

Defence

With rising government expenditure on defence, a strong push for self-reliance under the 'Make in India' initiative, and an increasing number of defence contracts being awarded to domestic industries, the defence sector remains a strategic focus area for us.

Key applications

- Aircraft Hanger

- Missile launcher

4.2 Marketing initiatives

In our ongoing commitment to customer-centricity, the Marketing function has embarked on a transformative journey to deepen engagement and responsiveness across both digital and physical touchpoints. Through strategic enhancements to our websites which cover all our products & special engagement for MSMEs, dynamic social media campaigns, and a more agile customer contact centre, we have created seamless and personalised experiences for our audiences. Simultaneously, our branded retail outlets have been revitalised to reflect our brand ethos and foster stronger in-person connections. These integrated efforts are designed to ensure that every interaction — whether online or offline — reinforces our dedication to understanding and serving our customers better.

2,300+

Nationwide stores

300

More stores planned for FY 2025-26

The JSW experience centre

The Company launched 'The JSW Experience Centre', a cutting-edge facility designed to highlight its extensive range of products and services, strengthen brand engagement and empower customers to make informed purchasing decisions. The centre features the JSW Legacy Wall, showcasing its journey and impact on the steel industry. The interactive Product Wall allows visitors to explore JSW’s diverse offerings, while the Digital Portal with kiosks provides easy access to product information and brochures via QR codes. With 30 Experience Centres spread across 20+ key markets, JSW brings its vision closer to communities, customers, and partners throughout India.

JSW shoppe

JSW Shoppe is a distinctive franchise model that forms a key part of the Company’s retail strategy, offering customers direct access to its extensive product range. Launched in 2007, these outlets, run by franchisees and managed by its channel partners, provide exceptional customer experience with assured product quality and brand consistency. Serving both cities and rural areas, nearly half of the Company’s 2,300+ nationwide stores are located in semi-urban and rural regions, with 300 more planned in financial year 2025-26. Looking ahead, JSW Steel aims to expand internationally, starting with Sri Lanka and Nepal in the SAARC region.

JSW branded outlet training programme

The company understands the importance of standardisation across all its retail touchpoints to achieve enhanced customer experience and brand loyalty. It has commenced a training programme aimed at upskilling the personnel associated with these branded outlets. This initiative provides product knowledge, skill development, and customer service training.

Collaboration with autocar

JSW Steel partnered with the renowned automotive magazine, Autocar to launch an innovative four-part video series titled, ‘Future of Mobility’. This engaging series spotlighted steel’s pivotal role in shaping the automotive industry’s evolution, featuring insights from leading global car manufacturers. Promoted through YouTube, social media and programmatic advertising, the campaign generated significant buzz, reaching a cumulative audience of nearly 50 million across platforms, reinforcing JSW Steel’s position at the forefront of future-ready mobility solutions.

Mass communication

JSW Steel uses festivals as a pivot to create awareness about its products in regional markets. As part of this ongoing initiative, JSW Steel launched a campaign centred around the festival of Pongal to create awareness about Colouron+ in the Tamil Nadu market. The campaign was brought to life through static images denoting the cultural nuance of the festival and highlighting the key features & variants of Colouron+ roofing sheets. This campaign was promoted across social media platforms and programmatic sites. The campaign achieved a cumulative reach of ~60 million across platforms. The digital campaign was supplemented by a regional OOH campaign across the state. The OOH campaign got recognition from the Madras Advertising Club (Maddys) with a Sliver in the Regional Tamil OOH category.

Celebrating the spirit of MSME’s

JSW Steel launched a film on World MSME Day on 27th June, 2024. The film showcased, JSW Steel’s commitment to MSMEs and how these micro, small & medium enterprises through their innovative and resilient attitude are reimagining the possibilities for a new growing India. This film was promoted on various social media platforms and You Tube. Across platforms, this film had a cumulative reach of ~62 million and a total viewership of ~41 million. The film got recognised for its creative storytelling with a Silver at the AFAQ’S Digies, 2025 in the Thought Leadership category.

IPL association with Delhi Capitals

JSW Steel connects with its channel partners through the association with the IPL team, Delhi Capitals. JSW Steel associated with DC Utsav, a channel connect initiative where channel partners are invited for a meet and greet and an opportunity to watch the Delhi Capitals live in action at one of the designated venues. DC Utsav was conducted in Kolkata & Mumbai. Close to 100 channel partners were part of the DC Utsav in each of the cities.

4.3 The JSW experience centre

The Company launched 'The JSW Experience Centre', a cutting-edge facility designed to highlight its extensive range of products and services, strengthen brand engagement and empower customers to make informed purchasing decisions. The Centre features the JSW Legacy Wall, showcasing its journey and impact on the steel industry.

The interactive Product Wall allows visitors to explore JSW’s diverse offerings, while the Digital Portal with kiosks provides easy access to product information and brochures via QR codes. With 30 such centres across 20+ key markets, the Company brings its vision closer to communities, customers, and partners throughout India.

JSW Steel has partnered with IIT-Bombay to establish the ‘JSW Technology Hub’, a state-of-the-art facility to drive research and development in steelmaking. This collaboration focuses on advancing new and emerging steel technologies through cutting-edge research, training and technical studies, ensuring that both industry and academia can work together to pioneer innovative solutions for the future of steel.

5.1 Indian operations

JSW Vijayanagar Works located in Karnataka, is India's largest integrated steel facility, with a 12.5 MTPA capacity (at the beginning of FY 2024-25). From humble beginnings 26 years ago, it has evolved into a benchmark of cutting-edge technology and operational excellence, showcasing the Company’s focus towards innovation and sustainability in steelmaking.

FY 2024-25 highlights

30%

Iron ore consumption from captive mines

30

Safety digital initiatives optimised with Man-machine Interface (MMI)

205

Digitalisation projects completed

Competitive strengths

- Largest single location with 17.5 MTPA crude steelmaking capacity (including 1.7 MTPA under commissioning).

- India’s largest beneficiation plant, boasting a 20 MTPA capacity, the facility is equipped with cutting-edge infrastructure to process low and medium-grade iron ores, enhancing resource efficiency and feeding agglomeration units with optimised inputs.

- 20 MTPA pipe conveyor system transports iron ore seamlessly from the mines to the plant, offering a green, cost-effective logistics alternative that significantly reduces transportation costs and environmental impact.

- India’s largest Pellet Plant (PP#3) with a capacity of 8 MTPA, employing low-pressure gas for pellet induration, delivering energy-efficient, high-quality pellets.

- Captive power capacity of 865 MW ensures reliable energy for operations, complemented by a 225 MW solar power plant. Wind Power, ~450 MW already commissioned and balance 150 MW under commissioning.

- Equipped with the Maximised Emission Reduction of Sintering (MEROS) system, the Sinter Plant complies with stringent environmental norms by significantly reducing stack emissions.

- Produces premium coke through stamp charged coke ovens with dry quenching, enhancing fuel efficiency by reducing coke moisture.

- Achieves 100% process waste utilisation via techniques like micro-pelletisation, briquetting (mill scale, LF slag, DRI fines), tailing beneficiation and converting slag to sand, pioneering circular economy practices.

- Implements unique clean steelmaking technologies such as the KR facility for deep desulphurisation, sub-lance systems, Electromagnetic Stirring (EMS) in slab casters auto mould-width adjustments and Twin RH degassing for superior steel quality.

- India’s largest auto-grade steel facility with a 2.3 MTPA capacity, offering an extensive portfolio of automotive and electrical steels to meet diverse industrial demands.

- Committed to import substitution and first-time adoption of Best Available Technologies (BAT), ensuring global standards in quality, efficiency and innovation.

20 MTPA

Capacity Iron ore Beneficiation plant

865 MW

Captive power generation capacity

20 MTPA

Pipe conveyor capacity

Digitalisation

- 239 projects undertaken and 205 projects completed during the year.

- 7,648 sensors were deployed across 1,725 critical rotating equipment for predictive condition-based monitoring, thereby enhancing performance monitoring and operational efficiency.

- An Automatic Guided Vehicle (AGV) system has been implemented at Blast Furnace (BF)-3 for handling coal mill rejection material, eliminating man-machine interface through sensor-based hopper level detection, line-following coal collection, algorithm-driven reporting, electronic valve control and intranet connectivity for seamless automation and communication.

- At BF-4, AI and machine learning have been deployed to identify incoming raw materials to the stock house and assess conveyor health, with the system’s output integrated with the distributed control system for interlocking and alarm generation, enhancing automation, accuracy, and operational safety.

- Remote slag skimming has been implemented using a thermal camera to detect slag levels during skimming, resulting in reduced hot metal handling losses, fewer chemical defects caused by sulphur, and enhanced operator safety.

- A slag detection system has been implemented using a low-wavelength infrared camera, which alerts the operator when to lift the converter, effectively preventing slag from entering the steel ladle.

- Implemented a robotic sticker pasting system at Colour Coating Line, where a robot with a printing head marks the coil number post band-strapping, retrieves the label from the printing machine, and pastes it on the coil using data received from the Level 2 interface.

- Introduced digital flare monitoring for gas volume analysis using AI-based cameras to track flare stack flame length and width, enabling optimised gas utilisation, quicker decision-making, and enhanced operational efficiency.

₹16 crore

Invested towards digitalisation

Environmental initiatives

- Installed and commissioned in-house source mounted De-Dusting System (DDS) at PP1 (Pellet Plant 1) to reduce dust emissions from the conveyor.

- 500 KLD (Kilo Litres per Day) Sewage Treatment Plant (STP) plant commissioned to treat and reuse sewage generated within the plant (office & canteen) and treated sewage water is reused in steel melt shop 3 for secondary application there by reducing its water requirement.

- Installed a dust suppression system in Junction House (JH) 7 & 8 of RMHS (Raw Material Handling System) and a DDS at JH-12 which resulted in reduction of Fugitive Emission.

- Noise study carried out in Agglomeration units to monitor high/ critical noise sources.

₹12 crore

Invested towards environment

Health and safety initiatives

- Replacement of 5.95 kilometres of vulnerable gas pipeline segments has enhanced safety and reduced leakage risks.

- Safety Culture Survey covered over 90% of employees, enabling targeted safety improvements.

- Contractor Safety Management (CSM) system was externally audited for compliance and improvement.

- Roof sheeting safety was strengthened through deployment of certified agency’s teams.

- A new software was implemented for advanced Quantitative Risk Assessment (QRA) studies.

- Two additional fire tenders were added to strengthen emergency response capabilities.

- Seventy new road signboards were installed to improve traffic safety and visibility.

- A Digital Asset Management System was deployed to monitor and maintain firefighting equipment.

- Three more Automatic Number Plate Recognition (ANPR) units were installed, totalling 17 units for quick vehicle identification.

- Twelve advanced radar-based speed display units were installed to promote safe driving behaviour.

- Advanced Driver Assistance Systems (ADAS) were installed in 13 heavy vehicles to reduce on-road risks.

₹26 crore

Spent on health and safety

Awards received

- IIM National Sustainability Award for initiatives in quality, higher product development, profit making, human resources management and environmental performances.

- CII DX 2024 Award for best practises in digital transformation for innovative category (10 awards).

- Responsible Steel Certification for Vijayanagar Manufacturing Sites.

- Jury Choice Award at Annual Sustainability Symposium and Excellence Awards by Indian Chamber of Commerce (ICC) for ESG Performance.

- Best Industry Award (Iron & Steel Industry) in safety performance from the Directorate of Factories, Boilers, Industrial Safety & Health, Government of Karnataka, during 53rd National Safety Day event.

- Manufacturing Occupational Health Safety & Environment excellence award by World Safety Organisation.

- GreenCo Platinum Certification from the Confederation of Indian Industry (CII) is a prestigious recognition acknowledging exceptional environmental performance and sustainability practices in their operations.

- Golden Peacock Eco-Innovation Award for 2024 for development of a corrosion protective coating to steel composed of Magnesium, Aluminium and Zinc.

Capacity expansion initiatives

During FY 2024-25, JSW Vijayanagar Metallics Limited (JVML) a wholly owned subsidiary of the Company, successfully commissioned a 4.5 MTPA Blast Furnace, with the Blast Furnace ramping well and operating at over 90% capacity utilisation in March 2025. JVML has also commissioned Steel Melt Shop with a 3.3 MTPA capacity, with one converter and both casters fully operational. The second converter at the SMS is expected to be commissioned in Q2 FY 2025-26 (1.7 MTPA under commissioning in JVML).

FY 2025-26 priorities

Blast Furnace 3 upgradation

Revamp and upgrade of Blast Furnace 3 from 3 MTPA to 4.5 MTPA along with associated auxiliary units. This upgradation will increase the crude steel capacity to 19 MTPA at Vijayanagar and provide cost savings due to larger Blast Furnace operations. The project is expected to be commissioned in Q4 of FY 2025-26.

Operationalise three iron ore mines in Karnataka

Increase the production from the existing nine iron ore mines and operationalise three new iron ore mines viz. Vyasankere, Jaisinghpura South, Jaisinghpura North to cater to the iron ore requirements at Vijayanagar.

Operationalise other key projects

- Modernisation of Hot Strip Mill 1, increasing the capacity from 3.2 MTPA to 3.8 MTPA.

- Commissioning of the Coke Oven – 5 battery C of 0.75 MTPA by Q4 of FY 2025-26.

JSW Dolvi Works is a 10 MTPA integrated steel facility that stands as a symbol of transformation and technological advancement. Since its acquisition in 2010, the Company has expanded the plant’s capacity from 3.3 MTPA to 10 MTPA through strategic brownfield expansion. Specialising in flat steel production, Dolvi boasts 8.5 MTPA capacity in flat products and 1.5 MTPA in long products. It pioneered the use of Conarc technology in India for steelmaking and compact strip production for manufacture of Hot Rolled Coils. The site also features a dry Gas Cleaning Plant and Energy Recovery System in its Steel Melt Shop.

FY 2024-25 highlights

27%

Iron ore consumption from captive mines

25

Digitalisation projects completed

4

Safety digital initiatives optimised with Man-machine Interface (MMI)

Competitive strengths

- JSW Dolvi Works leverages its strategic coastal location for seamless logistics and efficient supply chain management. This advantage is further strengthened by the mechanised operations at JSW Jaigarh Port, which enable substantial raw material handling capacity, reducing road transport reliance.

- Dolvi Works is the first plant in India to adopt a combination of Conarc technology for steelmaking and compact strip production for producing hot rolled coils, providing the unit with flexibility to use a combination of solid charge and liquid hot metal.

- The plant is also powered by sustainable infrastructure, including 175 MW Waste Heat Recovery Boilers (WHRB) and a 60 MW captive power plant, which utilise flue gases and CDQ steam to efficiently meet the energy needs of the Phase II 5 MTPA expansion.

- Further strengthening operational resilience, the site has upgraded its 220 KV Air Insulated Substation to a more durable and space-efficient Gas Insulated Substation, supporting future capacity and enhancing system reliability.

- A state-of-the-art central store project has introduced automated storage and retrieval systems (ASRS), alongside AI-led inventory management to streamline operations and reduce manual errors.

- Dolvi’s product portfolio is as diverse as its capabilities, catering to industries such as automotive, infrastructure, machinery, construction, LPG cylinder manufacturing, cold rolling, oil and gas and consumer durables.

10 MTPA

Capacity

301 MW

Captive power generation capacity

8.5 MTPA

Capacity in flat products

Digitalisation

- Machine learning-based predictive model to estimate the Reduction Degradation Index (RDI) of sinter in real-time for proactive process control and consistent product quality.

- A real time laser technology monitoring system to track the overlap position of belt in pipe conveyors to ensures belt alignment, preventing belt damage, and enhance equipment reliability.

- High-precision infrared line scanners were installed and integrated with level 1 system for online monitoring to enhances casting quality and operational consistency at both casters.

- Online Condition monitoring sensors deployed along with dashboard for critical rotating equipment & Conveyors for predictive conditionbased monitoring, thereby enhancing performance monitoring and equipment reliability.

- High-voltage (33kv and 6.6KV) protection relays were networked centralised for recording and monitoring of faults and events. This initiative improves power system reliability and troubleshooting time through end-to-end visibility on dashboard.

- Condition monitoring of critical material handling conveyors to prevent spillage and improve cost efficiencies using digital solution.

- A centralised Operational Technology network health monitoring system has been set up to assess the condition of communication and control systems in the Compact Strip Production (CSP) Mill to avoid network system failures, resulting in operational efficiency.

- A hot metal de-slagging system with automated raking and vision system has been implemented to enhance operator safety and reduces manual intervention during slag removal.

- Digital Twin technology based digital solution has been deployed for condition monitoring of universal joint bearings in roughing Mill to predict the anomalies and their respective measures to enhance the equipment reliability and operational efficiency.

- Digital Twin technology based digital solution has been deployed for condition monitoring of Coke Oven Exhausters (4 Nos.) to predict the anomalies and their respective measures to enhance the equipment reliability and operational efficiency.

- SAMPARK Digitalisation for logistics and material tracking was implemented for inbound materials and is under implementation for in-plant movement. This initiative ensures end to end visibility and logistics efficiency.

- Machine learning based model was introduced to optimise the addition of ferro alloys in Steel Melting Shop 1 resulting in optimum alloy consumption and consequent reduction in production cost.

- Long Range Wide Area Network (LoRaWAN) based connected workforce solution implemented in Coke Oven 1 and Coke Oven 2 for workforce safety.

₹7 crore

Invested towards digitalisation

Environmental initiatives

- Installed and commissioned 300 KL per day STP (Sewage Treatment Plant) which will reduce fresh water consumption.

- Installation of feeding system along with Dust Extraction (DE) system in Sinter Plant 2 for feeding and consuming waste material.

- Installed low-pressure and high-pressure Dry Fog Dust Suppression (DFDS) system at pellet yard on the back side of incinerator area and jetty yard to eliminate fugitive emissions during bulk material handling.

- Installed Dust Extraction for Product Building for Induration Feed end & Pneumatic Conveying System to eliminate any fugitive emission generation during operation.

- Fogger System was installed in the Electric Arc Furnace (EAF) Slag pit area to control fugitive emissions during slag handling.

- Conducted the Biodiversity Dependency-Impact Assessment for NNL (No Net Loss on Biodiversity) Study; in the process of publishing its first report on Biodiversity.

- 1,766 trees planted inside the plant boundary.

₹100 crore

Invested towards environment

Health and safety initiatives

- ‘Safety Culture Survey’ was conducted for 11,643 employees (including on role, associates and contract employees) and action plans were prepared.

- 5 Subject Matter Expert (SME) certification programmes were conducted.

- 12 GEMBA walk downs conducted during FY 2024-25 and achieved 96% of average compliance on opportunity for improvements (OFIs) identified during GEMBA walk downs.

- Conducted 245 departmental areawise Cross-Functional Safety Audits in FY 2024-25 by identified leaders.

- The Company advanced safety and emergency preparedness through Rakshak’s connected workforce alerts, immersive VR and simulator-based trainings, 3D animated case studies, extensive e-learning modules and a revamped Safety Experience Centre.

₹16 crore

Spent on health and safety

Capacity expansion initiatives

JSW Steel Dolvi Works, a 10 MTPA integrated steel plant, is expanding to 15 MTPA by September 2027. through installations of state-of-theart facilities such as 4.8 MTPA Blast Furnace, Steel Melt Shop of 5 MTPA and Hybrid Continuous Strip Mil that can produce plates and coils. The project includes setting up of 250 MW captive power plant which will utilise the excess gas available from the Blast Furnace reducing the overall power cost at Dolvi. The project is expected to be commissioned by September 2027. Progress includes 60% engineering completion, ordering completion and innovative initiatives like Power BI dashboards, drone surveys, BIM models and automated welding solutions.

FY 2025-26 priorities

Capital Shutdown of Blast Furnace-1

Capital shutdown of Blast Furnace-1 for replacement of staves and improve operational efficiency in terms of fuel cost reduction, increase in Pulverised Coal Injection to enhance production and reduction in costs

Higher scrap usage at steel melt shop

Increased usage of scrap at Steel Melt Shop for enhancing production volumes.

Renewable power sourcing

In phase I, Dolvi had planned to set up 94.5 MW of wind power for replacement of coal-based power to reduce the CO2 emissions and reduction in power cost. Currently ~70% of wind power capacity is commissioned and the entire 94.5 MW wind power is expected to be commissioned by Q2 of FY 2025-26.

Awards & recognition

- Achieved ‘Core Site Certification’ against the Responsible Steel International Production Standard.

- ‘International Winner Award’ from Greentech Foundation recognises global-level excellence in implementing innovative and impactful EHS practices including digital safety systems, behavioural safety programmes and leadership engagement.

- National OHS Award-2024 (Large Enterprises-Steel Sector) from Global Safety Summit for outstanding Occupational Health & Safety (OHS) performance for implementation of proactive safety culture, health risk mitigation, and compliance excellence.

- Platinum Award from Grow Care India OHS Award-2024 for exemplary safety leadership, system implementation, and employee engagement.

- Platinum Award from 9th Apex India OHS Award-2024 acknowledges high-performing organisations in OHS policy execution and industry benchmarking.

- Gold Award from Indian Chamber of Commerce in 6th ICC National OHS Awards-2024 Recognises leadership and continuous improvement in OHS systems.

- First Prize – Manufacturing (Large) category from CII Western Region ‘SHE Excellence & Innovation Awards 2024’, appreciates innovation and sustainability in safety, health, and environment practices.

- Winner Award – ‘Workplace Safety Excellence 2024’, both from Greentech Foundation and Green Enviro Foundation for recognising excellence and continuous improvement in workplace safety and employee wellbeing.

- Silver Award – 7th CII-IQ National Safety Practice Competition, encourages sharing of innovative and replicable safety practices across industry