At JSW Steel Limited, corporate governance is a continuous journey centred on integrity, transparency, and accountability. With a balanced Board of experts, top-level executives, and skilled professionals, supported by robust systems, we ensure ethical conduct across our operations. Our commitment to strong governance, beyond mere policies, drives our growth while considering the well-being of all stakeholders.

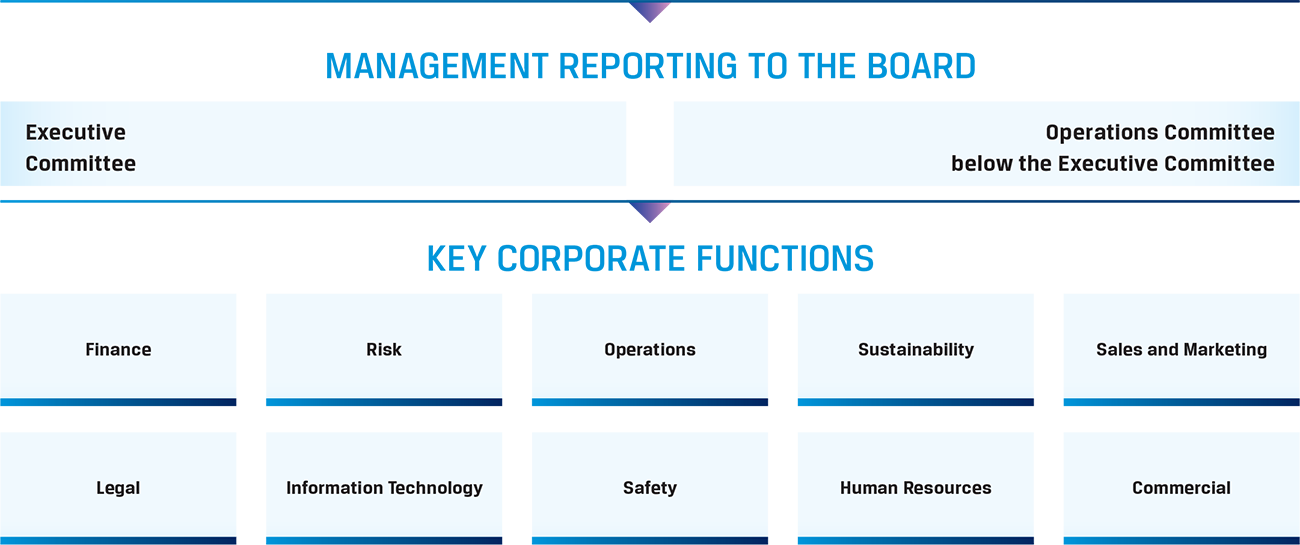

The Board of Directors at JSW Steel oversees the governance and strategic direction of the Company, ensuring long-term stakeholder interests are served. The responsibility for implementing Company strategy, managing the business, and making operational decisions is delegated to the Executive Committee. This committee, comprising top-level executives, works closely with various Board Committees to ensure robust governance, ethical practices, and alignment with JSW Steel's strategic goals.

Balanced Board of Executive and Non-Executive Independent Directors with a diverse range of expertise and experience

Under the guidance of the Board and its committees, JSW Steel drives performance by adopting various policies on key domains such as corporate governance, sustainability and CSR. Respective information on the policies is available at our website

*For Investigating a leak or suspected leak of unpublished price-sensitive information

We uphold high ethical standards throughout our operations, emphasising transparency and robust governance. Our Board oversees strict adherence to our Code of Conduct, ensuring alignment with our ethical principles in every decision. Further, all our employees are fully committed to these standards, reinforcing our dedication to ethical conduct at every level of the organisation.

Our Whistleblower policy provides a secure and confidential platform, which is active 24*7, for reporting ethical concerns, fraud, or breaches of our Code of Conduct. In FY 2023-24, the Ethics Helpline handled 16 cases, out of which four cases are under investigation. Accordingly, as on March 31, 2024, 75% were resolved.

We conduct comprehensive human rights risk assessments, engaging stakeholders for in-depth evaluations. Strengthening our due diligence process, we have implemented a confidential grievance system to promptly address discrimination and harassment. Continuous monitoring and auditing ensure accountability, while training programmes enhance awareness and protection of human rights. We actively promote human rights standards among our suppliers, favouring those who align with our values. Committed to both legal and voluntary obligations, we transparently report our performance and strictly prohibit discrimination and partnerships with entities that violate human rights. Our Sustainability Framework drives continuous improvement and compliance across all operations.

![]() Read our approach

to human rights on page

Read our approach

to human rights on page

We adhere to JSW Group’s robust Sustainability Framework, which is systematically implemented across our sites. This structured approach ensures the effective management of key sustainability issues and elements of our strategy with utmost efficiency, upholding our commitment to environmental stewardship, social responsibility, and economic resilience.

At JSW Steel, cybersecurity is pivotal in fortifying our digital infrastructure against evolving threats. Guided by a proactive strategy overseen by our Chief Information Officer and the Risk Management Board Committee, we ensure robust protection for our operations.

![]() Access our Cyber Security Policy on our page

Access our Cyber Security Policy on our page

During FY 2023-24, our contributions totalled approximately H12 crore towards memberships and subscriptions in organisations like World Steel, the Indian Steel Association, ASSOCHAM, FICCI, etc. These contributions were directed exclusively to non-political entities. Detailed tax information is available in Form AOC, which forms an integral part of our annual report. Additionally, our Tax Transparency Report underscores our commitment to transparency, responsibility, and accountability. This report outlines our tax principles, policies, governance mechanisms, and provides quantitative information on our various contributions.

![]() Access our Tax Transparency Report

Access our Tax Transparency Report

We actively engage in trade bodies and associations to share insights and foster the exchange of ideas. Our regular participation in discussions ensures we stay informed about global and regional industry trends.

The Audit Committee oversees and evaluates the performance of external auditors on behalf of the Board, recommending their appointment or re-appointment based on stringent criteria. These criteria include technical competence, operational credibility, ability to provide transparent and accurate recommendations, and overall reliability. According to the Companies Act, 2013, no individual can serve as an auditor for more than one term of five consecutive years, and no audit firm can serve for more than two such terms. SRBC & Co. LLP was appointed as statutory auditors for a five-year term starting from the 23rd AGM until the 28th AGM, with shareholder approval for a subsequent five-year term until the 33rd AGM. SRBC & Co. LLP, a network firm of EY in India, adheres to rigorous procedures for partner assignments and rotation in audit responsibilities.

We enforce business conduct policies across our workforce and value chain partners to ensure compliance and ethical behaviour. Our stakeholder grievance mechanism offers a structured platform for addressing concerns. In FY 2023-24, we received 852 shareholder complaints and 100% were resolved satisfactorily. Complaints received from employees, workers and customers were also addressed and resolved.

Independent Directors

on the Board

Women Directors

on the Board

Average tenure of

Independent Directors

Average tenure

of the Board

Average age of the Board

> 60 years – 6 | <= 60 Years – 4

Chairman & Managing Director, Non-Independent Executive Director

Mr. Jindal holds a Bachelor’s Degree in Mechanical Engineering from Bangalore University and is the principal promoter of the Company. His dedication to a self-reliant India is evident in the technological innovations that distinguish each JSW company. Under his leadership, JSW Group has expanded into key sectors of the economy, including Steel, Power, Infrastructure and Cement. Today, the JSW Group operates some of the most energy-efficient and eco-friendly manufacturing facilities in the country. Mr. Jindal also serves as a council member of the Indian Institute of Metals and serves on the Executive Committee and as Chairman of the Sustainability Committee of World Steel Association. He is also the former President of Institute of Steel Development and Growth. In 2007, he was named the Ernst and Young ‘Entrepreneur of the Year’ in the Manufacturing category. In 2009, he was honoured with the Willy Korf Ken Iverson Steel Vision Award by the American Metal Market and World Steel Dynamics.

Jt. Managing Director & CEO

Mr. Jayant Acharya is the Joint Managing Director & CEO of JSW Steel and a member of its Board of Directors. He holds degrees in Chemical Engineering and Masters in Physics from the Birla Institute of Technology, Pilani, India, and an MBA.

With over 37 years of industry experience, Mr. Acharya has been instrumental in JSW Steel's organic and inorganic growth, overseeing significant capacity additions and key acquisitions. His leadership has been key to integrating the Company's operations in India and overseas, thereby establishing JSW Steel as the largest steel and coated steel producer in India.

Under his guidance, JSW Steel's product portfolio has expanded to include new and diverse offerings for both domestic and international markets. A focused approach has enhanced the Company's supply chain reliability, raw material security through backward integration with mines for iron ore and coal, delivering capacity growth at lower specific costs per tonne and driving superior returns on investments.

Mr. Acharya is a respected voice in the steel sector, often sharing insights on sustainable steel production and consumption. He serves on the Executive Committee of the World Business Council for Sustainable Development, is a member of the National Committee of CII, and co-chairs the Steel Committee of CII.

Chief Operating Officer

Mr. Gajraj Singh Rathore is the Chief Operating Officer of JSW Steel. He has over 35 years of Steel industry experience with expertise on large scale transformation and digitalisation. He has been with JSW Steel for about 27 years and has championed multiple strategic priorities such as leading the Steel making and Mills at the Vijayanagar Plant as Executive Vice President, Operations and successfully overseeing the expansion and capacity utilisation of the Dolvi Plant as its President.

Mr. Rathore has pioneered the development of technical know-how and integration of digital use cases into day-to-day operations of integrated steel plants. He has been at the forefront of leading sustainable business practices across JSW with its flagship programme, SEED, in Vijaynagar and its horizontal deployment at Dolvi. For his exceptional contributions, Mr. Rathore has been recognised as the COO of the Year for Technology Integration by Steel and Metallurgy. He is associated with Industry bodies such as FICCI, SIMA and is actively vocal about sustainable business practices. Mr. Rathore holds a Bachelor’s degree in Metallurgy from NIT, Tiruchirappalli and certifications from Brown University.

Nominee Director, JFE Steel Corporation, Japan

Mr. Hiroyuki Ogawa holds a Master’s degree in Engineering from the Department of Mechanical Engineering, Graduate School of Engineering, The University of Tokyo. He also has a Master’s degree in Science (Management of Technology) from MIT and a Master’s degree in Science (Engineering Management) from Stanford University.

Mr. Ogawa is a member of the Board and Executive Vice President in charge of the Global Business Development Division, Digital Transformation Strategy Headquarters, Cyber Security Management Dept., Business Process Innovation Team, Raw Materials Dept (I&II) and Materials & Machinery Purchasing Dept. of JFE Steel Corporation. Prior to his positions at JFE Steel’s head office, he was Vice President, General Superintendent, West Japan Works, Fukuyama, Assistant General Superintendent, West Japan Works- Kurashiki. He joined Kawasaki Steel Corporation in 1985.

Nominee Director, KSIIDC

Dr. Sateesha B. C. belongs to the 2012 batch of Indian Administrative Service. He holds a Bachelor’s degree in Veterinary Sciences from the University of Agriculture Sciences, Bengaluru. His experience in administration spans from the sub-division to district level. His contribution in land acquisition for important projects is significant and crucial and includes Suvarna Vidhana Soudha in Belagavi and expansion of airports in Belagavi and Hubballi. His stint in the Commerce and Industry ministry as Deputy Secretary (Mines) is remembered for handling difficult proposals effectively and efficiently. His tenures, in different capacities, in districts like Yadgir, Dharwad and Belagavi have further vitalised his ability as an agent of change. When he became the Deputy Commissioner of Raichur and Kodagu districts, all the cumulative experience was put to use. His experience of working as CEO of Zilla Panchayat and Deputy Commissioner of two districts moulded him into an effective and efficient public administrator. His experience as SLAO, AC, ADC, Commissioner, Watershed Development Dept, Malnad Development Board, CEO and DC have come in handy for a Corporation like KSIIDC, which has undertaken crucial infrastructure projects.

Independent Non-Executive Director

Mr. Haigreve Khaitan, LLB, has been a Partner at Khaitan & Co since 1995 and heads the firm's M&A and Private Equity practice. He began his career in Litigation before specialising in Corporate Law. Mr. Khaitan has extensive experience in all aspects of Mergers & Acquisitions, including due diligence, structuring, and documentation for listed companies, cross-border transactions, and medium and small businesses.

In addition, he is skilled in restructuring, providing advice and documentation for creditor restructuring, sick companies, demergers spinoffs, sale of assets etc. His expertise also extends to foreign investment, joint ventures and foreign collaborations. Mr. Khaitan advises a wide range of large Indian conglomerates and multinational clients across various sectors, including Infrastructure, Power, Telecom, Automobiles, Steel, Software and Information Technology, Retail, etc.

Independent Non-Executive Director

Mr. Seturaman Mahalingam, a Chartered Accountant by qualification, began his career as an IT consultant and played a pivotal role in marketing Tata Consultancy Services (TCS) globally, developing processes, and creating large software development centres for the company. He has held key positions such as Executive Director and Chief Financial Officer (CFO) of TCS, retiring in February 2013 after over 42 years of service.

Before becoming CFO in February 2003, Mr. Mahalingam managed various critical functions at TCS, including Marketing, Operations, Education and Training, and Human Resources. He oversaw the company’s operations in London and New York during the early stages of TCS's global expansion.

Mr. Mahalingam has also served as President of the Computer Society of India, former Chairman of the Southern Region of the Confederation of Indian Industry (CII), and President of the Institute of Management Consultants of India. He is the Chairman of the CII National Council Task Force on Sector Skills Councils & Employment and was a member of the Tax Administration Reform Commission (TARC) set up by the Government of India under the Chairmanship Dr. Parthasarathi Shome.

Mr. Mahalingam has been recognised as the best CFO in various years by Business Today, International Market Assessment (IMA), CNBC TV18, CFO Innovation, Finance Asia, and Institutional Investors. In 2012, Treasury & Risk, a US-based magazine, named him one of the 16 globally most influential CFOs.

Independent Non-Executive Director

Mrs. Nirupama Rao is a retired Indian diplomat, Foreign Secretary, and Ambassador. She was educated in India and, she joined the Indian Foreign Service in 1973. Over her four-decade-long diplomatic career, she held several significant positions. Mrs. Rao was India's first female spokesperson in the Ministry of External Affairs, New Delhi, the first female High Commissioner to Sri Lanka, and the first Indian woman Ambassador to the People’s Republic of China. She served as India’s Foreign Secretary from 2009 to 2011, after which she was appointed as India’s Ambassador to the United States, serving from 2011 to 2013.

Independent Non-Executive Director

Ms. Fiona Jane Mary Paulus has 37 years of extensive experience in Operational Leadership and Investment Banking at top-ranked global banks. She has transitioned to a career as a Non-Executive Director, holding two active Board roles, including one with a FTSE 250 company. Ms. Paulus has advised Boards and top management of FTSE 100 companies, multinationals, private equity firms, and infrastructure funds on major strategic initiatives such as M&A, various types of bank financing, debt and equity capital market transactions, and risk management solutions. She has executed transactions in multiple jurisdictions and has over 15 years of global risk management leadership experience.

Independent Non-Executive Director

Mr. Marcel Fasswald began his career in 1995 as a design and execution engineer at Mannesmann Demag Hüttentechnik, which later became part of SMS group in 1999. Since then, he has been associated with SMS group, where he served as Chief Technology Officer and Chief Operating Officer on the Managing Board. Prior to his appointment to the Managing Board in 2015, he was Technical Director and Head of Engineering and served as CEO and Managing Director of SMS group in India for six years.

Mr. Fasswald, a qualified engineer, brings extensive international experience from various management positions in Plant Engineering at SMS. Additionally, he was the Chief Operating Officer of Thyssenkrupp Industrial Solutions AG from April 2018 to September 2018 and CEO from October 2018 to October 2019. His profound knowledge of the Plant Engineering business, combined with his operational expertise and international experience, will be of immense benefit to JSW Steel.

Chairman

Chairman

Member

Member

Directors adhere to the minimum attendance criteria for attending Board meetings as per the Companies Act, 2013 ('Act'). In accordance with sub section 1(b) of Section 167 of the Act, the Directors are required to attend a minimum of one meeting conducted during the year. Over last 3 years, the average attendance rate at Board meeting has been 89.56% demonstrating that all the Board members attend the meeting. During the reporting year, six Board meetings were conducted, the minimum attendance of an individual Director was 3 out of 6 which aggregates to 50%.

Audit Committee

Audit Committee, a sub-committee of the Board of Directors, comprises Independent Directors. The Audit Committee oversees the Company’s financial reporting process, approves related-party transactions and regularly reviews financial statements, changes in accounting policies and practices, audit plans, significant audit findings, adequacy of internal controls, compliance with accounting standards, appointment of auditors, among others.

Nomination and Remuneration Committee

The Nomination and Remuneration Committee’s constitution and terms of reference comply with the provisions of the Companies Act, 2013 and Regulation 19 and Part D of the Schedule II of the SEBI (LODR) regulations. The primary responsibilities of the committee include identifying persons qualified to become Directors, decide on Senior Management appointments and remuneration, evaluating the performance of every Director. Additionally, the committee reviews the extension of tenures for Independent Directors based on their performance evaluations.

Stakeholders Relationship Committee

The Stakeholders Relationship Committee periodically looks after the functioning of the Company’s shareholder/investor grievance redressal system and its improvements, besides reporting serious concerns, if any.

Risk Management Committee

The Risk Management Committee develops a comprehensive risk management policy, reviewing it periodically, at least once every two years, taking into account evolving industry dynamics and complexity. Its aim is to ensure that the Company has suitable methodologies, processes, and systems in place to monitor and evaluate business-related risks effectively.

Project Review Committee

The Project Review Committee closely monitors the progress of large projects, while ensuring seamless coordination among various project modules. Its primary aim is to ensure timely project completion within the allocated budget.

Business Responsibility/ Sustainability Reporting Committee

The Business Responsibility/ Sustainability Reporting Committee is responsible for the adoption of National Guidelines on Responsible Business Conduct (NGRBC) in JSW Steel’s operations. Additionally, the committee addresses issues concerning climate change, water, and biodiversity, providing guidance on necessary actions to promote sustainability practices.

Corporate Social

Responsibility

Committee

The Corporate Social Responsibility Committee formulates and recommends the Corporate Social Responsibility Policy to the Board. This policy outlines a selection of CSR projects or programmes that the Company intends to undertake and recommends the expenditure to be allocated to each activity. Additionally, the committee periodically monitors the Company’s CSR policy.

Hedging Policy Review Committee

The Hedging Policy Review Committee implements protective measures to hedge against forex losses and makes decisions regarding all matters related to commodities hedging. It also takes steps to hedge against commodity price fluctuations.

Finance Committee

The Finance Committee is responsible for approving the availment of credit/ financial facilities, opening new branch offices of the Company, making loans to Individuals/bodies corporate, and placing deposits with other companies/ firms. Additionally, it is authorised to open current accounts, collection accounts, operation accounts, or any other accounts with banks, as well as to authorise personnel to sign excise, import, and export documents, and execute customs house documents.

JSWSL ESOP Committee

The JSWSL ESOP Committee is tasked with determining the terms and conditions for granting, issuing, re-issuing, cancelling, and withdrawing Employee Stock Options (ESOP) as necessary. It is also responsible for formulating, approving, evolving, deciding upon, and implementing any sub-scheme or plan for granting options to employees, as well as issuing directives to the trustees of the JSW Steel Employees Welfare Trust and amending the trust deed if necessary. Furthermore, the committee establishes procedures for ensuring fair and reasonable adjustments, as well as methods for satisfying any tax obligations related to the options or shares. It also outlines procedures for the cashless exercise of options.

JSWSL Code of Conduct Implementation Committee

The JSWSL Code of Conduct Implementation Committee is responsible for implementing the 'JSWSL Code of Conduct to Regulate, Monitor, and Report Trading by Insiders' and ensuring compliance with the SEBI (Prohibition of Insider Trading) Regulations, 1992.

Share Allotment Committee

Share Allotment Committee is responsible for offer, issue and allotment of shares of all kinds and/ or any other financial instrument(s) representing either equity shares or convertible securities, as may be approved by the Board from time to time. It is also responsible for approving and issuing the letter of allotment to the proposed allottees and to register the names of the allotees in the Register of Members of the Company.

Share/Debenture Transfer Committee

The Share/ Debenture Transfer Committee is responsible for approving and registering transfer/transmission/ transposition of all classes of shares / debentures, approving sub-division, consolidation and issue share / debenture certificates on behalf of the Company; issuing duplicate shares and approving the de-materialisation / re-materialisation of the securities of the Company upon request by the holders.

Inquiry Committee for Inquiring Leak Or Suspected Leak Of Unpublished Price Sensitive Information

The Inquiry Committee is responsible for dealing with any leak of Unpublished Price Sensitive Information (UPSI) or suspected leak of UPSI, upon becoming aware of such leak; it also conducts inquiries as laid out in the Policy in case of such leaks or suspected leaks and informs the Board promptly of such leaks, inquiries and the result of such inquiries