Our management of finances and treasury, efficient allocation of capital, and access to international funding sources have consistently reinforced our financial stability. As a result, we have been able to pursue our expansion plans and acquisitions with a cost of capital that gives us a competitive edge. With a robust financial profile, manageable debt levels, improved credit ratings, and a strong liquidity position, we are well-prepared to embark on the path of accelerated growth.

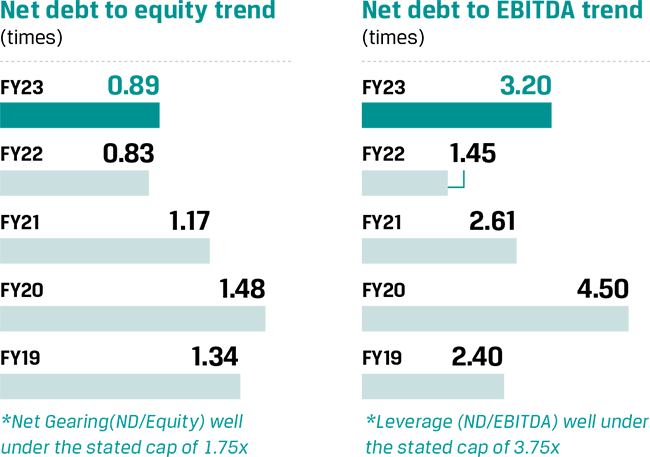

Net debt to equity

Net debt to EBITDA

Cash and cash equivalents

Credit rating

International

In June 2022, Moody's Investors Service upgraded JSW Steel's Corporate Family Rating (CFR) and its senior unsecured notes rating to Ba1 from Ba2 with Stable Outlook.

In May 2022, Fitch Ratings upgraded the Company’s Issuer Default Rating (IDR) to 'BB' from 'BB-'.

Domestic

ICRA: AA (Stable outlook)

IndRa: AA (Stable outlook)

CARE: AA (Stable outlook)

Capitals deployed

SOCIAL AND RELATIONSHIP

Capitals enhanced

FINANCIAL

Key risks

Material issues

Key trends

Focus on growth and cost reduction projects amid uncertain environment

Amidst the uncertain environment, we remained focused on growth and cost reduction initiatives. The planned CapEx of ₹20,000 crores was moderated to ₹15,000 crores, with actual spending reaching ₹14,214 crores. The year saw the successful commissioning of projects such as the capacity expansion of BPSL from 2.75 MTPA to 3.5 MTPA. Our cost-reduction initiatives included the commissioning of a 0.75 MTPA Coke oven battery A at Vijayanagar in November 2022 and the construction of 175 MW and 60 MW power plants at Dolvi. Additionally, efforts were made to enrich the product mix through projects such as the LRPC phase 1 expansion of 0.72 MTPA at Vijayanagar in December 2022 and the commissioning of 0.25 MTPA Tin plate 2 at Tarapur and a 0.5 MTPA Continuous Annealing Line at Vasind in November 2022.

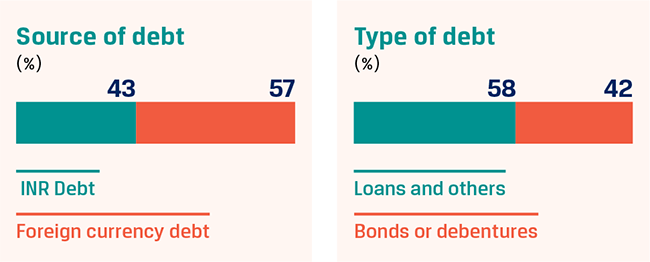

Debt profile

We prioritise high levels of active communication and collaboration with both domestic and international banks and financial institutions who trust us with their capital investments. We view it as our fiduciary duty to consistently generate financial returns and create value, thereby earning and maintaining their unwavering trust in us.

Capital successfully raised through international markets since 2014

At the end of FY 2022-23, our net debt stood at ₹59,345 crore, with our net gearing (net debt to equity) well under the stated cap of 1.75x and leverage (net debt to EBITDA) under the stated cap of 3.75x.

During the year, we spent ₹14,214 crore on CapEx projects, aligned to our capacity expansion strategy. Our debt increased only by ₹2,695 crore during the year.

Raising funds for a responsible tomorrow

In September 2021, we became the first steel company globally to raise Sustainability Linked Bonds. We raised $1 billion via bonds issuance in the overseas market through a Reg S/144A issuance. We raised two tranches of bonds with a tenure of 5.5 and 10.5 years, respectively. The proceeds of the issue will be used to fund CapEx plans as well as to refinance debt. The 10.5-year tranche was issued as a Sustainability Linked Bond (SLB) where we committed to a target of achieving ≤1.95 tonnes of CO2 per tonne of crude steel produced, by March 2030. We have chosen to measure our performance against the Sustainability Performance Target (SPT) with CO2 emissions intensity as our KPI, calculated as tonnes CO2 per tonne of crude steel produced (tCO2/tcs). This will cover our Scope 1 and Scope 2 emissions from the three ISPs in India. We will assess our sustainability performance against SPT for the period 2020 to 2030, providing a target towards reducing the CO2 emission intensity from our three ISPs in India. We aim to reduce our emissions by ~23% by 2030 to a level ≤1.95 tCO2 /tcs. As a step towards this, we already reduced our emissions by 5.6% during FY 2022-23.

Near-term

Long term