The Indian steel industry is experiencing a remarkable surge due to the government's infrastructure push as well as the favourable dynamics in the international market. JSW Steel is best placed to capitalise on these opportunities, while contributing to India's rapid ascent to be an economic powerhouse. With growing demand for steel across various sectors, we are investing in both greenfield and brownfield capacity expansions while selectively pursuing inorganic growth opportunities.

Total domestic installed capacity

Total downstream capacity

*Excluding recent National Steel acquisition

Capitals deployed

FINANCIAL

NATURAL

HUMAN

Capitals enhanced

MANUFACTURED

Key risks

Material issues

Key trends

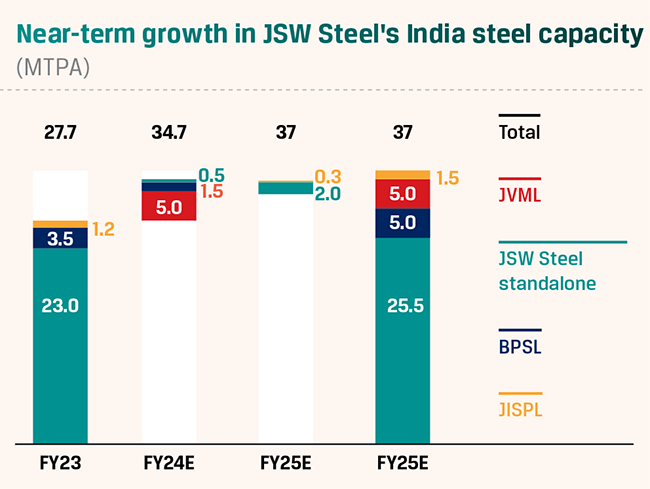

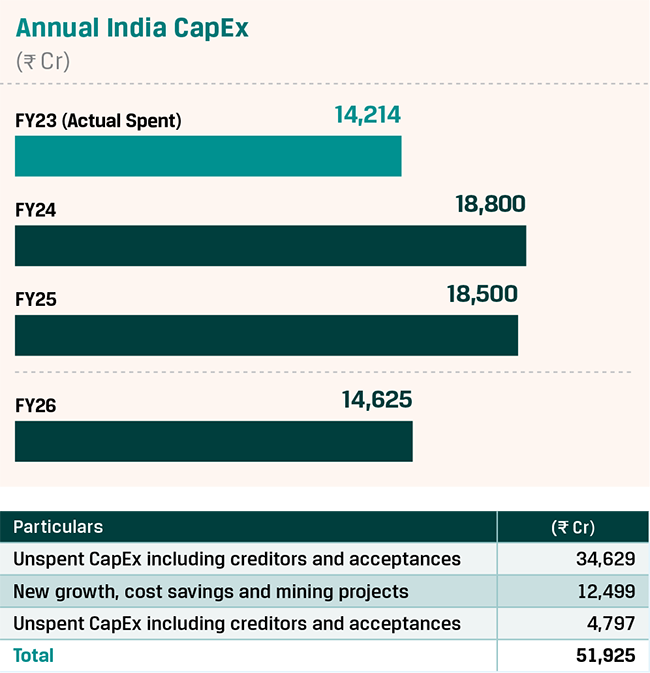

Our 5 MTPA Dolvi expansion project successfully commenced integrated operations in FY 2021-22 and achieved full ramp-up within a year. Additionally, our 5 MTPA brownfield expansion being built at Vijayanagar will be value accretive, with a relatively low capital expenditure of approximately $500 per tonne. To further augment our capacities, we have embarked on an incremental expansion of 2.5 MTPA at Vijayanagar, including debottlenecking projects along with the expansion of existing facilities to be completed by FY 2024-25. Further, we expanded the capacity of BPSL from 2.75 MTPA to 3.5 MTPA in FY 2022-23 and are well on track to take it to 5 MTPA by FY 2023-24. Importantly, our organic brownfield capacity expansions have been executed with capital expenditures significantly below the global benchmarks of replacement cost, which typically stands at around $1,000 per tonne for BF-based capacity.

Key project updates

At Vijayanagar, we have commenced our 5 MTPA brownfield project, where construction activities are currently underway for all packages, and we have also commenced work on piping and electricals for the project. Furthermore, equipment erection has begun across all packages, showcasing our commitment to timely execution. We anticipate completing the project by the end of FY 2023-24, ensuring that we stay on track to meet our expansion goals at Vijayanagar.

We also commissioned Coke Oven 5 Battery A, with a capacity of 0.75 MTPA, in September 2022. We are on track to commission Battery B of capacity 0.75 MTPA by the second quarter of FY 2023-24. In addition, to support our 5 MPTA steelmaking expansion, we are adding another 1.5 MTPA of Coke Oven at Vijayanagar. The commissioning of this additional capacity will be carried out in phases, with completion expected in the fourth quarter of FY 2023-24.

We also commissioned the Colour-coating line of 0.3 MTPA, which was part of the Cold Rolling Mill 1 expansion at Vijayanagar. With this, the CRM 1 expansion from 1.0 MTPA to 1.80 MTPA at Vijayanagar has been fully completed.

At BPSL, we have completed the first phase of expansion from 2.75 MTPA to 3.5 MTPA during FY 2022-23. We have initiated Phase-II expansion at BPSL and our other downstream operations, aiming to increase capacity from 3.5 to 5 MTPA. Currently, civil work and structural erection are in progress for the SMS-2 Project and New Wire Rod Mill-2. We have also received long lead-time items at the site and commenced equipment erection for various components, including New Wire Rod Mill-2, SMS-2, PCI upgradation for BF-1 & 2, and Lime Calcination Plant-6. With these developments, we are on track to complete the expansion project by FY 2023-24.

At JSW Coated, we completed the commissioning of new 0.5 MTPA continuous annealing line at Vasind and the second tin plate line of 0.25 MTPA at Tarapur during FY 2022-23. In Rajpura, Punjab, we have initiated operations at the 0.25 MTPA Colour Coating line facility. Additionally, in Jammu & Kashmir, we are setting up a 0.12 MTPA Colour- Coating line, with a target to commission the line by for the end of FY 2023-24.

Inorganic growth

Recent acquisitions and synergies

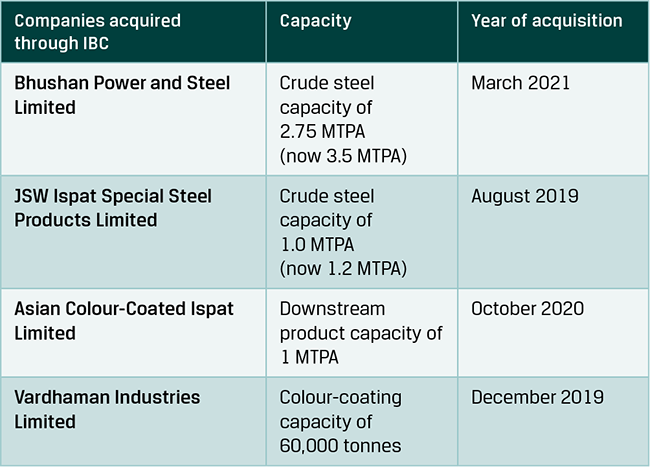

We have actively pursued strategic joint ventures and equity acquisitions to expand our horizons and unlock greater potential. These endeavours have empowered us to offer a wider range of value-added products, strengthen our global presence, secure crucial raw materials, establish backward integration, and enhance our technological expertise. Furthermore, we have capitalised on exceptional opportunities within niche markets, particularly in distressed assets.

One significant milestone in our journey is the establishment of a 50:50 joint venture with Severfield UK PLC, a renowned UK-based provider of structural steel building solutions. This collaboration has proven highly beneficial as their manufacturing facility is conveniently situated within the premises of our own Vijayanagar plant. With an impressive capacity of 100,000 tonnes per annum, they excel in engineering, fabrication, and erection of structural steel. Additionally, through a joint venture with Structural Metal Decks Limited, UK, they offer cutting-edge composite metal decking and flooring technology.

Another prominent partnership we have forged is with Marubeni-Itochu Steel, resulting in the creation of JSW MI Steel Service Center Private Limited. This joint venture aims to establish steel service centres in the north and west regions of India. Our primary objective is to provide efficient and reliable just-in-time solutions to key industries such as automotive, white goods, and construction.

Acquisitions

Near-term

Long term