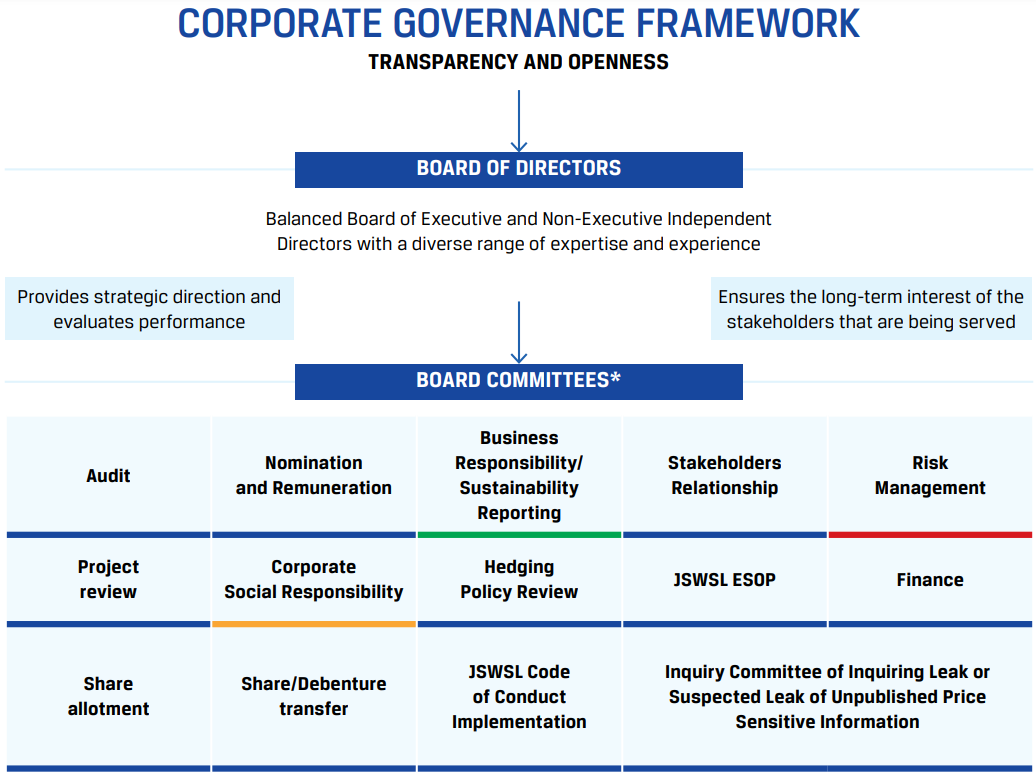

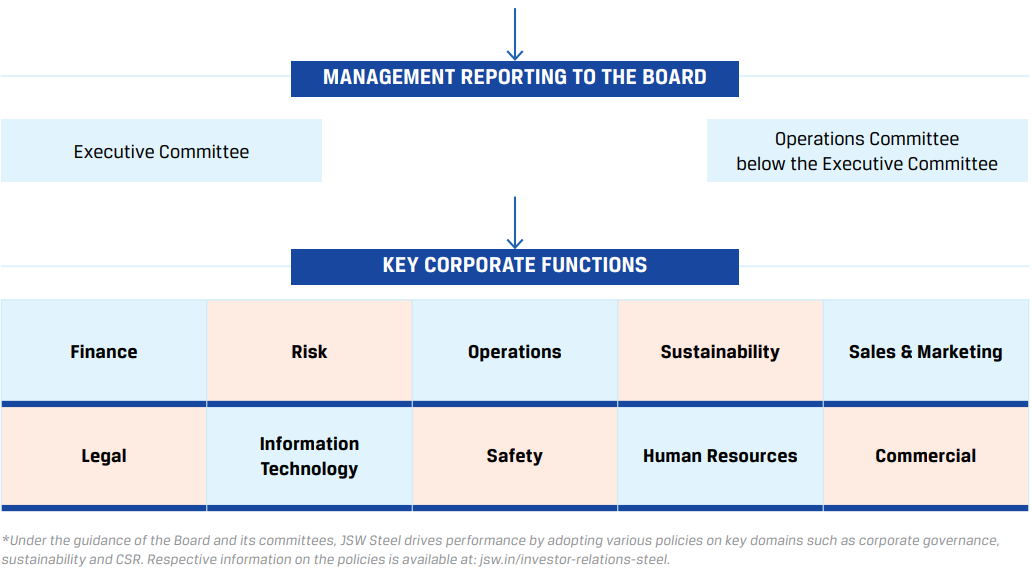

We have created a strong system of governance that is built on two essential foundations: transparency and integrity. Our leadership team comprises a seasoned and erudite Board with multifaceted expertise, supported by a team of skilled professionals in senior management. Working together, the Board and senior management uphold our core values and principles, serving as guardians of our governance system.

Business ethics

We are committed to undertake business ethically, and in doing so, improve consumer perception, reduce costs, and enhance employee satisfaction, among other long-term business goals. Our policies on business conduct show our commitment to embedding sound governance and transparency in our operations while tackling corruption and managing risks. Our board of Directors oversees our Code of conduct and corporate behaviour. 100% of our employees are committed to Code of Conduct.

Human rights

We are strongly committed to respect human rights. We involve our employees in upholding and sustaining the SA8000 policy. We are committed to ensuring a workplace that adheres to international guidelines and conventions such as ILO. We recognise that every individual brings a different and unique set of perspectives and capabilities to the team. We are committed to employing people solely based on their skills, ensuring no discrimination based on race, colour, age, gender, sexual orientation, gender identity and expression, ethnicity, religion, disability, family status, or social origin, among others.

Cybersecurity

For us, cybersecurity is a top priority. As we embed digitalisation into our operations, our business is more prone to cyber threats. We have meticulously devised ways through which we can protect our business and our stakeholders, through various vulnerability and breach assessments, keeping ourselves updated as per the industry best practices. This is headed by our Chief Information Officer and overseen by the Risk Management Committee.

Contributions to institutions, bodies and political parties

During FY 2022-23, we contributed around ₹13.39 crore towards memberships of organisations such as World Steel, Indian Steel Association, ASSOCHAM and FICCI. No contributions were made to the political parties. Contribution given to charitable and other funds during the year was ₹1.89 crore.

Engaging with industry bodies

We are an active member of various trade bodies and associations that help us voice our opinions to the larger audience, and we even serve as fora for cross-pollination of ideas and thoughts. We strive to regularly participate in discussions conducted by these bodies, helping us keep a pulse on industry trends at both the global and regional levels.

Appointment and rotation of auditors

Our Audit Committee is responsible for overseeing and evaluating the performance of the external auditors on behalf of the Board and recommends to the Board whether a specific external auditor should be elected or re-elected. We have established stringent criteria for the performance assessment of external auditors. The assessment includes technical and operational capability, credibility of the auditing firm, team strength, ability to provide transparent and accurate recommendations, open and effective communication and coordination with the Audit Committee, Corporate Auditing, and the management.

As per the Companies Act, 2013, no listed company can appoint or reappoint, an individual as auditor for more than one term of five consecutive years and an audit firm as auditor for more than two terms of five consecutive years. The members of the Company at the 23rd AGM held on June 29, 2017 appointed SRBC & Co. LLP as the Statutory Auditors of the Company for a term of 5 years to hold office from the conclusion of the 23rd Annual General Meeting until the conclusion of the 28th Annual General Meeting of the Company. Further, the Shareholders approved the re-appointment of SRBC & Co. LLP for a second term of five years commencing the conclusion of the 28th AGM held on July 20, 2022 until the conclusion of 33rd AGM.

SRBC & Co. LL P (SRBC), is EY’s network firm performing the audit function in India. The firm follows a stringent process for assigning partners as in-charge of audits. The firm also has guidelines for partners’ rotation.

Stakeholders grievance mechanism

We have policies to govern business conduct which apply to all our employees and value chain partners. We also have a structured stakeholders grievance redressal mechanism through which stakeholders can freely share their concerns and grievances. In FY 2022-23, we received 699 shareholder complaints. All of them were looked into and satisfactorily resolved.

Whistleblower policy

We have a Whistleblower Policy in place so that our people can report genuine concerns about unethical behaviour, actual or suspected fraud or violation of the Code of Conduct or Ethics Policy. We have launched a dedicated ‘Ethics Helpline’ to discuss the concerns of our stakeholders, including employees, Directors, vendors and suppliers. Our helpline is managed by independent consultants. During FY 2022-23, there have been 06 whistleblower cases and 05 have been resolved, with one case under investigation.

Policies

We have set up several internal systems and policies to establish a robust corporate culture while ensuring seamless business operations. These include policies on key domains such as corporate governance, sustainability and CSR among many others.

To read more on our policies please refer to our website https://www.jswsteel.in/investors/jsw-steelgovernance-and-regulatory-information-policies-0

Key memberships

World Steel Association

Confederation of Indian Industry (CII)

Federation of Indian Chambers of Commerce & Industry (FICCI)

Associated Chambers of Commerce and Industry of India (ASSOCHAM)

Indian Steel Association

Global Reporting Initiative (GRI)

United Nations Global Compact (UNGC)

Indian Institute of Metals

Bengaluru Chamber of Industry & Commerce

World Business Council for Sustainable Development (WBSCD)

Bengal Chamber of Commerce & Industry

Karnataka Iron & Steel Manufacturers’ Association (KISMA)

Sponge Iron Manufacturers Association (SIMA)

Federation of Indian Mineral Industries (FIMI)

Alloy Steel Producers Association (ASPA)

Indian Tin Manufacturers Association (ITMA)

BOARD OF DIRECTORS

Mr. Sajjan Jindal

Chairman & Managing Director, Non-Independent Executive Director

Mr. Jindal holds a bachelor’s degree in mechanical engineering from the Bangalore University. He is also the principal promoter of the Company. Mr. Jindal’s dedication to the cause of a self-reliant India is reflected in the technological innovations that define and set apart each JSW company. Under his leadership, JSW Group over the years has expanded in other core sectors of the economy, such as Steel, Power, infrastructure building and Cement. Today, the JSW Group runs some of the most energy efficient and eco-friendly manufacturing facilities in the country.

Mr. Jindal is a firm believer in the “Make in India” philosophy and has received several global awards for his commendable work. He was awarded the “EY Entrepreneur of the Year” in Feb 2023, and in the past, he received the “CEO of the Year 2019” awarded by Business Standard (India’s leading business publication) and the “Best CEO Award 2019” by Business Today Magazine. He has also been recognised as the “Outstanding Business Leader of the year 2018” by IBLA - CNBC TV18 (India’s leading business news channel). Furthermore, he was awarded the JRD Tata Award 2017 for “Excellence in Corporate Leadership in Metallurgical Industry,” and the “2014 National Metallurgist Award: Industry” instituted by the Ministry of Steel, Government of India.

Mr. Jindal is globally recognised for his impact on the steel industry and currently serves as the Vice Chairman of the World Steel Association, one of the largest and most dynamic industry associations in the world. He is also the Vice President & Chairman, Ferrous Division of the Indian Institute of Metals, and was the past President of Indian Steel Association (ISA) and former President of the Institute of Steel Development & Growth (INSDAG). Additionally, he was the past Chairman of the World Steel Association, and the first representative from an Indian company to serve in this role.

Mr. Jayant Acharya

Jt. Managing Director & CEO

Mr. Jayant Acharya possesses a Chemical Engineering Degree and a Masters in Physics from BITS (Birla Institute of Technology, Pilani, India). Post that, he went on to complete his Master’s in Business Administration. Born in January, 1963.

Mr. Acharya started his career with SAIL (Steel Authority of India) in the year 1986 and then worked with renowned Indian Business Groups in various Capacities until he joined the JSW group in 1999. With an Industry Experience spanning more than three decades, Mr. Acharya has been instrumental in redefining the Steel Landscape of India. Mr. Acharya headed both the facets of Business viz Buy side of bulk raw material and Sell side of steel, with aplomb. Under his stewardship several key transformations have taken place within JSW in the areas of Organised steel retailing, Development of Critical and Advanced Grade of Steels for Automotive, Long-term supply contracting etc.

Over the years, Mr. Acharya has been voicing his views on Steel and Business in many forums across the industry and has played a stellar role in propagating the use of steel in Construction with a mission to promote a Green Environment going forward. He has also spearheaded New Product Development initiatives and has been able to create a substantial market presence for JSW for Alloy Steel Rounds and Bars, Electrical Steel, Tin Plates etc. On the Bulk Raw Materials side, he heads the Global Sourcing and with the team has been able to develop consistent and reliable supply channels. Mr. Acharya has also been instrumental in successfully completing the acquisitions of a 1.3 MnT long product unit in Italy and a 3 MnT flat product unit in USA. This has been in line with the company’s strategic focus of expanding in key geographies and strengthening its global footprint.

Owing to his vast experience and the value he brings to the Company, his efforts are recognised by various Institutions and he has been conferred as one of the 'Greatest Marketing Influencers' by BBC Knowledge in India. In addition, for his contribution and excellence in commercial and marketing initiatives, he was awarded the 'Steelies India 2018' award for excellence by Steel and Metallurgy Magazine. Mr. Acharya also serves as the Co-Chair of the committee on Steel and Non-ferrous metals for the Federation of Indian Chamber of Commerce and Industry (FICCI) and has addressed various conventions highlighting key industry issues.

Chairperson

Member

Mrs. Savitri Devi Jindal

Chairperson Emeritus

Mr. Gajraj Singh Rathore

Whole-time Director & Chief Operating Officer

Mr. Gajraj Singh Rathore is the Chief Operating Officer for JSW Steel. He brings with him over 35 years of steel industry experience with expertise on large scale transformation & digitalisation. He has been associated with JSW Steel for about 27 years and has championed multiple strategic priorities such as leading the Steel making and Mills at the Vijayanagar plant as Executive Vice President, Operations and successfully overseeing the expansion and capacity utilisation of the Dolvi plant as its President.

Having successfully led large scale transformations with a focus on value delivery, he is known for his people-centric leadership style, strategic acumen, and deep functional expertise across the steel value chain. He is also a member of the JSW Group digitalisation board and has pioneered the development of technical know-how and integration of digital use cases into day-to-day operations of integrated Steel plants. He has also led key technical collaborations with our global partners.

Dr. M.R. Ravi, IAS

Nominee Director, KSIIDC

Dr. M.R. Ravi, IAS, belongs to 2012 batch of Indian Administration Service. Academically, he holds a Master’s degree in M.A (History), M.A (English, Gold Medalist) in Journalism and Ph. D in History from University of Mysore. He served as Commissioner, Mysore City Corporation, CMC, Shivamogga and Additional Regional Commissioner, Mysore and as MD, KSTDC, Bengaluru. He has also worked as Private Secretary to Hon’ble Minister for Higher Education, Government of Karnataka. He was CEO, Zilla Panchayath, Mangalore, Commissioner for Textile Development & Director Handlooms, Bengaluru and Deputy Commissioner & District Magistrate, Chamarajanagar District. As CEO, Zilla Panchayath, Dakshina Kannada, he won two national awards for Swachh Bharath during 2018. Further, he was also awarded Best Election Officer from Election Commission of India, Bengaluru during 2019.

Mr. Hiroyuki Ogawa

Nominee Director, JFE Steel Corpn., Japan

Mr. Hiroyuki Ogawa holds a Master’s Degree in Engineering from the Department of Mechanical Engineering, Graduate School of Engineering, The University of Tokyo. He also holds a Master’s Degree in Science (Management of Technology) from MIT and a Master’s Degree in Science (Engineering Management) from Stanford University.

Mr. Hiroyuki Ogawa is Member of the Board and Executive Vice President in charge of Corporate Planning Dept., Overseas Business Planning Dept., Facilities Planning Dept., Mexico CGL Project Team, Technical Cooperation Dept., IT Innovation Leading Dept., Business Process Innovation Team, Data Science Project Dept., Raw Materials Depts., and Materials & Machinery Purchasing Dept. Prior to his positions at JFE Steel’s head office, he was Vice President, General Superintendent, West Japan Works, Fukuyama, Assistant General Superintendent, West Japan Works- Kurashiki. He joined Kawasaki Steel Corporation in 1985.

Dr. (Mrs). Punita Kumar Sinha

Independent Non-Executive Director

Dr. (Mrs). Punita Kumar Sinha was appointed on the Board of Directors in October 2012. She is the Founder and Managing Partner, Pacific Paradigm Advisors, an independent investment advisory and management firm. Prior to founding Pacific Paradigm Advisors in 2012, she was Senior Managing Director of Blackstone Group, leading Blackstone Asia Advisors as the business unit head and Chief Investment Officer. Dr. (Mrs.) Punita Kumar Sinha was also the Senior Portfolio Manager for The India Fund (NYSE:IFN), the largest Indian Fund in the US for almost 15 years and The Asia Tigers Fund (NYSE:GRR), and The Asia Opportunities Fund L.P. She has more than thirty years of experience in fund management in international and emerging markets. Mrs. Punita Kumar Sinha has a Ph.D. and a Master’s in Finance from the Wharton School, University of Pennsylvania. She received her undergraduate degree in chemical engineering with distinction from the Indian Institute of Technology, New Delhi. She has an MBA and is also a CFA Charter holder. Mrs. Punita Kumar Sinha is a member of the Boston Security Analysts Society and the Council on Foreign Relations. She is a Charter Member and Board Member of TIE-Boston. In 2016, she was awarded the Asian Centre for Corporate Governance and Sustainability’s best woman director award.

Mr. Haigreve Khaitan

Independent Non-Executive Director

Mr. Haigreve Khaitan, LLB is a Partner at Khaitan & Co since 1995 and heads the Firm's M&A and Private Equity practice. Mr. Haigreve started his career in Litigation and then moved on to specialise in Corporate Law. Mr. Haigreve Khaitan has rich experience in all aspects of Mergers & Acquisitions due diligence, structuring, documentation involving listed companies, cross border transactions, medium and small businesses etc., in restructuring – such as advice and documentation involving creditors restructuring, sick companies, de-mergers spin-offs, sale of assets etc. Mr. Haigreve also has rich experience in Foreign Investment, Joint Ventures and Foreign Collaborations. He advises a range of large Indian Conglomerates and multinational clients in various business sectors including infrastructure, power, telecom, automobiles, steel, software and information technology, retail etc.

Mr. Harsh Charandas Mariwala

Independent Non-Executive Director

Mr. Harsh Charandas Mariwala, leads Marico Limited as its Chairman. He is also the Chairman & Managing Director of Kaya Limited. Over the past three decades, Mr. Mariwala has transformed a traditional commodities-driven business into a leading consumer products and services company in the Beauty and Wellness space. Under his leadership, Marico has achieved several awards and over 100 external recognitions in the last few years. Mr. Mariwala's entrepreneurial drive and passion for innovation, enthused him to establish the Marico Innovation Foundation in 2003. The Foundation acts as a catalyst to fuel innovation in India. Mr. Mariwala started ASCENT in 2012, a not-for-profit expression of his passion to create a unique trust-based peer-to- peer platform for high potential growth-stage entrepreneurs that leverages the 'power of the collective' and enables them to share and exchange experiences, ideas, insights and create a healthy ecosystem to learn from each other and grow their enterprise. He has also founded the Mariwala Health Initiative (MHI) in 2015, with the philanthropic aim of giving back to society. Mariwala Health Initiative (MHI) is the leading funding body in the field of mental health in India.

Mr. Seturaman Mahalingam

Independent Non-Executive Director

Mr. Seturaman Mahalingam, a chartered accountant by qualification, began his career as an IT consultant and thereafter played a major role in marketing Tata Consultancy Services (TCS) services across the globe, developing processes and creating large software development centres for the Company. He has held key positions such as Executive Director and Chief Financial Officer of TCS. Mr. Mahalingam retired from TCS in February 2013 after serving the company for over 42 years. Prior to becoming the Chief Financial Officer in February 2003, Mr. Mahalingam has managed many of the key functions in TCS including Marketing, Operations, Education and Training as well as Human Resources. He managed the company’s operations in London and New York in the early days of TCS’ global journey. Mr. Mahalingam has also been the President of Computer Society of India, the former Chairman of the Southern Region of Confederation of Indian Industry (CII), He was also the President of the Institute of Management Consultants of India. Mr. Mahalingam is the Chairman of CII National Council Task Force on Sector Skills Councils & Employment and was a member of the Tax Administration Reform Commission (TARC) set up by the Government of India under the chairmanship of Dr. Parthasarathi Shome. Mr. Mahalingam was chosen as the best ‘CFO” in various years by Business Today, International Market Assessment (IMA), CNBC TV18, CFO Innovation, Finance Asia and Institutional Investors. In 2012, Treasury & Risk, a US based magazine named him as one of the 16 globally most influential CFOs.

Mrs. Nirupama Rao

Independent Non-Executive Director

Mrs. Nirupama Rao is a retired Indian Diplomat, Foreign Secretary and Ambassador. She was educated in India and joined the Indian Foreign Service in 1973. During her four-decade-long diplomatic career, she held several important assignments.

Mrs. Nirupama Rao was India’s first woman spokesperson in the Ministry of External Affairs, New Delhi, the first woman high commissioner to Sri Lanka and the first Indian Woman ambassador to the People’s Republic of China. She served as India’s Foreign Secretary from 2009-2011. At the end of that term, she was appointed India’s Ambassador to the United States where she served for a term of two years from 2011-2013.

Ms. Fiona Jane Mary Paulus

Independent Non-Executive Director

Ms. Fiona Jane Mary Paulus has 37 years of extensive operational leadership and investment banking career at top ranked global banks. She has since built a career as a Non-Executive Director with two active Board roles, one with a FTSE 250 company. She has advised Boards & top managements of FTSE 100 companies, multinationals, private equity & infrastructure funds on major strategic initiatives including M&A; all types of bank financing; debt & equity capital market transactions; as well as risk management solutions. She has executed transactions in multiple jurisdictions. She has also won the banking industry’s most prestigious award as Global Energy Advisor of the Year in 2007 at the peak of the energy and resources cycle, which included ABN Amro Bank’s role as sole advisor & joint financier of Iberdrola’s $29bn acquisition of Scottish Power; and as joint advisor & financier of Tata Steel’s $12bn acquisition of Corus, UK. She is used to working effectively with regulators around the world & in complex, political & challenging situations.

She has over 15 years of global risk management leadership experience. As founding member of ABN AMRO’s (ABN) Global Credit and Risk Committee in 2005-2007, Ms. Fiona recommended improvements to the origination & risk mitigation practices. Following RBS’s acquisition of ABN in 2007, Ms. Fiona was appointed as a founding member of RBS’s Global Risk and Regulatory Capital Committee, & Chair of the European Committee where RBS had most of its credit exposure.

Ms. Fiona has also been actively engaged in global leadership roles in ESG since 2004.

BOARD COMMITTEES

Audit committee A

Audit Committee, a sub-committee of the Board of Directors, comprises Independent Directors. The Audit Committee oversees the Company’s financial reporting process, approves related-party transactions and regularly reviews financial statements, changes in accounting policies and practices, audit plans, significant audit findings, adequacy of internal controls, compliance with accounting standards, appointment of statutory auditors among others.

Number of meetings held: 11

Nomination and remuneration committee N

The Nomination & Remuneration Committee’s constitution and terms of reference are in compliance with the provisions of the Companies Act, 2013 and Regulation 19 and Part D of the Schedule II of the SEBI (LODR) Regulations. The primary responsibilities of the Committee include identifying persons qualified to become Directors, decide on senior management appointments and carrying out evaluation of every Director’s performance. The Committee also looks into extension of tenures of Independent Directors on the basis of the report of performance evaluation of Independent Directors.

Number of meetings held: 2

Stakeholders relationship committee S

To periodically look into the functioning of the Company’s shareholder/investor grievance redressal system and oversee improvements in the same, besides reporting serious concerns, if any.

Number of meetings held: 2

Risk management committee R

To formulate a detailed risk management policy, to periodically review the risk management policy, at least once in two years, including by considering the changing industry dynamics and evolving complexity. To ensure that appropriate methodology, processes and systems are in place to monitor and evaluate risks associated with the business of the Company

Number of meetings held: 2

OTHER MAJOR COMMITTEES

Project review committee P

To closely monitor the progress of large projects, in addition to ensuring a proper and effective coordination among the various project modules, essentially with the objective of timely project completion within the budgeted project outlay.

Number of meetings held: 5

Business responsibility/Sustainability reporting committee B

Responsible for the adoption of National Guidelines on Responsible Business Conduct (NGRBC) in the business practices of JSW Steel. The committee also overlooks matters related to climate change, water and biodiversity and guides required actions for these sustainability practices.

Number of meetings held: 1

Corporate social responsibility committee C

To formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate a list of CSR projects or programmes which a Company plans to undertake while also recommending the amount of expenditure to be incurred on each of the activities and to monitor the CSR policy of the Company from time to time.

Number of meetings held: 2

Hedging policy review committee H

To take protective measures to hedge forex losses and to decide on all matters related to commodities hedging and to take measures to hedge commodity price fluctuations.

Number of meetings held: 3

Finance committee F

To approve availing of credit/financial facilities. To open new Branch Offices of the Company. To make loans to Individuals/Bodies Corporate and/or to place deposits with other Companies/ firms. To open Current Account(s), Collection Account(s), Operation Account(s), or any other Account(s) with Banks and to authorise personnel to sign excise, import and export documents, execute Customs House Documents.

Number of meetings held: Need based – several meetings (23)

JSWSL ESOP committee JE

To determine the terms and conditions of grant, issue, re-issue, cancellation and withdrawal of Employee Stock Options from time to time. To formulate, approve, evolve, decide upon and bring into effect, suspend, withdraw or revive any sub-scheme or plan for the purpose of grant of Options to the employees. To issue any direction to the trustees of the JSW Steel Employees Welfare Trust. To make necessary amendments to the JSW Steel Employees Welfare Trust Deed, if need be. To lay down the procedure for making a fair and reasonable adjustment. To lay down the method for satisfaction of any tax obligation arising in connection with the Options or such Shares and to lay down the procedure for cashless exercise of Options.

Number of meetings held: 1

JSWSL Code of Conduct implementation committee JC

To implement the ‘JSWSL Code of Conduct to Regulate, Monitor and Report trading by Insiders’ and the SEBI (Prohibition of Insider Trading) Regulations, 1992.

Number of meetings held: 2