Our comprehensive double materiality assessment identifies key issues impacting long-term value creation. This exercise informs a well-defined, strategic roadmap focused on delivering sustainable value, aligning our operations with evolving stakeholder expectations and environmental, social, and economic priorities.

Double materiality

Long-term value creation demands a comprehensive understanding of the dynamic interplay between sustainability factors and business outcomes. Double materiality enables us to integrate both impact materiality and financial materiality into our strategy planning. While impact materiality examines how our operations affect the environment and society (inside-out), financial materiality focuses on how sustainability-related risks and opportunities influence our financial performance and long-term resilience (outside-in).

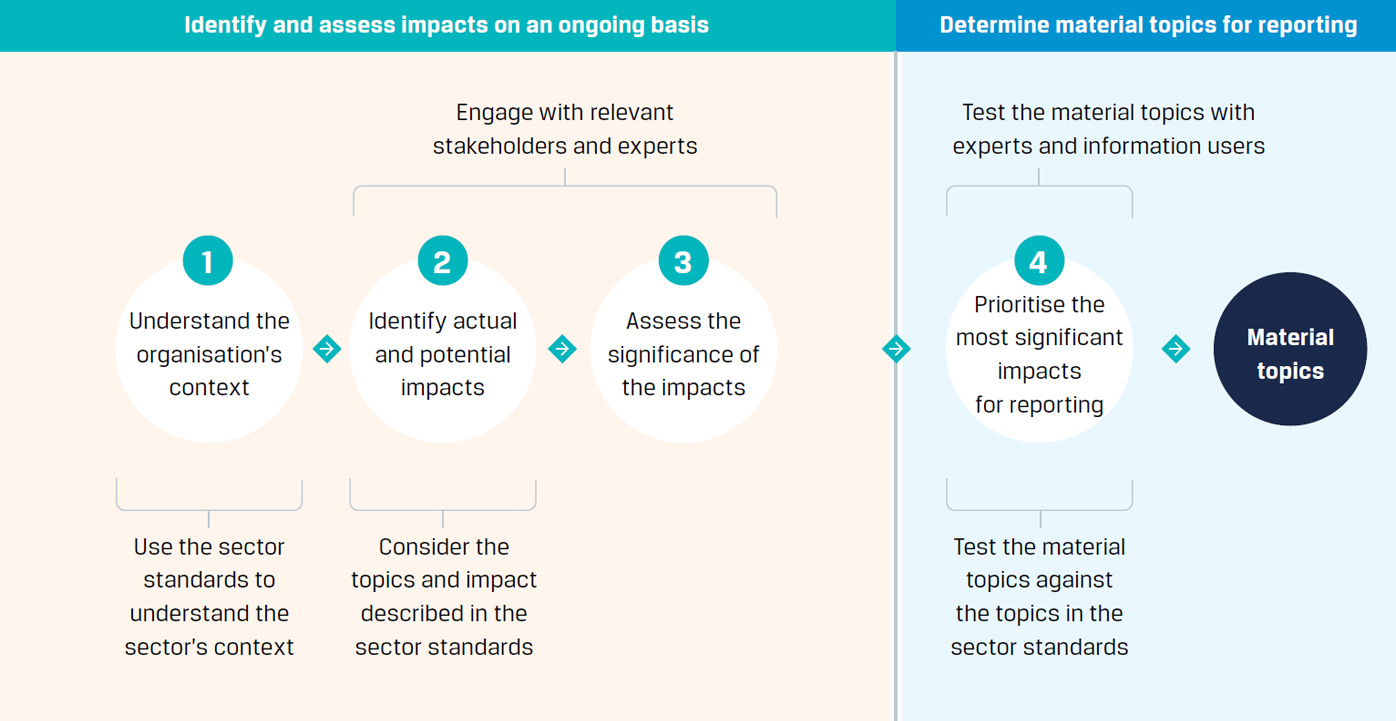

In FY 2023-24, we conducted a detailed double materiality assessment, aligned with the GRI Universal Standards 2021 for impact materiality and with the IFRS S1 & S2 and SASB guidelines for financial materiality. The process comprised two key phases: stakeholder engagement and impact analysis. We evaluated 30 potential material topics based on parameters such as scale, scope, likelihood, and the irreversibility of impacts. This analysis helped us identify 18 high-priority material topics that are critical to our business and broader sustainability goals.

These topics form the bedrock of our ESG strategy. As we move forward, we remain focused on periodically revisiting and refining our materiality assessment to stay aligned with evolving stakeholder needs, market dynamics, and global sustainability frameworks.

Process to determine material topics

The following high-priority material topics have been identified

| ENVIRONMENT | SOCIAL | GOVERNANCE | ECONOMIC |

|---|---|---|---|

|

|

|

|