PROFILE AND RATINGS

- Business ethics

- Economic performance

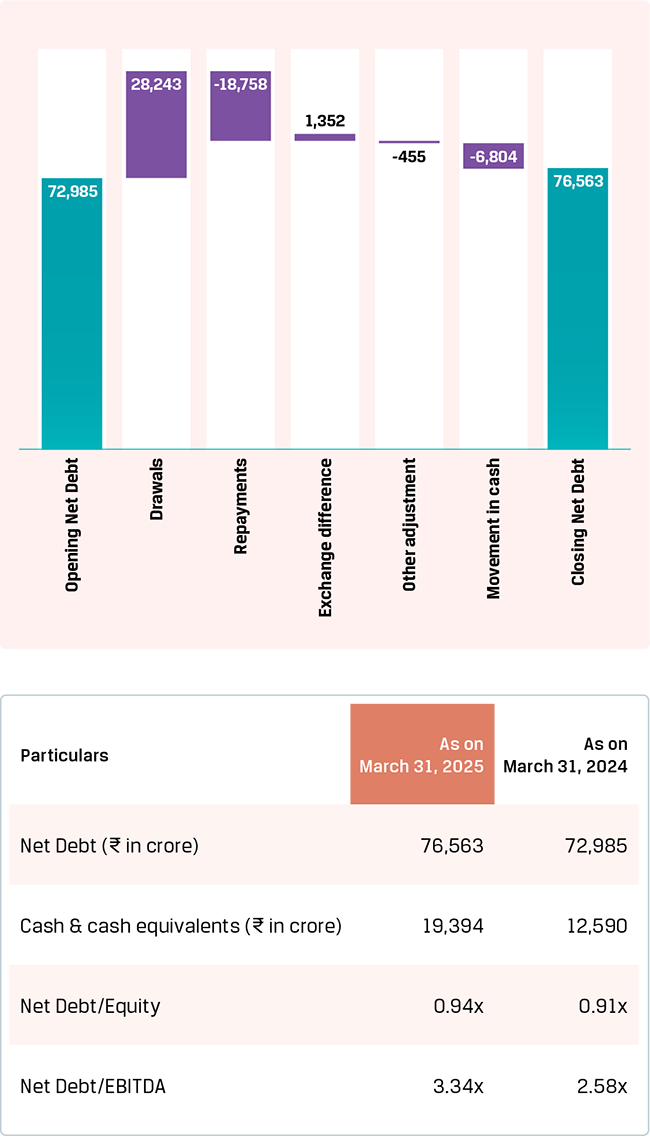

Net debt to equity

Net debt to EBITDA

Financial discipline and focus on return profile

Operating in a capital-intensive sector marked by price volatility, we continue to fortify our financial foundation. A strong balance sheet is essential to fuel our long-term growth ambitions. With a sharp focus on cost discipline and strategic investments, we adhere to well-defined financial principles and evaluation criteria for acquisitions and expansions. By prudently managing capacity growth, optimising our debt maturity profile and diversifying funding sources, we aim to seize market opportunities while limiting risk. Through careful capital allocation across competing projects and acquisitions, we ensure every investment contributes to value creation with measured and sustainable returns.

In line with our strategy to promote efficient and prudent capital allocation at JSW Steel, preserve resources for future growth, and enable management to concentrate on the core steel business, the Odisha Slurry Pipeline undertaking of JSW Utkal Steel Limited, a wholly owned subsidiary which was developing a slurry pipeline to transport iron ore from the Nuagaon mines to Jagatsinghpur in Odisha—was transferred in March 2025 to JSW Infrastructure Ltd. for a consideration of `1,654 crore.

Debt profile

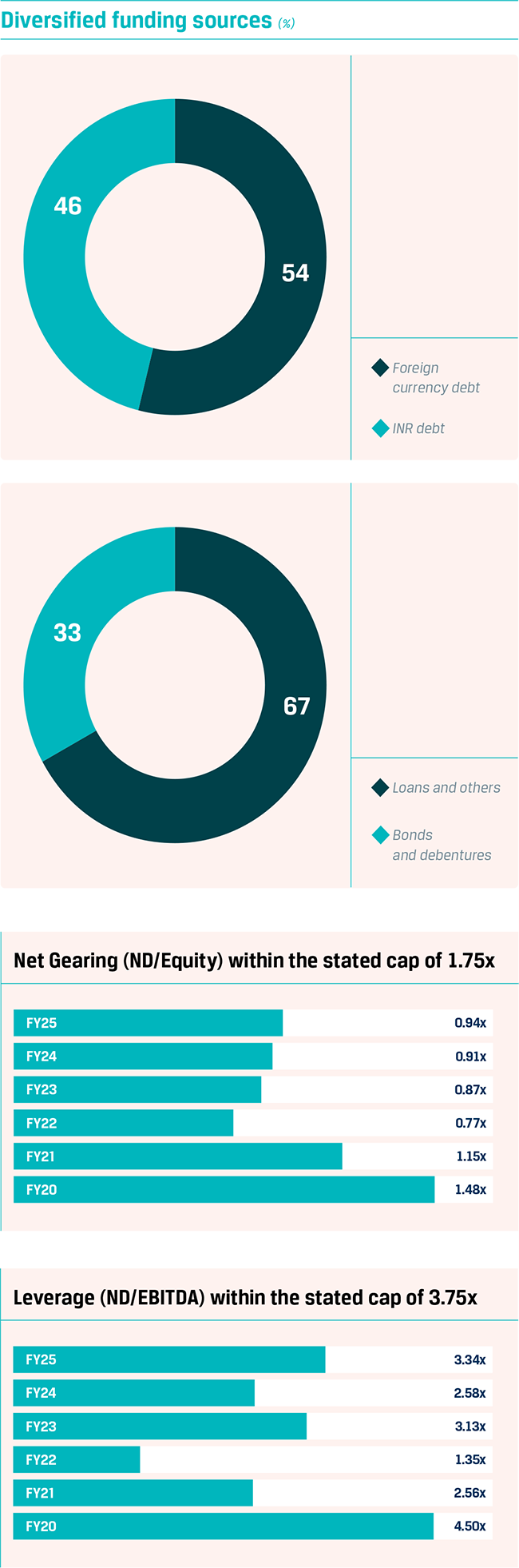

We actively sustain and expand our access to a broad spectrum of liquidity sources, supported by robust relationships with both domestic and international financial institutions. Our Company’s debt portfolio is strategically diversified across instruments and currencies, with 44% of debt denominated in Indian Rupees and 56% in foreign currencies as at March 31, 2025, ensuring risk mitigation and financial flexibility. A prudent blend of fixed-rate bonds and debentures (37% of debt), coupled with floating-rate loans (63% of debt), supports our interest rate risk management strategy. With net gearing and leverage comfortably within our thresholds of 1.75x and 3.75x, respectively, we continue to manage our debt prudently.

Some of the notable financing transactions successfully concluded recently include –

- Two tranches of External Commercial Borrowings aggregating to $1.80 billion by way of general syndication – in line with strategy to further diversify pool of liquidity and build new relationships.

- Non-convertible Debenture issuance aggregating to `2,250 crore with long tenor – in line with strategy to enhance fund raising from market instruments.

We continue to explore opportunities for optimising cost of debt, extending the maturity profile and diversifying sources of financing.

Since 2014, we have raised US$3.84 billion via global bond markets, of which US$1.9 billion has been repaid as of April 2025. Notably, we pioneered the global steel industry’s first USD Sustainability-Linked Bond in September 2021.

Consolidated net debt movement in FY 2024-25 (₹ in crore)

Strong liquidity

We maintain a strong liquidity position with cash and cash equivalents totalling `19,394 crore as at March 31, 2025. Maintaining strong liquidity ensures financial resilience, supports operational flexibility and enables timely capital deployment for growth opportunities.

Credit ratings

Our robust financial standing is reflected in our credit ratings, with Moody’s and Fitch assigning “Ba1” and “BB” ratings respectively, both with stable outlooks. Domestically, ICRA and CARE Ratings have rated us “AA” (Stable), while India Ratings (Ind-Ra) has assigned an “AA” rating with a rating watch for developing implications.

Sustainability-linked bonds

In September 2021, we became the first steel company globally to issue Sustainability Linked Bonds (SLBs) in the US market, successfully raising US$1 billion. The issuance, split equally between 5.5-year and 10.5-year tranches, attracted strong interest from ESG-focused investors, offering both scale and pricing benefits. The 10.5-year tranche includes a commitment to reduce carbon emissions to 1.95 tonnes of CO2 per tonne of crude steel by March 2030, a 23% cut from 2020 levels. Should this target not be achieved, a 37.5 basis points step-up in pricing will apply for the bond's remaining tenure.

This innovative financing structure effectively links financial outcomes with sustainability objectives, offering investors a chance to support socially responsible enterprises while motivating JSW Steel to continuously improve its environmental performance.

Risk management – Forex & Commodity

Our Company has a Board approved Risk Management Policy for managing the foreign exchange, interest rates and commodity price risk. This policy is designed to safeguard business planning and operations from adverse movements in currency and interest rates. The board’s Hedging Policy Review Committee oversees and guides the hedging actions in line with the internal policy. We utilise derivative financial instruments to hedge foreign currency risks linked to our revenue exposure and debt portfolio. We do not engage in any derivative contract for speculative purposes.

We follow a gross hedging approach for both imports and exports. Export exposures are hedged through forward contracts, while import exposures are managed using forwards or options as appropriate. To mitigate the forex currency risk in loan portfolio, we deploy options and swaps as deemed necessary. We review the interest rate risk on the loans portfolio periodically and may hedge the risk if needed. Our commodity hedging strategy, closely aligned with our procurement sources, timelines and price risk profile, seeks to hedge the price risk on input commodities through swap and option arrangements. These hedges may extend beyond the financial year and the overall hedge ratios are dependent on the quantum of underlying supply contracts linked to global benchmarks.

Multiple initiatives are underway to automate the hedging function to the extent possible, achieve real time exposure data collection and minimise hedging cost.

OUTLOOK

Near-term

- Finance our Company’s expansion plans while maintaining a prudent balance sheet footprint.

- Maintain diversified funding sources through an optimal blend of Rupee-denominated and foreign currency debt.

- Strengthen and expand banking relationships through prudent governance and adherence to compliance standards.

Long-term

- Aspire to rank among the top five global steel producers in terms of Return on Capital Employed (RoCE).

- Prudent capital allocation strategy, with Net debt to EBITDA and Net Debt to Equity maintained within prudent thresholds of 3.75x and 1.75x, respectively.

- Uphold financial discipline and consistently maintain strong credit ratings from both domestic and international rating agencies.