COMPELLING

VALUE PROPOSITION

JSW Steel is India’s largest and most geographically diversified integrated steel producer. With the country on a strong growth trajectory, supported by the government’s infrastructure-led initiatives, JSW Steel is well-positioned to capitalise on this momentum. The Company has a strong track record of timely capacity expansions and operational excellence. It has consistently delivered value to shareholders while actively advancing its climate agenda, with a target of achieving Net Neutrality in Carbon Emissions for all operations under its direct control by 2050.

What makes JSW Steel an attractive investment?

Value-accretive capacity expansion to address India’s growing steel demand

1

Enriching product mix to maintain over 50% value-added products sales

2

Enhancing cost efficiency and raw material security

3

Future-ready with technology and digitalisation

4

Efficient capital allocation and healthy balance sheet

5

Strong track record of delivering superior returns

6

Sustainability at the core of the enterprise

7

1 Value-accretive capacity expansion to address India’s growing steel demand

Steel consumption in India has recorded double-digit growth for four consecutive years, driven by robust infrastructure investment, rising consumption and a growing manufacturing base. This underscores the 'nation-building' phase that India is currently in, during which steel demand outpaces real GDP growth. These factors position India as one of the most attractive steel markets globally, with strong long-term growth visibility.

At JSW Steel, we have added 16 MTPA capacity in the past five years and are on track to add more than 7 MTPA capacity by September 2027. These capacity expansions are at a significantly lower capex per tonne than global benchmarks. Our strategic roadmap is to achieve 50 MTPA capacity in India by FY 2030-31. We have brownfield expansion options at Vijayanagar, Dolvi and BPSL, and development of 4 MTPA of green steel capacity at Salav. Further, we have a 13 MTPA greenfield site at Jagatsinghpur, Odisha. In addition, we are also augmenting our downstream and value-added product capabilities. We have an approved capex plan of `61,863 crore over the next three years to be spent on augmenting steelmaking and downstream capacities, efficiency projects, raw material security and decarbonisation.

`61,863 crore

Approved capex over the next three years

42 MTPA

Targeted capacity in India by FY 2027-28

50 MTPA

Targeted capacity in India by FY 2030-31

2 Enriching product mix to maintain over 50% value-added products sales

As India develops modern infrastructure, the demand for specialised steel grades across manufacturing, auto, and engineering continues to grow. JSW Steel is addressing these evolving needs through innovative solutions and tailored products. We have expanded downstream capacities and introduced new grades which significantly reduce India’s dependence on imports. Our portfolio includes sustainable steel offerings from packaging and roofing to AHSS (Advanced HighStrength Steel) for automobile light-weighting. Recognising the importance of CRGO steel in energy transition, we have acquired Thyssenkrupp’s CRGO facility in India through a JV with JFE Steel, and are also setting up the country’s first end-to-end CRGO production line at Vijayanagar through the same partnership.

62%

Share of VASP in total sales in FY 2024-25*

48%

Branded product sales in total retail sales

*Excluding JVML volumes

3 Enhancing cost efficiency and

resource security

JSW Steel is an efficient steel producer with one of the lowest conversion costs globally. Our integrated operations are further strengthened by robust raw material linkages, especially for iron ore. We have access to 23 iron ore mines and deposits, with 1.6 BnT in reserves; of which, 12 are currently operational. For coking coal, we have secured three captive mines in Eastern India and 2 MTPA Dugda washery along with long-term linkages from Coal India. Overseas, we have completed the acquisition of a 20% stake in the Illawarra metallurgical coal mines in Australia. In Mozambique, we are in the process of acquiring the Minas de Revuboè (MdR) deposit that hosts a large untapped reserve of coking coal. These two overseas assets will significantly strengthen our long-term access to high-quality metallurgical coal.

To strengthen our global cost leadership, we leverage cutting-edge technologies to optimise fuel usage, enhance process flexibility, and efficiently blend multiple grades of raw materials for maximum yield. A 30 MTPA slurry pipeline for transporting iron ore in Odisha will be commissioned in FY 2026-27 which will deliver significant logistics cost savings. Additionally, our focus on capturing waste gas and waste heat from the steelmaking process for power generation further enhances our cost competitiveness.

US$132/tonne

Conversion cost

(Standalone basis)

37%

Iron ore consumption met through captive mines

30 MTPA

Slurry pipeline for transporting iron ore in Odisha to be commissioned in FY 2026-27

4 Future-ready with technology and digitalisation

At JSW Steel, digitalisation is central to enhancing production processes, optimising costs, improving safety, and advancing our sustainability agenda. Our initiatives now span across functions, including sales and marketing, where an AI-driven inventory allocation system piloted at Dolvi, is set for full-scale rollout in FY 2025–26. We have also launched a future-ready digital platform for channel partners, digitalised over 80 processes, and improved retailer engagement, coverage, and productivity. Automation and AI are boosting lead conversions through real-time CRM, smart surveillance, and productivity bots.

In plant operations, machine learning, robotics, and computer vision support cost-quality optimisation and automated surface inspections. With digital logistics, cloud-based control towers, IoT-enabled workers, and predictive analytics, we are driving efficient, data-led decision-making.

80+

Processes digitalised at channel partners

5,000+ hours

Of digital training

12+

Flagship digital projects

5 Efficient capital allocation and healthy balance sheet

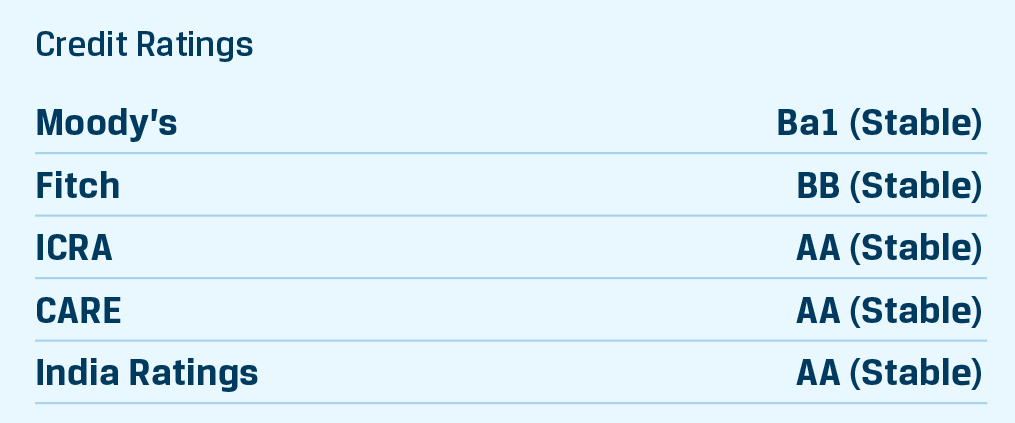

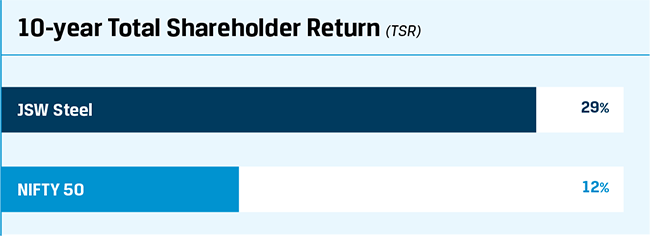

JSW Steel has a strong track record of disciplined and prudent approach to capital allocation, which has allowed us to create significant value for shareholders, with a TSR of 28% over the last 23 years. We have maintained a healthy balance sheet with a gearing of 0.94x, aided by `19,394 crore in cash and cash equivalents. This strength in our balance sheet is reflected in our favourable credit ratings from domestic and international rating agencies and our ability to raise growth capital from diversified sources. We have raised US$3.84 billion via global bond markets since 2014 and pioneered the global steel industry’s first USD Sustainability-Linked Bond in 2021. We have successfully raised ECB of US$1.8 billion through syndicated loans in the past 12 months and Non-Convertible Debenture of ₹2,250 crore in August 2024.

0.94x

Net Debt to Equity

3.34x

Net debt to EBITDA

`19,394 crore

Cash and cash equivalents

6 Strong track record of delivering superior returns

With a healthy balance sheet, comfortable debt levels, strong liquidity, and favourable credit ratings, we are well-positioned to deliver sustained, superior risk-adjusted returns through consistent dividend payments and share price appreciation. We continue to invest in value-creating opportunities while maintaining a healthy balance sheet and strong credit ratings, ensuring long-term profitability and shareholder confidence.

28%

TSR CAGR since FY 2001-02

`2.8/share

Dividend in FY 2024-25

7 Mainstreaming Sustainability

A key pillar of JSW Steel’s decarbonisation roadmap is the targeted reduction of CO2 emissions intensity to 1.95 tCO2 per tonne of crude steel by FY 2029-30 and achieving carbon neutrality across all operations under our direct control by 2050. We are progressively integrating disruptive technologies such as green hydrogen and carbon capture, utilisation and storage (CCUS), alongside increasing scrap usage. In line with this goal, we are enhancing energy and process efficiency, adopting digitalisation for improved water management and transitioning to renewable energy sources. We have maintained zero liquid discharge, promoted a circular economy with a focus on ‘zero waste to landfill’ and implemented a Biodiversity Management Plan across all our operational sites.

Net Neutral in Carbon Emissions by 2050

worldsteel Sustainability Champion

for the 7th consecutive year