S5

CAPITALS DEPLOYED

CAPITALS ENHANCED

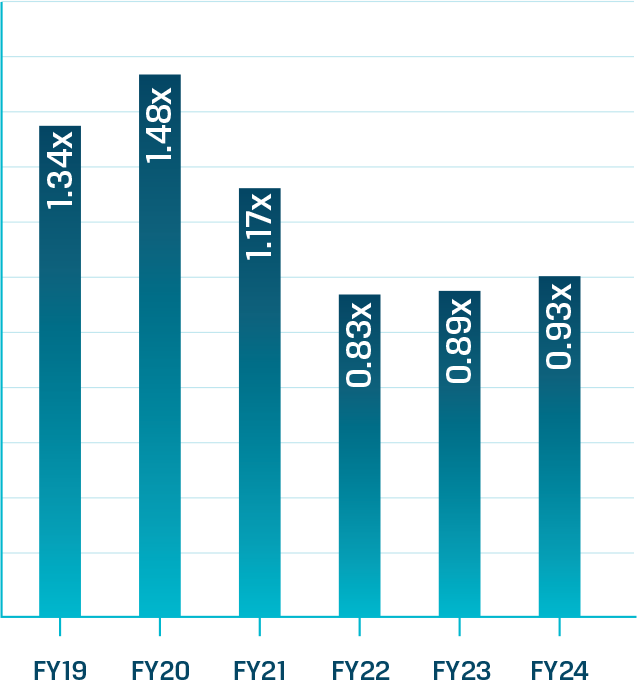

0.93x

Net debt to equity

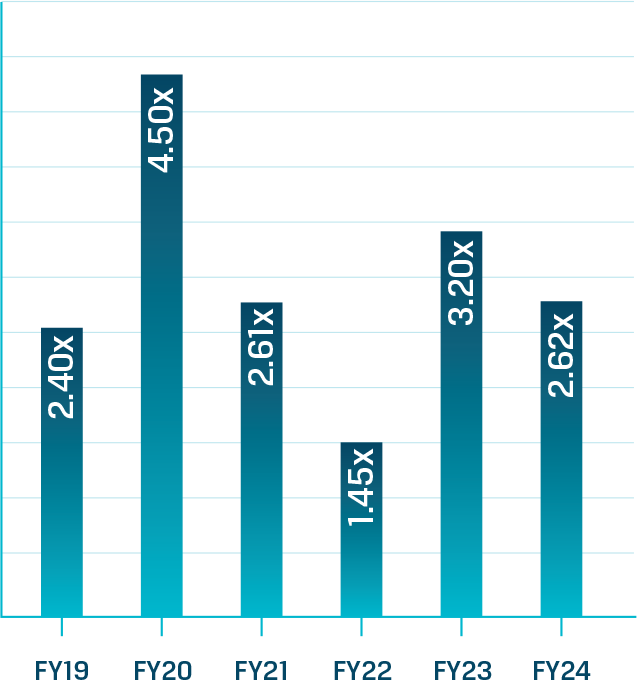

2.62x

Net debt to EBITDA

To ensure sustainable growth and stability, we prioritise meticulous capital allocation, a strong balance sheet, and optimisation of cash flow. This disciplined approach to financial management strengthens our financial health and enhances shareholder value, guiding our long-term vision of achieving resilient and sustainable growth in the highly competitive steel industry.

MAINTAIN

Strong financial profile and ratings

Financial discipline and focus on return profile

We operate in a capital-intensive industry with a history of volatile prices. Therefore, we continuously seek to improve our financial profile. We believe a strong financial position will be critical to support our future growth. Furthermore, we maintain a strong focus on cost management and prudent investment in new projects.

We have developed financial principles and business criteria to assess potential acquisitions and expansions. We intend to manage our capacity expansion, improve our debt maturity profile, and diversify our funding sources to capture market opportunities without taking on excessive risk.

We follow a judicious allocation of capital amongst competing capital expansion projects and strategic acquisitions, to capture market opportunities at minimum risk.

Debt profile

JSW Steel maintains a robust debt portfolio while employing a strategic approach to financial management. As of March 31, 2024, the Company's net debt stood at `73,916 crore, up from `59,345 crore in the previous year, reflecting new loans taken, investment in working capital and currency fluctuation impacts. The net debt to equity ratio is 0.93x, while the net debt to EBITDA ratio is 2.62x, both metrics within the Company’s stated caps of 1.75x and 3.75x, respectively.

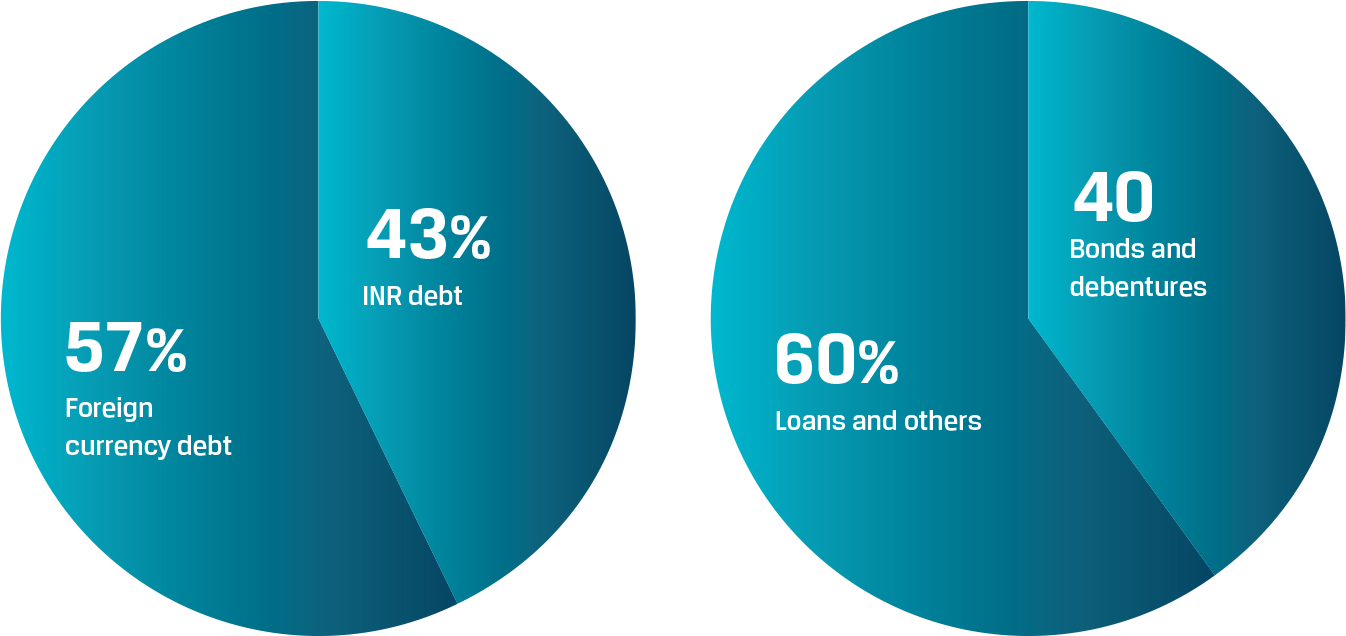

The Company's debt is well-distributed across various instruments and currencies, with 43% of debt denominated in rupee and 57% in foreign currencies. Approximately, 40% of the total debt comprises bonds and debentures, while the remaining 60% includes loans and other instruments. This diversification ensures access to a wide pool of liquidity and reduces refinancing risks.

Diversified Funding Sources

Net Gearing (ND/Equity) within

the stated cap of 1.75x

Leverage (ND/EBITDA) within the

stated cap of 3.75x

Credit rating

JSW Steel’s strong financial profile is reflected in its credit ratings. The Company holds a Ba1 rating with a stable outlook from Moody’s and a BB rating with a stable outlook from Fitch, internationally. Domestically, JSW Steel is rated AA with a stable outlook by ICRA, IndRa, and CARE. These ratings are supported by JSW Steel's strong liquidity position, with cash and cash equivalents of H12,590 crore as of March 2024.

Sustainability linked bonds

In September 2021, JSW Steel made history by becoming the world’s first steel company to issue Sustainability Linked Bonds (SLBs) in the US market, successfully raising US$1 billion. This landmark issuance consisted of two tranches: a 5.5-year tranche and a 10.5-year tranche, each valued at US$500 million. The SLB structure allowed JSW Steel to attract ESG-focused funds, offering a size and price benefit. The 10.5-year tranche committed JSW Steel to achieving a significant environmental target: reducing carbon emissions to 1.95 tonnes of CO2 per tonne of crude steel by March 2030, a 23% reduction from 2020 levels. Failure to meet this target will result in a 37.5 bps step-up in pricing for the remaining life of the bond.

The proceeds from the SLBs are earmarked for funding capital expenditure plans and refinancing existing debt. This innovative financing mechanism aligns financial performance with sustainability goals, providing investors with an avenue to support socially responsible companies while incentivising JSW Steel to enhance its environmental performance.

Hedging activities

We use derivative financial instruments to hedge the foreign currency risk arising on account of our revenue and debt portfolio. All hedging activities are carried out in accordance with our internal risk management policies, as approved by the Board of Directors, and in accordance with the applicable regulations where we operate. Our risk management policies attempt to protect business planning from adverse currency and interest rate movements. We do not use derivative contracts for speculative purposes.

Hedging activities in India are governed by RBI regulations, which we strictly adhere to. We implement a gross hedging policy for our imports and exports. Exports are hedged using forward contracts. For imports, we appropriately hedge our exposure through forwards or options. We manage our US dollar interest rate risk by using interest rate swaps to mitigate floating rate exposure. Our commodity hedging strategy, aligned with our procurement schedule and price risks, aims for economic benefits through swaps. This is primarily a risk offsetting measure, and depending on market conditions, hedges may extend beyond the financial year. We maintain a policy of hedging up to 25% of our consumption.

Outlook

Near-term

- Acquiring assets with minimal impact on balance sheet.

Long-term

- Projects to be funded by debt and internal accruals with net debt to EBITDA and net debt to equity within levels of 3.75x and 1.75x, respectively.

- Diversify sourcing of funding with a right mix of rupee and foreign currency debt.

- Be among the top five steel companies globally in terms of RoCE.

- Maintain financial discipline and sustain credit ratings by domestic and international agencies.