MATERIALITY

Assessing topics of significant potential impact

In FY 2023-24, we conducted a comprehensive double materiality assessment to pinpoint critical issues that could influence our long-term value creation. This assessment is pivotal in shaping a detailed and strategic roadmap aimed at ensuring sustainable value delivery.

Double materiality

Double materiality is a framework that integrates two critical dimensions: impact materiality and financial materiality. This approach recognises the dynamic interplay between an organisation’s sustainability impacts and its financial performance, underscoring how sustainability issues influence the Company’s market standing and how the Company, in turn, affects the environment and society. At JSW Steel, we recognise that embracing this holistic approach allows us to develop strategies that harmonise economic success with environmental and social responsibility.

In line with this, we conducted an extensive double materiality assessment during the reporting year. This assessment is instrumental in guiding our future sustainability strategies, policies, and practices. By leveraging insights from both dimensions, we aim to make informed decisions that balance our economic, social, and environmental impacts, ultimately enhancing our sustainability and resilience as an organisation.

The impact materiality assessment, adhering to the GRI Universal Standards of 2021, takes an inside-out approach, examining how an organisation’s operations affect the environment and society. In contrast, the financial materiality assessment, conducted in alignment with International Financial Reporting Standards (IFRS) and the Sustainability Accounting Standards Board (SASB), follows an outside-in perspective, evaluating how external sustainability issues impact the organisation’s financial performance.

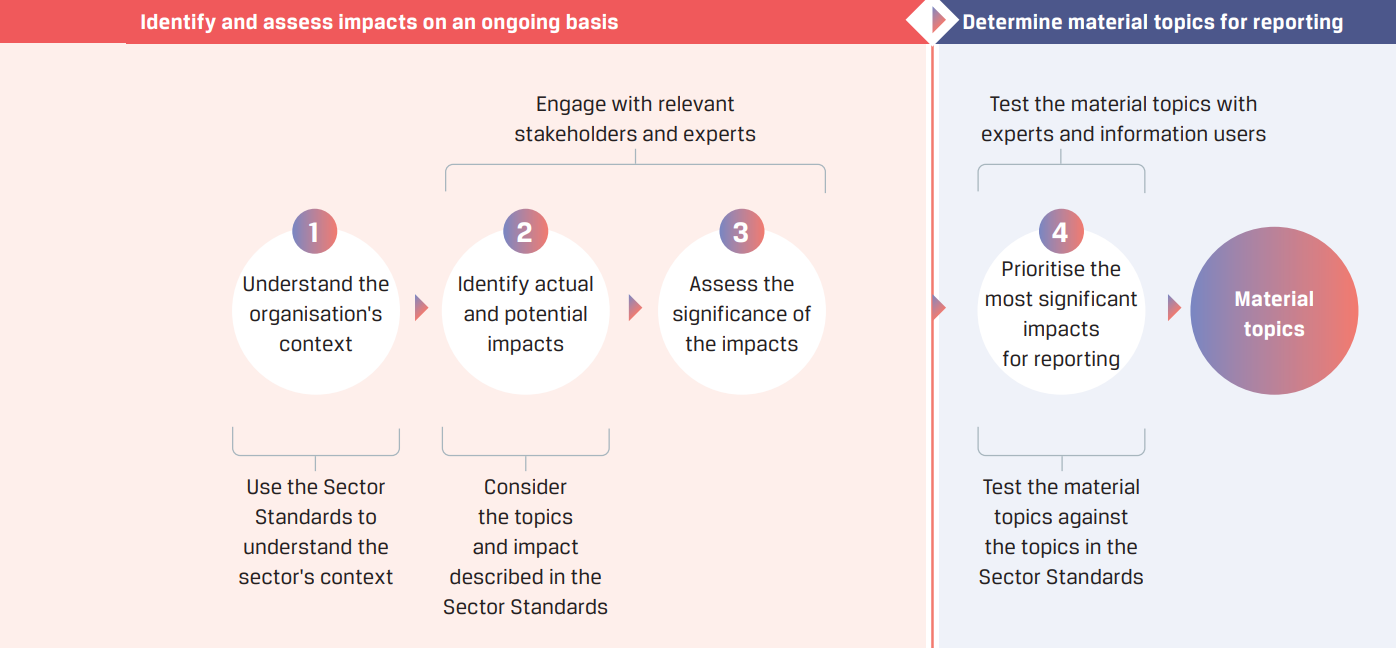

The assessment process encompassed two phases: stakeholder engagement and impact assessment. During the stakeholder engagement phase, we gathered insights and expectations from stakeholders on a bucket list of 30 material topics. We engaged with both internal and external stakeholders, collecting detailed feedback on various parameters such as scale, scope, irremediability, likelihood, etc. This extensive data collection and analysis allowed us to evaluate both impact and financial materiality effectively. As a result, we identified 18 high-priority material topics that will guide our strategic focus and ensure a balanced approach to economic, social, and environmental responsibilities.

The following high-priority material topics have been identified:

- Climate change and emissions management

- Air emissions and air quality management

- Water resource use and management

- Energy use and management

- Resource use and management

- Waste management

- Circular economy

- Impact on biodiversity

- Wastewater

- Occupational health and safety

- Vendor management and development

- Business ethics

- Training and education

- Investment in clean technology and environmentally friendly products

- Digitalisation and automation

- Technology, product and process innovation

- Diversified product portfolio

- Economic performance